To quote one of the most iconic voices of the 1980s – “Oh what a feeling, when we’re dancing on the ceiling.” Now that we have implanted that ear worm in your heads, let’s segue to a ceiling of another sort – the Bank of Canada’s latest rate decision and the likelihood that the BoC has reached the ceiling.

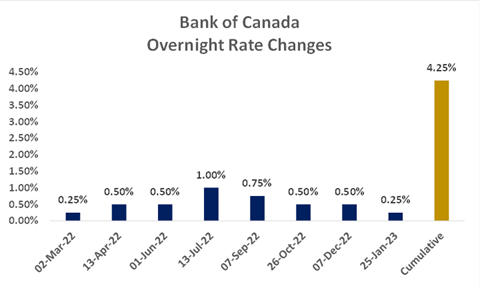

The Bank raised rates another quarter point this week, bringing the cumulative sum of rate hikes to 425 basis points (the overnight rate started this cycle at 0.25%, so it is currently 4.5%):

Following the rate hike this week, the BoC said it “expects to hold the policy rate at its current level while it assesses the impact of cumulative interest rate increases.” This is central banker code for – we felt one more hike was needed to put a cherry on top of the sundae, but unless something really surprises us, we are content with the sundae we’ve got and will not be adding anymore Oreo cookie pieces to the sundae.

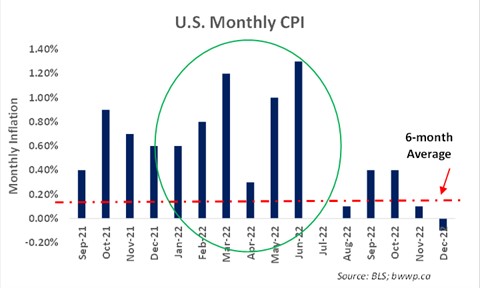

As far as what would make the BoC less content with the sundae they’ve made (we are going to extend this painful analogy as long as we can), inflation is likely the only real wildcard from here. As we have written several times in the past few months (Thoughts On...Revisiting the Inflation Debate), inflation is coming down and is likely to continue to do so into mid-year. The two biggest drivers of this will be: 1) the monthly inflation readings from January through June of 2022 were really chubby:

And 2) certain components of inflation (owner’s equivalent rent the biggie) will start to come down rapidly as 2023 progresses as they usually lag by 6-12 months. Thus, while one can never rule out another rate hike, we believe the likelihood is probably now fairly low.

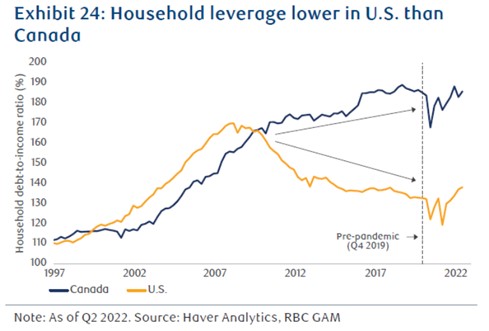

Now, the effect of all of these rate hikes will be felt for some time to come with RBC Economics continuing to forecast a mild recession in Canada beginning sometime in the next 3-9 months. The biggest risk for Canada vs. the U.S. is the general level of indebtedness in Canada with Canadians collectively entering this hiking cycle in a much worse place than their peers to the south:

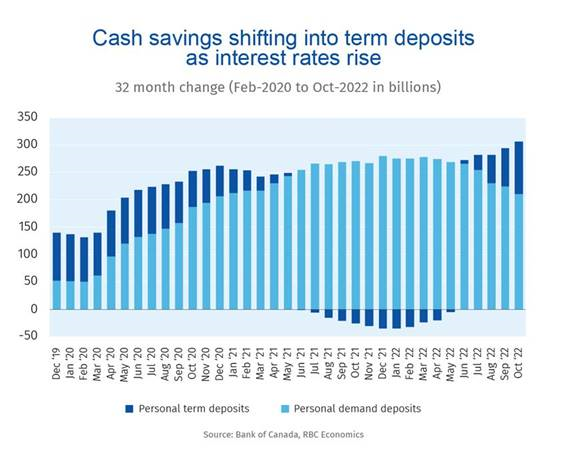

With interest rates significantly higher than they were a year ago, this increased debt burden will weigh on the Canadian economy and may prompt the BoC to be more apt to begin reducing rates sooner than the U.S. Fed. That said – the news is not all bad for Canada:

As you can see, Canadians do have a significant cash buffer that was built up through the COVID-crisis. Thus, while the pinch of higher rates and slower economy are going to weigh on growth, there is a significant savings buffer to help absorb the blow.

Market Update

With the first month of the year nearly in the books, we thought a quick market comment would be in order. So far, markets have had a strong start to 2023. This has caused many to bring out their trusty Investor’s Almanacs to find out what a positive January augers for the rest of the year. With that in mind, let’s take a look and then comment:

As you can see, a positive January (there have been 53 since 1945) has generally been followed by a strong rest of the year, whereas a negative January (25 of them) have generally been followed by flattish returns. Further, the likelihood of a positive year following a positive January is ~77%, so it is unusual (but not impossible) to see markets backslide after a strong start to the year.

Thus, while we remain cautious on the outlook for 2023, we do take some comfort in the positive start to the year.