Despite a strong pullback in the spring, markets have now rebounded back near all-time highs, led largely by optimism surrounding AI-related growth. Although we agree that AI will revolutionize and disrupt multiple different sectors, the assumptions built in to many of these companies defy reason and are a source of increasing vulnerability for the US stock market.

This Time isn't Different

An iconic quote from the dotcom mania that is especially relevant to today’s equity markets comes from Scott McNealy, who at the time was the CEO of Sun Microsystems, one of the darlings of the dotcom bubble. At its peak his stock hit valuation of ten-times revenues. A couple of years afterward he had this to say about that time (via Bloomberg)

At 10 times revenues, to give you a 10-year payback, I have to pay you 100% of revenues for 10 straight years in dividends. That assumes I can get that by my shareholders. That assumes I have zero cost of goods sold, which is very hard for a computer company. That assumes zero expenses, which is really hard with 39,000 employees. That assumes I pay no taxes, which is very hard. And that assumes you pay no taxes on your dividends, which is kind of illegal. And that assumes with zero R&D for the next 10 years, I can maintain the current revenue run rate. Now, having done that, would any of you like to buy my stock at $64? Do you realize how ridiculous those basic assumptions are? You don’t need any transparency. You don’t need any footnotes. What were you thinking?

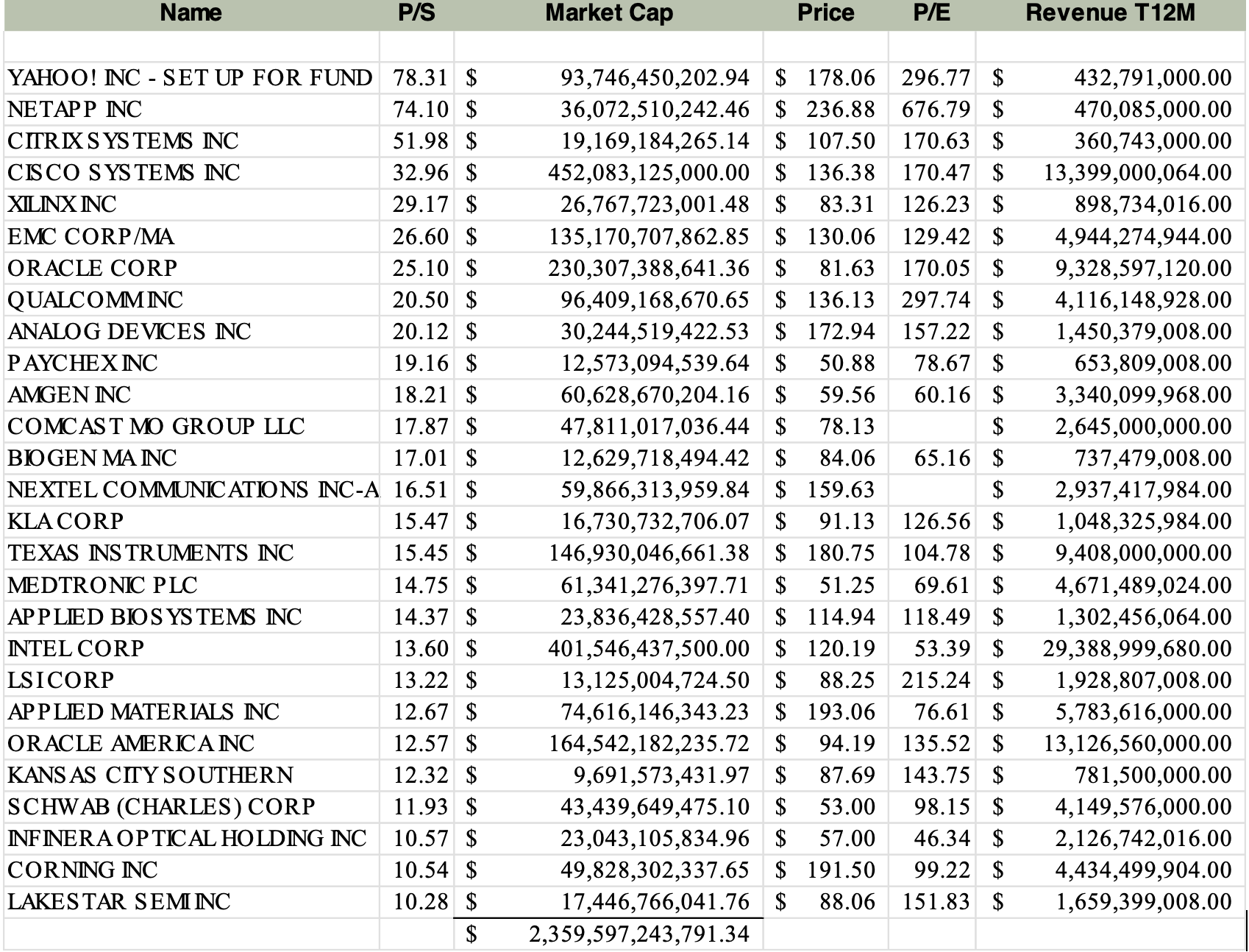

Interestingly, there were 26 stocks within the S&P 500 that traded above ten times revenues at the peak of the dotcom mania in March 2000.

