In Today’s Note:

- The Bank of Canada and Federal Reserve both cut interest rates by 0.25% yesterday, as expected

- Unlike Canada, economic data in the U.S. remains strong while inflation is well above target

- The Fed is talking like a hawk (acknowledging high inflation & low unemployment) but walking like a dove (cutting interest rates)

- We believe inflation, debasement, and perpetually high fiscal deficits are a key risk to the US dollar and a key opportunity for gold and international stocks

Yesterday both the Bank of Canada and the Federal Reserve cut their key interest rates by 0.25%, as expected. It’s easy to make the case for a cut here in Canada, with negative Q2 GDP and very concerning jobs losses being reported over the summer, not to mention a languishing housing sector amid near-zero population growth.

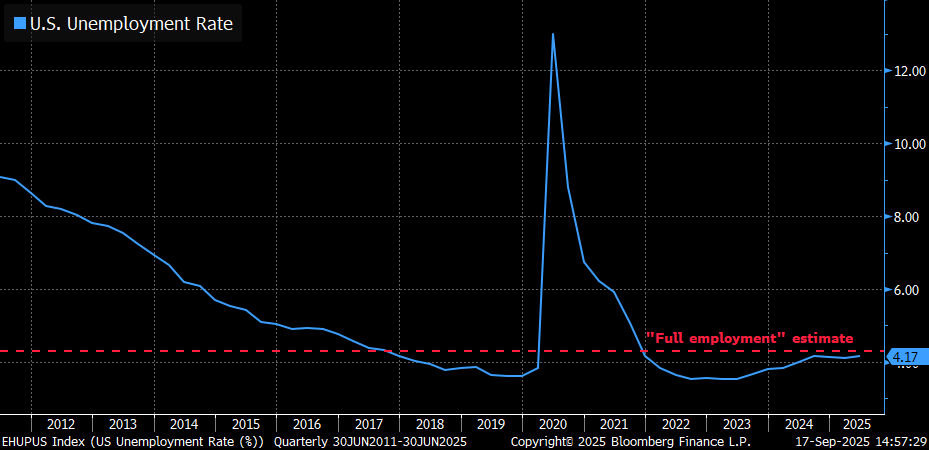

In contrast, US economic data has been robust. It’s true that the latest jobs report was underwhelming, but overall the labor market remains strong, with the U.S. unemployment rate sitting near record-low levels. Inflation has also stayed stubbornly high in the U.S. – core inflation has now notched 54 consecutive months above the Fed’s 2% target. Rate cuts are meant to stoke growth and increase inflation – does the below chart look like they need to be pushing inflation higher?

Of course the Federal Reserve’s job is to uphold its famous “dual mandate”, which aims to achieve stable inflation near 2% and “full employment”, which is generally estimated to be an unemployment rate near 4.2%. While Canada’s unemployment rate has risen quickly to over 7%, in the U.S. it’s still within a stone’s throw of the lowest level recorded in over 70 years.

Fed Chair Jay Powell’s post meeting press conference started with a very unusual set of sentences, where he acknowledged that unemployment is low and inflation is high, but they’re cutting rates anyway. Bloomberg analyst Anna Wong succinctly identifies the strange doublespeak coming from the Fed.

The policy statement added language to flag increasing downside employment risks, while acknowledging that inflation has moved up. In contrast, officials marked up their growth estimate this year and lowered the unemployment rate estimates in the SEP forecast horizon.

So Fed officials have slightly increased their growth estimates and lowered their unemployment estimates at a time when inflation has been rising, and their response is to cut rates to stimulate additional economic activity and inflation – exactly the opposite of what you’d expect in this type of environment.

Perhaps this doublespeak is simply a reflection that the Fed is seeing something that the rest of us aren’t – it’s possible that their analysts are seeing some concerning underlying data that isn’t yet flowing through to broader economic data. Perhaps the Fed is succumbing to the strong and constant political pressure from President Trump, who has been very vocal about his displeasure with interest rates (and will be picking the new Fed chair in just 8 months).

However, as investors it’s much more important to look at what the Fed is doing rather than why they’re doing it. And what they’re doing is cutting rates, with another two rate cuts now expected at the final two meetings of 2025, and more to come next year as well.

