A Random Walk Down Bay Street

With the first quarter of 2024 now in the books, we thought we would spend a bit of time doing a quick run through where various Canadian economic and market indicators stand.

Canadian Economy

Probably the best way to describe it is – things are meh. GDP did rise by 0.6% in January and is expected to rise a further 0.4% in February when numbers are released. While this is a welcome respite from the back half of 2023 in which GDP essentially flatlined, we would offer some cautious nuggets:

- The ending of teacher’s strike in Quebec that weighed on GDP in November and December contributed roughly half of the January gain. So, in a sense, Q4 growth was not as bad as it seemed because of the strike, but Q1 growth is not as good as it seems because of the ending of the strike.

- Population growth remains parabolically high and as we have pointed out – this helps to boost overall GDP, but when looked at on a per capita basis, GDP growth remains negative. In other words, were it not for robustly robust immigration, Canada’s economy would likely be shrinking in absolute terms.

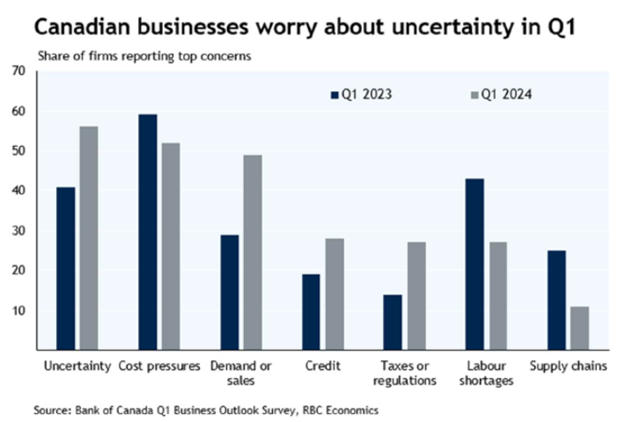

- There’s a gigantic pall hanging over Canadian businesses that is proving hard to shake. Let’s look at a chart and then comment:

General “uncertainty” among businesses is up sharply from a year ago, which is quite striking. Consider that a year ago, we were coming off a year of sharp interest rate hikes with limited indication that inflation was coming down. Fast forward a year and inflation is definitively headed in the right direction, the Bank of Canada is likely getting ready to cut rates (more on this in a bit) and the U.S. economy has avoided recession. And yet – uncertainty for Canadian businesses is higher, not lower than a year ago. Further, while cost pressures (inflation), labour shortages (related to inflation) and supply chains (also related to inflation) have improved, businesses see sharply higher risks in end demand, access to credit and taxes/regulations as ever bigger concerns.

Housing

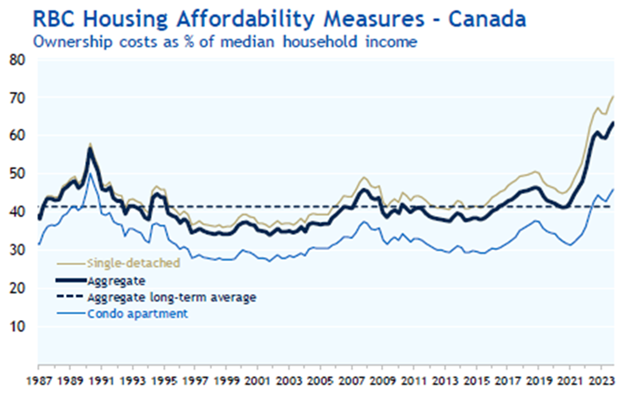

While we continue to believe that Canada is vulnerable to a housing bubble over the next few years, with interest rates still high, the market is unlikely to see a rise in demand over the next couple of quarters.

Housing affordability has now pushed to its worst levels on record as the high cost of homes, coupled with the high costs of borrowing weighs on the market. The government announced this week that it would look to curtail the number of non-permanent resident entrants into Canada in part to take some pressure off the housing market; although, we are skeptical this will have much of an impact considering the immigration numbers over the past couple of years.

Interest Rates & the Dollar

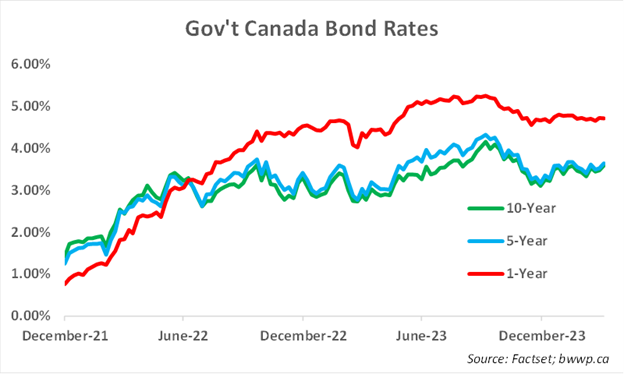

On the interest rate front, yields have generally settled into a range after falling in the back half of 2023:

1-year yields currently sit at around 4.7%. Markets are currently pricing in the first Bank of Canada rate cut in July, followed by two more before year end. We continue to believe that the BoC should be more aggressive in reducing rates regardless of how sticky inflation has been. This is largely driven by the large number of mortgages that will be resetting in 2024 and 2025 and the negative impact that could have on the Canadian economy.

