When Lazy Becomes Stupid and Stupid Becomes Ironic

For this week’s missive, we honor the not late and the not-so-great campaign of Ronald Dion DeSantis. You see, Ron, or Neon Dion to his peeps (sorry, wrong Dion), announced last weekend, when 90% of the American public was watching along with Travis Kelce’s girlfriend the Chiefs/Bills game (spoiler alert, the Bills missed yet another field goal wide right and they and their fans remain in sports hell), that his campaign for President was at an end.

The campaign got off to an ignominious start with a botched Twitter, err X, err eccentric billionaire’s dying website, launch and then died on Iowa mountain, the first of 94 Republican primaries. The best part of Neon’s departure as The Atlantic pointed out was a Winston Churchill quote that the campaign used to promise that while Ron was down, he was far from out and that he would return better than ever - presumably in four years when Donald Trump is not around (we can hope) to steal what is left of DeSantis’s soul.

But - as The Atlantic noted - the Churchill quote was not actually a Churchill quote, but rather was from an old Budweiser advertisement - which is beyond ironic because DeSantis and his group known collectively as “Florida Man” fought a public campaign against Budweiser in 2022 because of perceived beer wokeness (the PC term for “King of Beers” is now apparently “Leader of Malt Beverages”).

While we prefer our beer cold - wokeness optional - we do appreciate when lazy becomes stupid and stupid becomes ironic – so, we raise a toast with our cold Bud to RDD and hope that we never have reason again to wax poetically about him.

Early Election Thoughts

Speaking of U.S. Elections, we thought we would provide some early thoughts. We are going to avoid some of the darker topics that are sure to plague the airwaves over the next 10-months in favor of a more data driven approach. We would note (and caution) that polls mean virtually nothing in January of an Election Year (Donald Trump led all his would-be 2020 foes at this point in 2020 and Joe Biden was fading fast in the Democratic primaries to site two examples) and thus we would not jump to any conclusions (or from any windows) just because some polls show a certain outcome. Okay, let’s get to it with a chart:

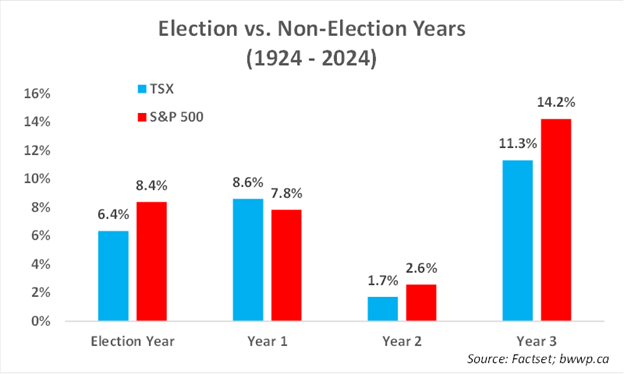

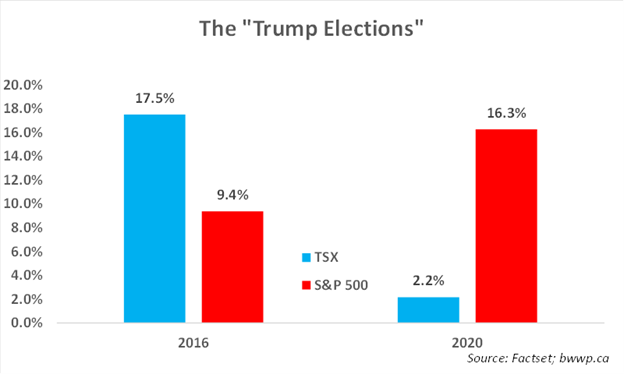

Over the past 100-years, Presidential Election years have generally been okay for stock markets when compared to non-Election years. There is some disparity around when there is no incumbent running (several really bad years occurred around termed out Presidents), but given that is not the case in 2024, we will ignore these outliers. In case you wondered what the last two “Donald Trump” election years looked like, here you go:

Over the past 100-years, Presidential Election years have generally been okay for stock markets when compared to non-Election years. There is some disparity around when there is no incumbent running (several really bad years occurred around termed out Presidents), but given that is not the case in 2024, we will ignore these outliers. In case you wondered what the last two “Donald Trump” election years looked like, here you go:

