The weeks that immediately followed a Republican sweep of the White House, Congress and Senate were met with a surge of optimism in markets: the S&P 500 climbed 5%, megacap tech stocks jumped, Bitcoin surged to an all-time high, and a variety of so-called meme-stocks exploded in value. The playbook for what worked in those early days was quite simple: the more speculative the asset the better. The rationale for this exuberance was that a Trump presidency would see lower taxes, more deregulation, and a friendly business environment overall.

Recently, however, some air has come out of this trade. A barrage of tariff related headlines combined with softer than anticipated economic data (even while inflation has come in hotter than expected) has provided investors with a dose of caution. From speaking to business owners, it’s not necessarily the tariffs themselves that are the number one concern, it’s the uncertainty. In fact just this morning Trump announced Canadian and Mexican tariffs would be implemented on March 4th, nearly a month earlier than was expected (and an unexpected additional 10% tariff on China). We could very well see this pushed back again if last month’s process is any guide. Given this fast-changing trade landscape, business investment is likely to be subdued throughout 2025, particularly here in Canada where we have more to lose from a protracted trade conflict.

With that being said, Bitcoin, meme-stocks and megacap tech are still above their pre-election levels, so it’s far too early to claim that a Trump presidency won’t be good for the more speculative and high-multiple segment of the market. However, we do think it’s important to remember that markets often behave in ways you wouldn’t expect under certain administrations, in large part because markets have already priced in expectations of a given president’s policies before they’re actually implemented. Some notable examples of this are the excellent performance of the healthcare, bank and defense sectors under Obama, green technology under Trump’s first term, and the energy sector under Biden, all of which are counterintuitive results given each President’s policy objectives.

Our view is that the historically expensive valuations that accompany many of the early Trump trade names are too detached from fundamentals to be attractive as long-term investments, and we prefer to take an increasingly defensive stance among stocks. It’s certainly still too early to make any sort of conclusions about the sustainability of the Trump trade , but the initial euphoria has taken a meaningful step back, and our hope is that this is the beginning of a market that’s more focused on fundamentals going forward.

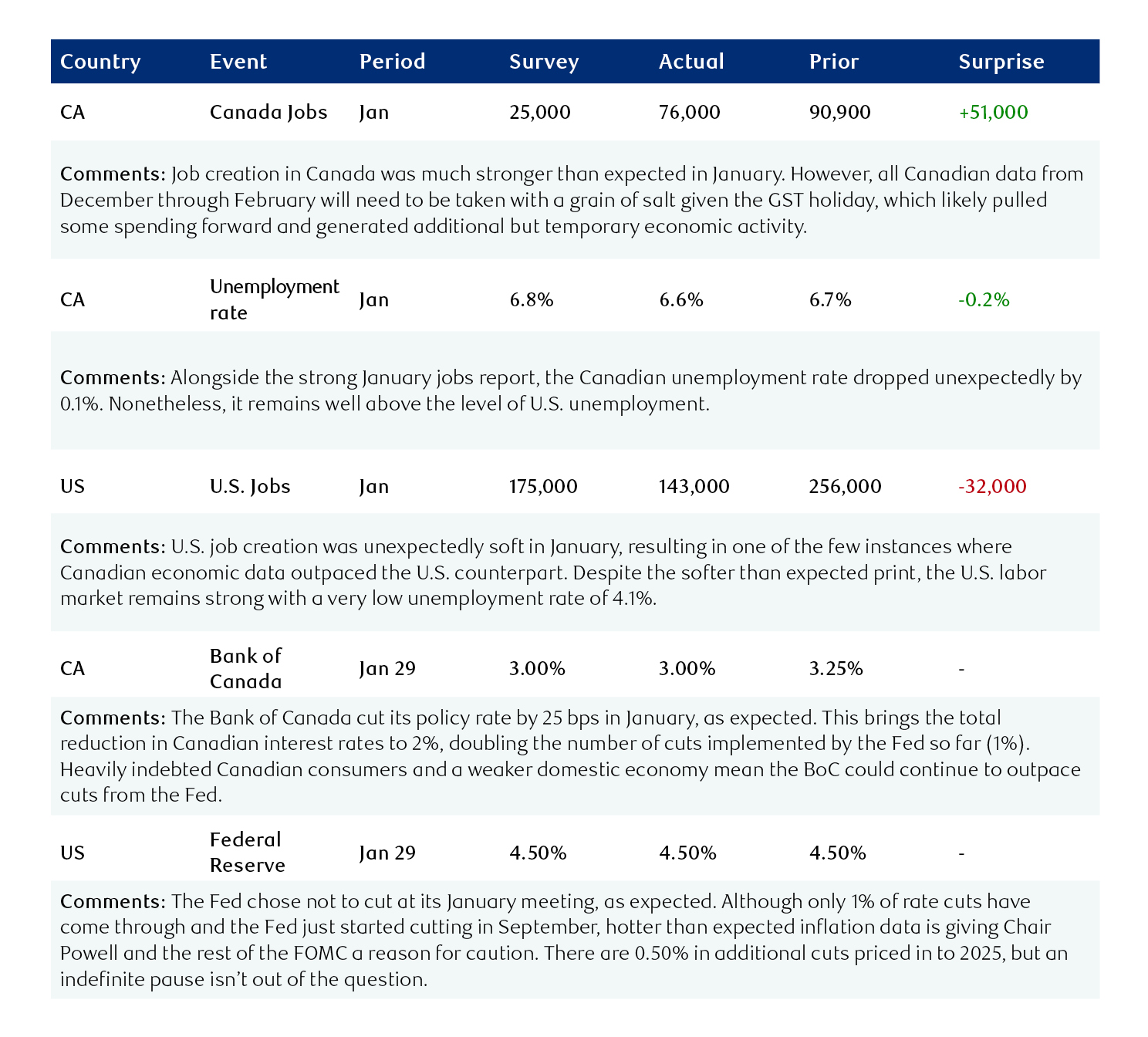

Data digest