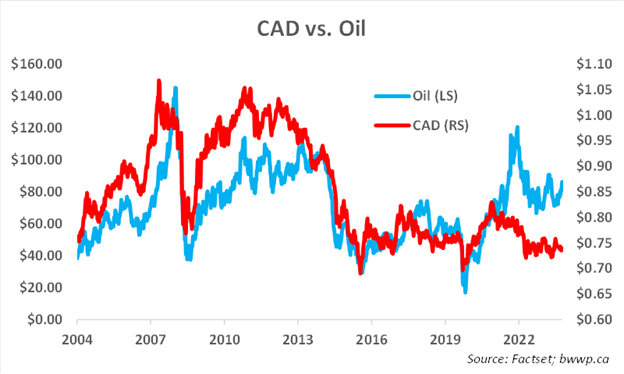

As for the Canadian dollar, it has remained stuck between $0.70 and $0.76 for the past 18-months with no signs that a breakout either way is imminent. We are going to note that the relationship between the Canadian dollar and crude, which we had previously argued was much more tenuous than most people gave credit, has appeared to fully breakdown in the past year:

For the 20-years spanning 2002 to 2022, when oil was above $75/barrel, the Canadian dollar averaged $0.97. Since then, CAD have averaged ~$0.75 when oil has been above $75 with very little correlation between the two. As we argued in A Re-Call to Arms a few weeks back, the importance of oil to the Canadian dollar and to the Canadian economy becomes less important when high oil prices are less likely to drive investment dollars toward Canada.

The TSX

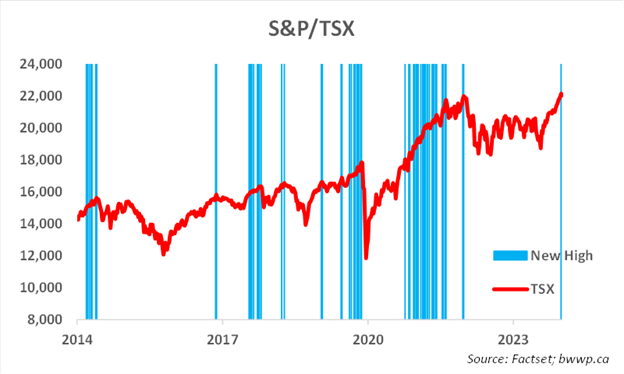

Against this backdrop, the S&P/TSX actually performed quite well in the first quarter of 2024, returning ~5.5%. In fact, for the first time in roughly 2-years, the TSX was able to establish a new all-time high, exceeding 22,000 for only the second time in its history:

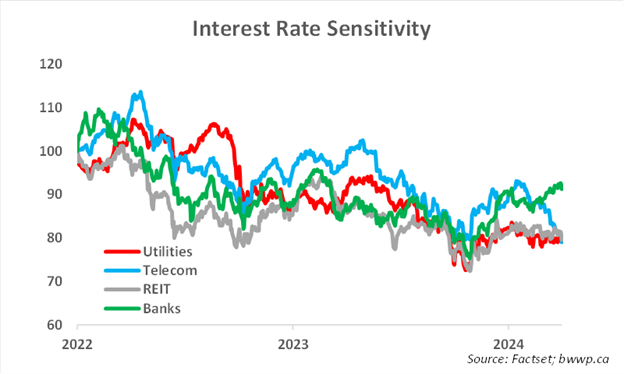

The main driver of this rally has been Energy, which has ridden a combination of the rise in oil prices and extremely friendly shareholder policies (higher dividends and share buybacks). As we have discussed over the past few years, the Canadian stock market has significantly more interest rate sensitivity than does the U.S. market because of the TSX’s heavy weighting in banks, utilities, telecom stocks (mainly Bell, Telus and Rogers) and real estate investment trusts (REITs). With the Bank of Canada set to provide some rate relief over the summer, we could see some thawing in the interest rate sensitive sectors, which have suffered significant losses since the end of 2021:

As you can see, the Utilities, Telcos and REITs remain down ~21% on average since the beginning of 2022, while the banks are down ~10%. With the exception of the banks, these sectors have been hit by two things: 1) higher interest rates make their dividends less attractive to investors on a relative basis; and 2) these companies generally carry a lot of debt and the cost of refinancing this debt has risen sharply over the past two years. As for the banks, the dividend argument is similar; however, higher rates generally mean higher credit losses as borrowers struggle under the weight of higher interest costs. In our view, rate cuts should start to ease some of the pressure on these stocks; although, it will likely take more than a few cuts from the Bank of Canada for a significant turnaround to occur.

Final Thoughts

Overall, it was a good start to the year for Canada from an investment perspective. The economy is showing some signs of life; however, we remain generally negative toward the Canadian economy given the various imbalances we discussed in A Re-Call to Arms. Next time, we will provide some updates on the U.S. economy and markets.