In today’s note:

- Trump can’t fire Powell in theory but can in practice. Either way, Powell will be replaced by a Trump pick in May.

- A more “accommodative” Fed Chair will be yet another tailwind to push inflation higher, and watching the yield curve’s reaction is the best way to assess the risk of higher inflation.

- Given our expectations for changes at the Fed, we want to protect client portfolios against the risk of higher inflation by favouring scarcity assets and stocks that can more easily pass costs on to customers.

After a fresh round of attacks against Federal Reserve Chair Jay Powell, many are asking whether it’s possible or feasible for President Trump to push him out. Does it even matter? The answer to both of these questions is a crystal clear “it depends”.

In theory the Federal Reserve is independent and the president can’t fire the chair except in cases of fraud or other sorts of gross negligence. In practice, President Trump could almost certainly make it happen, particularly since he resides at the top of the command structure that would decide what counts as “gross negligence”. What would happen if he did fire Powell is a more difficult question – it would certainly be an impactful precedent in the context of independent monetary policy, but that doesn’t necessarily mean the market reaction would be completely negative (although in aggregate the initial reaction would very likely be down).

Nonetheless, President Trump recently backed off the idea of firing Trump, and twice now the market has given the president a slap on the wrist for exploring the idea. But there can be no question that Trump is not a fan of Powell and the rest of the Fed’s reluctance to cut interest rates: he called Powell a numbskull this week and celebrated the fact that he would be gone by May.

One thing we’re quite certain on is that the next Fed chair will be more willing to cut rates than Powell currently is. With inflation still sitting firmly above the 2% target, jobs growth chugging along, and fiscal deficits running extremely hot, it’s difficult to make the argument that the US economy needs another jolt of stimulus. But Trump has been very vocal on wanting that stimulus in any case, and there’s really nothing to stop him from getting it. With the US economy already at full employment, we think the result will be inflationary.

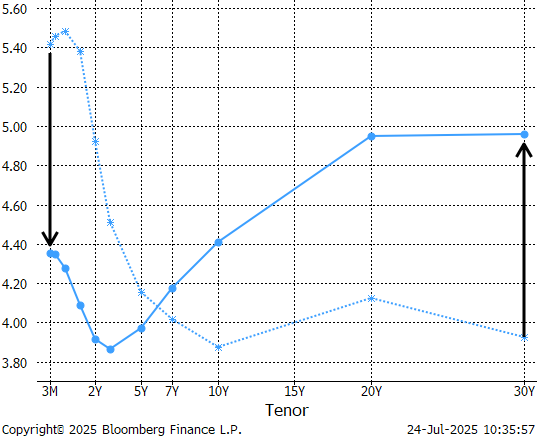

In particular we think the key piece of data to keep an eye on with respect to Powell’s replacement will be the reaction of the yield curve. You may recall three years ago when financial news media was saturated with breathless coverage of an “inverted yield curve”, which had almost perfectly predicted recession within 2 years every time it occurred (except this time). An inverted yield curve is when long term yields are lower than short term yields, which is viewed as negative because it means bond markets expect interest rate cuts in the near future to deal with a poor economy. This time around, we expect the reaction to a more “friendly” Fed chair would be the opposite: a steeper yield curve.

In fact much of this “steepening” has already occurred. The chart above shows the yield curve two years ago (dotted line) relative to today (solid line). Since July 2023, short term yields are much lower and long-term yields are much higher. If an inverted yield curve is bad news, a steep yield curve must be good news? Not necessarily, but there are certainly winners and losers from a steeper yield curve.

Our main focus given the continued uncertainty about Fed policy is that we want to protect client portfolios against the risk of inflation. This means investing in assets that retain their value in periods of higher inflation (including scarcity assets such as gold) as well as choosing sectors and companies that have greater ability to pass along higher costs to customers.

Just as we think most of the heavy lifting to prepare for Trump’s tariff impact needed to be done in late 2024, now is the time that we think portfolios need to be positioned for a more accommodative Fed Chair next spring, and the changes we’re making in portfolios recently reflect that view.