In Today’s Note:

-

Strong stock market performance has pushed valuations to historically high levels

-

Investing at high valuations is like climbing a mountain in thin air – it becomes more difficult and hazardous at higher elevations

-

High valuations leave the investors who are taking on the most risk particularly susceptible to changes in economic conditions

-

We believe these high valuations justify an increased focus on company fundamentals rather than chasing momentum

Readers of this newsletter know that as markets have continued to grind higher into the fourth quarter, we’ve grown increasingly cautious about what we believe the stock market will deliver in the coming years. Recency bias tempts us to believe that when prices are rising, they’ll keep rising. And while bull markets can last for years, there’s one variable that’s especially important to keep in mind: valuations.

Any increase in a stock’s price can be broken into two components: 1) the company’s profit, and 2) the “multiple” investors are willing to pay for that profit. For example, if a company earns $1 per share and the stock trades at $10, its “earnings multiple” is 10x. If that multiple rises to 15x, the shareholder gains 50%, even though the company’s profit hasn’t changed.

A high multiple reflects investors’ expectations for faster growth in sales and profits. It’s entirely normal for a wide range of multiples to exist across the market. But when the entire market starts trading at very high multiples, we need to proceed cautiously.

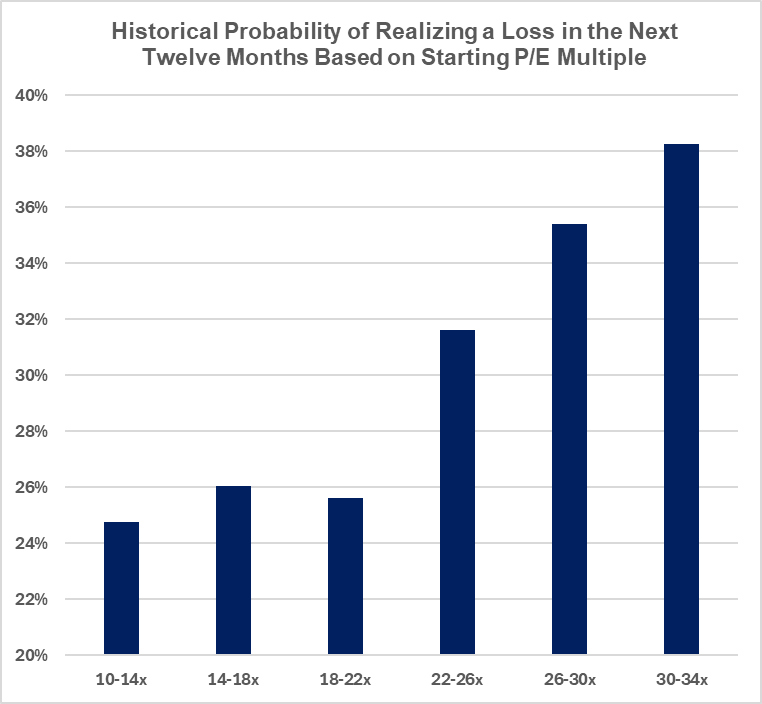

Historical data shows this relationship clearly. The higher the average earnings multiple climbs, the greater the likelihood that investors will face negative returns over the next year. Investing when markets sit near record highs is like high-altitude mountain climbing in thin air – not impossible, but increasingly difficult.

To illustrate this, we analyzed daily returns since 1990 for the MSCI World Index. When valuations were modest (around 10–20x), the historical likelihood of a negative 12-month return was about one in four. When starting multiples rose to 20–30x, that risk increased to roughly one in three.

For the world’s tallest peaks, altitudes above 8,000 meters are known as the “death zone” – air that’s simply too thin to survive in for long. In markets, profit multiples above 34x have historically represented their own “death zone”: the vast majority (over 90%) of forward one-year returns starting from that level have been negative.

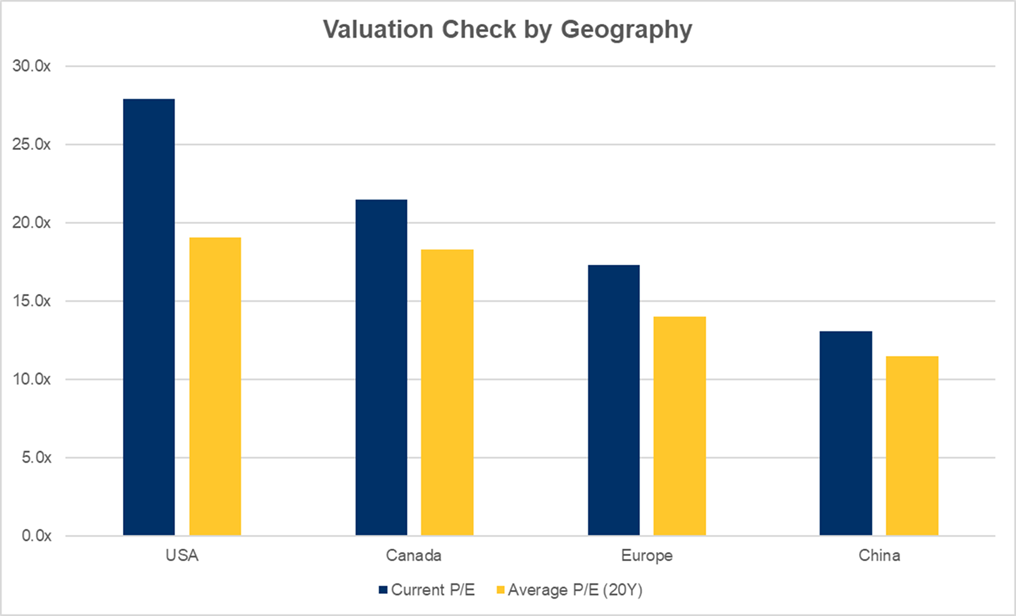

So how thin is the air currently? Well, we’re not yet in the death zone, but we wouldn’t want to be climbing without oxygen right now. U.S. valuations are very high, while most of the rest of the world is merely above average. That’s one of several reasons we’ve been steadily adding international exposure over the past 18 months.

Valuations aren’t the entire story, and using multiples as a market-timing tool rarely works. Still, ignoring the hazards of high-altitude investing is unwise. Investors who are camped high up on the mountain are much more susceptible to any adverse change in weather or conditions. As markets set new highs and climb further into thin air, it’s more important than ever to manage risk carefully and focus on companies with solid fundamentals rather than simply chasing the highest climbers.