Trump & GOP in the driver’s seat – now what? After a strong showing across the country and (likely) a complete sweep of the White House, Senate and Congress, this election went as well as the Republican Party could have hoped for. With this stark shift in US power dynamics, let’s look at what parts of the market are likely to benefit from Trump’s stated priorities. However, before we do so, it’s worth stating that we recognize and respect the diverse and passionate political views across our valued clients. However, it is our job as investment professionals to remove emotion and bias from the portfolio management process. For that reason, our focus is not on what any one of us thinks should happen, but what we think will happen. In the following analysis, views will be limited to the policy shifts that are likely to have an impact on markets only.

With that out of the way, let’s look at what we view as the three largest investment implications of a Trump presidency.

Tax: Trump is expected to extend the 2017 Tax Cuts and Jobs Act, which lowered corporate tax rates significantly and personal tax rates modestly and is set to expire next year. Tax reform is challenging to pass, but Republicans may look to use their new power to enshrine these changes permanently, expand on them, or both. With a deficit already approaching $2 trillion annually, federal debt and interest expense are expected to grow rapidly. Impulse: higher debt, higher growth, higher inflation, higher long term yields

Trade: One of Trump’s marquee promises during the campaign was to impose significant tariffs on trade partners (particularly China) in a bid to turn a persistent trade deficit into a trade surplus. Given the nature of America’s role in the global economy, flipping the trade deficit into a surplus would be an unlikely outcome even with the imposition of significant tariffs. It’s also our view that much of the aggressive trade rhetoric from Trump will be used as negotiating leverage – if China truly believes 60% tariffs are a possibility, they may be willing to compromise with an agreement that reflects their changing role on the global stage. Nonetheless, the market’s working assumption is that trade barriers will increase in Trump’s term, even if the magnitude remains uncertain. Impulse: higher inflation, higher wage growth, greater demand for industrial capacity, higher domestic credit growth, higher long-term yields

Immigration: One of Trump’s stated “Day One” objectives is to close the border to undocumented immigrants, which has seen elevated levels of crossings in recent years. A step beyond securing the border would be the mass deportation of existing undocumented immigrants, another of Trump’s promises. Both outcomes are much easier to promise than to implement, but at the very least we expect population growth to slow meaningfully. Impulse: lower GDP growth, higher domestic wage growth, higher services inflation

You’ll notice that higher inflation and higher long-term bond yields appear more than once, and indeed we view these as likely outcomes of Trump’s proposed policies. I won’t go into further detail on why bond yields have risen post-election, but we did discuss that potential market reaction in our latest Capital Currents podcast. If we turn to equities, the stock market’s day-after reaction seems logical. The best performing sectors were small-cap financials (lower regulation and higher domestic credit growth), energy drilling and exploration (increased drilling permits), and industrials (onshoring of industrial and manufacturing capacity). The worst performing sectors on November 6th were consumer staples (complex offshore supply chains at risk), utilities (higher bond yields), and real estate (higher bond yields push mortgage rates higher).

Investing post-election isn’t as easy as shifting away from these “losing” sectors and into the “winners” – in large part because there remains a great deal of uncertainty as to how Trump’s policies will unfold in reality as opposed to on the campaign trail. The bigger factor, though, is simply that the bulk of these changes have already been priced into markets in recent months, particularly as Trump’s odds of winning the election improved. We’re happy with how our investment strategy is positioned to defend against the risk of higher inflation while also taking advantage of increased domestic industrial capacity, but we will nonetheless be looking for new opportunities to take advantage of at the margin. As always, please let us know if you have any questions about this month’s newsletter, and feedback is always welcome.

Bottom Line: We believe the next four years are likely to see a rebound in inflation, higher long-term bond yields, and greater demand for domestic industrial capacity. We favour energy and industrials, with a particular focus on names that are relatively insulated from inflation and well positioned to take advantage of higher international trade barriers.