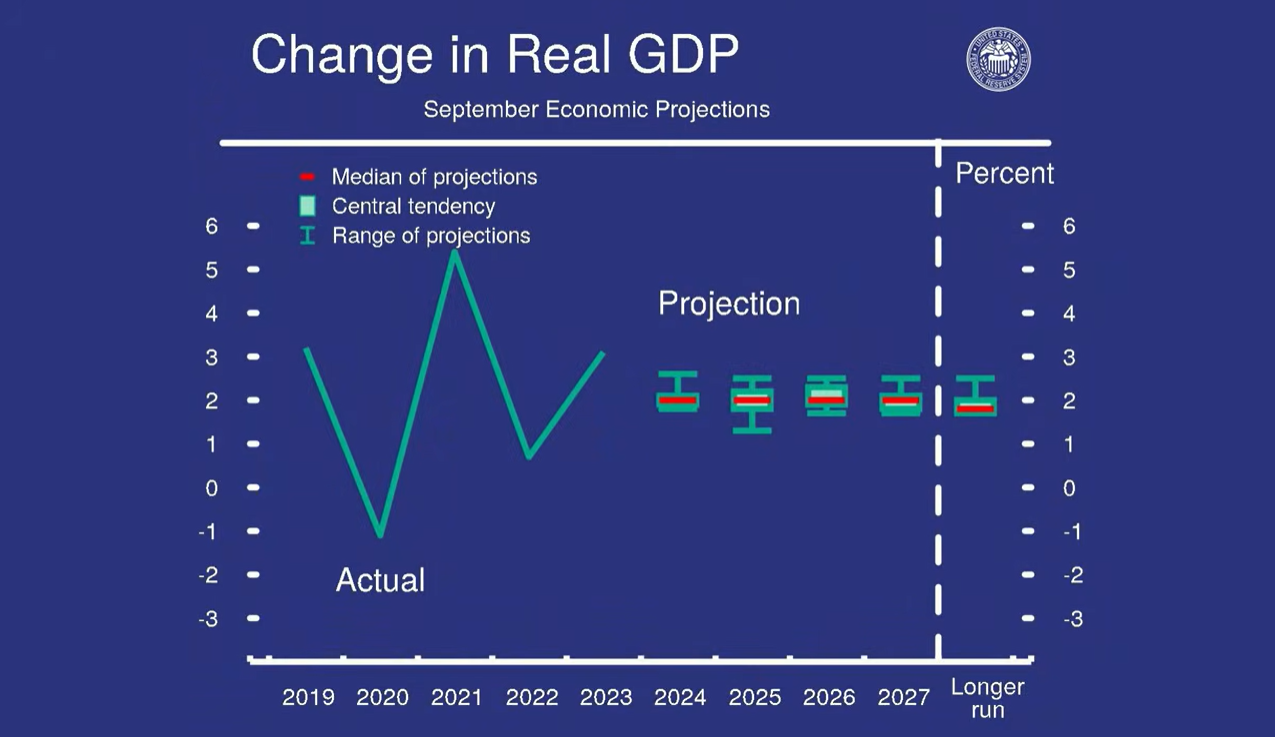

It’s also worth noting that nobody on the planet has been consistently able to forecast economic conditions or interest rates with all that much accuracy beyond a few quarters – even when the predictions are coming from the institution that actually sets interest rates! Look at the below chart and compare the very large variability in actual growth with the Fed projections for future years. Do you think growth is likely to be as stable as the Fed does going forward? I sure don’t. For this reason, it's important to place a very high band of uncertainty on where growth and inflation actually end up, because the Fed’s prediction record over the past 30 years is about as strong as the Maple Leafs in the playoffs.

This also increases the likelihood that the Bank of Canada continues following suit with rate cuts to avoid having the loonie strengthen too much relative to the US dollar, since a stronger loonie hurts struggling exports and would further hurt our already weak economic situation.

But regardless of why the Fed is cutting rates, they are cutting rates, and we need to make sure portfolios are positioned to benefit. For clients who have been reading our monthly newsletters (perfect for those among you who need help getting to sleep at night) or have had their annual review lately, you’ll know that we’ve talked a great deal about “debasement” in recent months. Debasement is the dilution of currency relative to scarce assets like gold or land, or productive assets like stocks of profitable companies who have a strong enough competitive position to pass price increases along to customers.

Recently it’s been gold that has been the biggest winner of the Fed’s shift to rate cuts and debasement – the price of gold has increased by 10% in just the last month alone, and briefly touched an all-time high of $3700/oz. In contrast, the US dollar has been the biggest loser, with the dollar having declined nearly 12% relative to foreign currencies since early January.

Although the path of the US dollar and interest rates will not be a straight line, we expect this trend to continue in the medium term and is a major reason why we favor gold and international equities over US stocks (particularly the speculative, high valuation names that have been stock market darlings over the past 3 years). It’s also worth noting that US stocks are dominated by a small number of names that are highly correlated to one another – the US market is nowhere near as diversified as it used to be.

We’ll continue watching the Fed’s words and actions, but for now our view is that we are becoming increasingly cautious. We want to make sure our clients are well protected against the risk of high inflation and well positioned to take advantage of monetary and fiscal policy designed to debase currency over time.