The Summer of 69

Bryan Adams is a Canadian icon. He is also a liar. Before the Adam-stans come after us, let us explain. Mr. Adams, another famous Canadian born in Kingston, Ontario, hit the scene in the early 1980s. His first big break was his third album, Cuts Like a Knife, which featured several hits and significant airplay for Mr. