The 96th Academy Awards will be held three weeks from now and in honor of the first ever AI-hosted event – Mario the Chatbot will be hosting utilizing the downloaded comedic routines of Buddy Hackett, Jackie Mason, George Carlin and the scripts of the last seven Marvel movies – we thought we would provide some general thoughts.

Oppenheimer, the first ever movie in which an actual nuclear bomb was detonated, leads the way with 13 nominations; although it will not be able to achieve the fabled “Cuckoo” or “Dr. Lector” – so named for the past two films to sweep the Big 5 awards – Picture, Actor, Actress, Director, Screenplay – as its director, Chris Nolan, generally does not include female roles in his films (we admit it was weird when his version of Jane Austen’s Emma did not actually include the role of Emma, but rather her brother Todd). Some less reported side bits for this year’s awards –Robbie Robertson of The Band is up for his first and sadly last Oscar (he passed in 2023) for the score of Killers of the Flower Moon, while Composer John Williams competes for his 54th Oscar, which is second to only Walt Disney, and extends his record as the oldest ever nominee at the age of 91 (Martin Scorsese also becomes the oldest ever Best Director nom for Killers). A special shoutout to a literal living legend – Eva Marie Saint (EMS to her peeps) – who celebrates the 70th anniversary of her Oscar win (and 100th birthday in July) and if there’s a better “so you think you can act, how do you like them apples!” when she throws down her award for playing Edith Doyle in On the Waterfront opposite Marlon Brando, then we would love to see that “contender”.

Inflation: We just can’t quit you

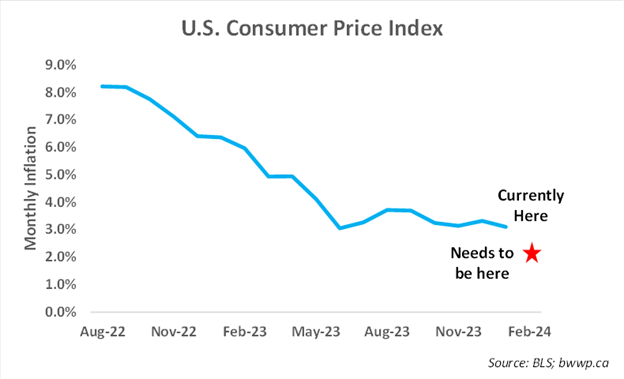

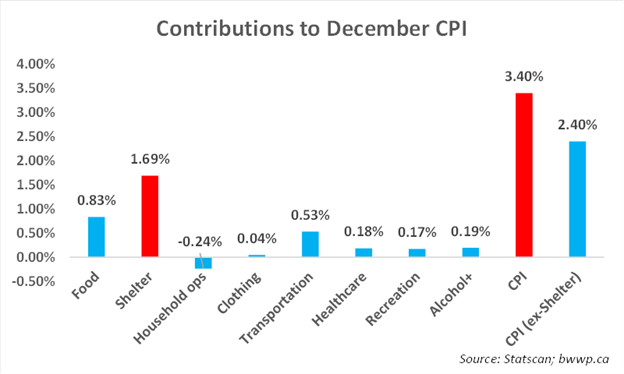

Let’s start with a chart and then comment:

CPI for the month of January came out this week at 0.3% month-over-month, which kept yearly inflation above 3% (3.1%) for the 33rd straight month. The Federal Reserve’s targeted inflation remains 2% and with several components of the inflation data set remaining sticky, that target would appear to be some months off. On that front, let’s add a bit of color to the inflation data:

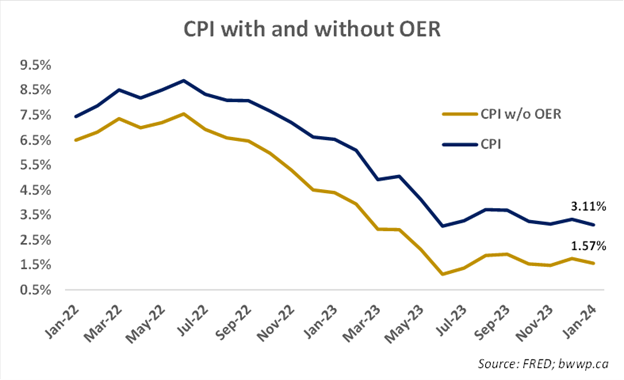

We have pointed this out for some time – but the single biggest driver of CPI remains Owners’ Equivalent Rent (OER) , which is an imputed value that tries to attach an inflation value to U.S. housing. Currently, OER is running at ~6.2% year-over-year, and because it accounts for ~30% of the CPI basket, it is almost single-handedly keeping CPI not only above 3%, but above 2% (as you can see in the chart above, CPI-ex OER is below 1.6%).

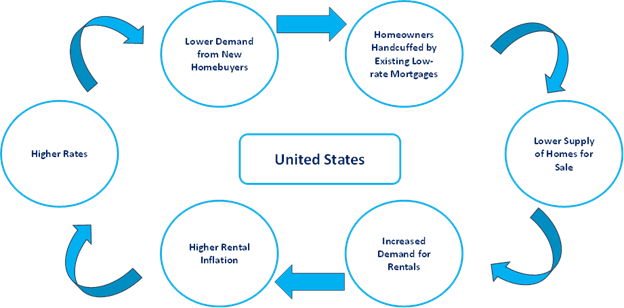

We would also add that the U.S. housing market remains caught in a vicious cycle of sorts. This is the case (note that we have written about this before) because ~90% of all mortgages in the U.S. are long-term (25-30 years) fixed rate mortgages. Unlike Canada, these mortgages cannot be ported to a new home purchase – in other words, if you sell your house and buy a new one, you need to go to the bank to get a brand-new mortgage. Of course, when you are sitting on a 30-year fixed rate mortgage at 3.5% or so (as many people are) and current mortgage rates are closer to 6.5% to 7%, giving up your existing rate for one roughly double what you are paying is not an attractive proposition for most and thus existing home supplies have fallen sharply. This not only keeps prices high (even though demand from new home buyers is down due to the costs of getting a new mortgage), but also stokes rental demand, thus increasing rental prices. The diagram below attempts to capture this cycle:

Source: www.bwwp.ca

We would also add the Producer Price Inflation (PPI) also remains too high, and this is not impacted by OER, so the story is not just one of shelter costs. Eventually, the Fed will find a way out of this, but it is not surprising that the market, which had been pricing in as many as seven rate cuts in 2024 is now down to roughly four and that may soon drop to three.

Okay, let’s now pivot to Canada:

Canada: The Cycle is Different, but the Result is the Same

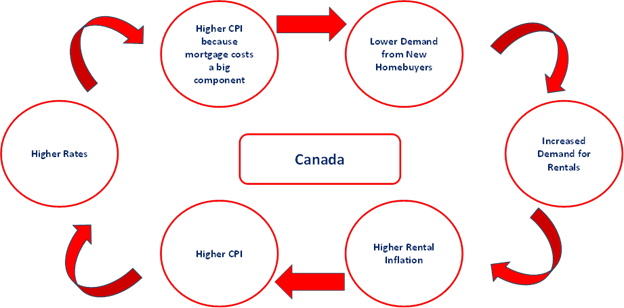

Let’s first start with Canada’s version of the above flow chart and then comment:

Source: www.bwwp.ca

As you can see, Canada works a bit differently. This is the case mainly because we do not have 30-year fixed rate mortgages, but rather shorter-term mortgages that need to be refinanced every few years. In addition, and perhaps most importantly, the Bank of Canada uses a different calculation for CPI that is a bit silly (at least in our humble view). Unlike the U.S., which imputes an inflation value for occupying a home, Canada’s inflation gauge includes the monthly change in mortgage costs. Of course, mortgage costs are directly the result of Bank of Canada interest rate policy, so every time the Bank raises interest rates because inflation is too high, this feeds into the Shelter component of CPI, which in turn pushes inflation higher, which in turn prompts the Bank to … well, hopefully, you get the point.

Is this too simplistic? Sure – but it is worth noting that the Bank of Canada continues to jawbone that inflation is too high (and it is), but the picture looks a fair bit different when we control for the one component that is going to show inflation precisely because the Bank of Canada is raising interest rates:

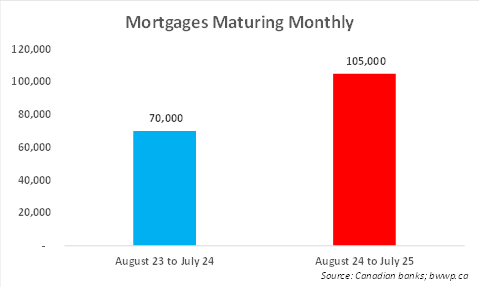

The good news is – with the Bank of Canada’s last hike in July of 2023 and further rate hikes highly unlikely, we will naturally start to see this component flatten out or even come down as we head into the Summer of 2024. This remains very important for the Canadian economy, which continues to shrink on a per capita basis, as we continue to face a “wall of mortgage maturities”:

Bottom Line: The battle against inflation has been uneven and stubborn. While we have seen it come down from ~9% in the middle of 2022 to between 3% and 4% now, getting it on a sustainable path to 2% remains an ongoing challenge. Our view remains that the Bank of Canada will be forced to act sooner than will the U.S. because of our inherent sensitivity to interest rates. We would expect that by the summer, the Bank of Canada will be on a rate cutting path; although, the U.S. is looking more like a second half of the year story, absent a sudden shift in the economy.