Chart of the Month

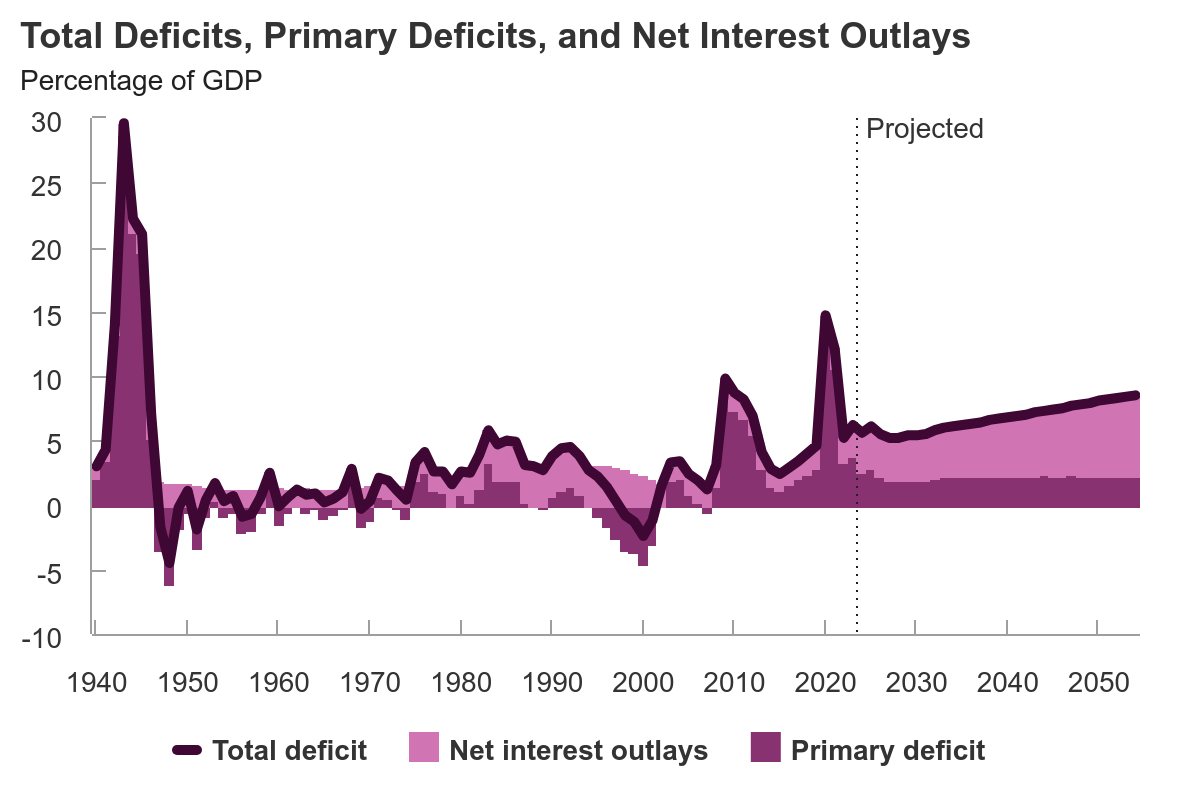

One outcome that has been all but assured even before election day is the continuation of multi-trillion dollar annual deficits. Neither party campaigned on fiscal austerity, and roughly $2 trillion in additional debt is expected to be added each year, although that could grow if Trump expands on his previous tax cuts. Annual interest expense now exceeds U.S. defense spending and is expected to grow significantly for the foreseeable future as existing maturities are refinanced at higher rates, all while the debt burden grows further each year. Unless future administrations implement severe austerity, the way out of this problem is a combination of artificially low interest rates and above-target inflation to increase tax receipts – a strategy known as financial repression. This inescapable reality is one of the key reasons we view inflation as one of the key risks to position portfolios for going forward.

Source: Congressional Budget Office

Data Digest

A selection of key economic data-points for the month.