Today, there are 43.

While it’s true today’s companies are in aggregate much more profitable than their counterparts from 25 years ago, it’s also true that the market cap of today’s companies trading above ten times revenues is orders of magnitude larger at USD $19.6 trillion. There has never been a time in the stock market’s history where a greater proportion of companies traded at these lofty valuations. These 43 companies together are valued at nearly 10x Canada’s GDP. Another jarring statistic is that these 43 companies are worth nearly half as much as the entire non-U.S. stock market. Keep in mind that the collective value of those 26 stocks from March 2000 is now roughly $2.7T, which equates to a cumulative price return of just 14% over 25 years, or roughly 0.5% annualized…an absolutely dreadful return for a quarter-century of investing.

So, to look again at McNealy’s quotes, for these companies it would take 17 years of paying out 100% of revenue with no cost of goods, no wages, no costs, and no taxes. It certainly looks like there many investors that will, at some point in the future, be asking themselves once again, ‘what was I thinking?’

It's true that history tends to rhyme more than it echoes, but there are plenty of concerning comparisons to be made to today’s stock market darlings. NVDA recent datacenter guidance projects USD $600 billion in capital expenditures in 2025 and USD $3-4 trillion before 2030. These numbers are simply ridiculous.

OpenAI in the past nine months has committed to spend around $60billion/year for compute from Oracle, $18billion on a data-center venture, build a new AI-hardware device and purchase $10 billion worth of customized chips. A natural question is how OpenAI will pay for such outsize ambitions when they lose billions of dollars a year and have told investors it is on pace to make $13 billion in revenue this year.

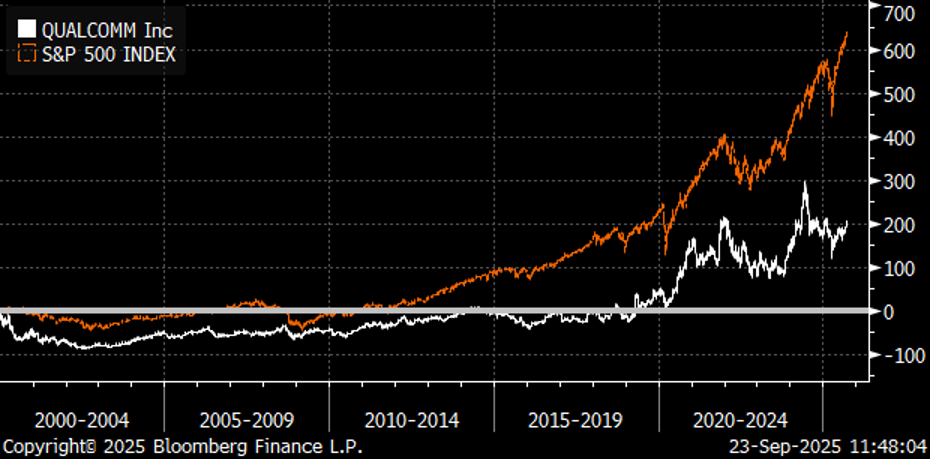

For some historical perspective, Qualcomm was up 2700% in 1999! It entered the year 2000 at 280x earnings. The actual underlying business had grown 60x since then – a fantastic success by virtually any measure. Yet over that time the share price has lagged the S&P500 by over 400%, and in fact investors who bought Qualcomm at the 2000 peak had to wait over 20 years just to break even (including dividends)! This is precisely why we often sound like a broken record when it comes to “expensive valuations” – there’s no business so amazing that it can’t be ruined as an investment by a too-high price.

It's important to distinguish between a business as a revenue generator and a business an investment. We have no doubt that AI related companies will grow rapidly in the coming years, just as internet related companies grew rapidly in the early 21st century – but if the expectations priced in to those companies is excessive, even rapid growth cannot make a good company a good investment.

Today, we have effectively 2x the concentration of high-multiple growth stocks relative to the dotcom bubble in the late 90’s. History is full of technological revolutions, and disruptors get disrupted… if you own the S&P500 today, you’re making a bet that it’s different this time.