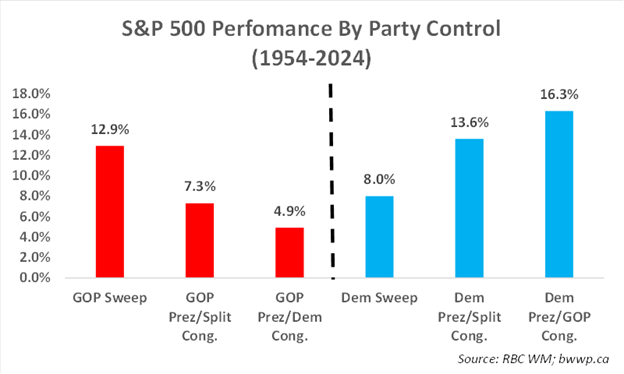

Okay, now one thing that does not tend to get a lot of attention but matters almost as much to markets as who wins the White House, is the composition of Congress. Generally speaking, markets tend to favor a Democratic White House, but mixed leadership tends to be the best outcome:

Okay, now one thing that does not tend to get a lot of attention but matters almost as much to markets as who wins the White House, is the composition of Congress. Generally speaking, markets tend to favor a Democratic White House, but mixed leadership tends to be the best outcome:

While control of the House of Representatives is always a bit a guessing game (especially in January), it is going to be a difficult road for the Democrats to maintain control of the Senate, in which they currently hold a 53-47 advantage. Of the 34 seats up for grabs in 2024, 22 are currently controlled by Dems with a few of those – West Virginia, Montana, Ohio – in deep red states and a couple of others – Arizona, Michigan – in toss up states.

While control of the House of Representatives is always a bit a guessing game (especially in January), it is going to be a difficult road for the Democrats to maintain control of the Senate, in which they currently hold a 53-47 advantage. Of the 34 seats up for grabs in 2024, 22 are currently controlled by Dems with a few of those – West Virginia, Montana, Ohio – in deep red states and a couple of others – Arizona, Michigan – in toss up states.

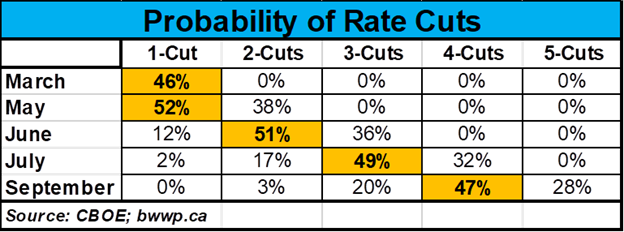

Okay, let’s pivot a bit and focus on interest rates. Let’s look at a table and then comment:

Investors are currently pricing in the first Fed rate cut by May of this year with March only slightly less than a 50/50 proposition. By the summer, expectations are for close to three cuts and by the election, there is now close to a 50% probability of four cuts. The Fed likes to maintain its independence and so rate cuts close to Election Day are generally less likely as they would be viewed to favor the party in power (the notable exception to this would be during times of financial stress), so there is some risk to the above forecast, especially as it relates to the September meeting.

Investors are currently pricing in the first Fed rate cut by May of this year with March only slightly less than a 50/50 proposition. By the summer, expectations are for close to three cuts and by the election, there is now close to a 50% probability of four cuts. The Fed likes to maintain its independence and so rate cuts close to Election Day are generally less likely as they would be viewed to favor the party in power (the notable exception to this would be during times of financial stress), so there is some risk to the above forecast, especially as it relates to the September meeting.

We would note that while we will all probably focus a lot on politics this year, the path of interest rates is likely to be a far bigger driver of the market than who ends up winning the White House or Congress.

Bottom Line: Election Years generally turn out okay with some notable exceptions that tend to occur during years in which no incumbent is running for office – 2000, 2008. Almost as important, at least from an historic perspective, as who wins the White House, is whether or not Congress is controlled by the same party as the White House – with mixed government – especially if it’s a Democrat in the White House – the preferred outcome. And while we do not wish to downplay the importance of this election, we do believe that monetary policy is likely to matter more than politics and thus is worth keeping a close eye on in the months to comes. Until then, we will enjoy our woke Bud.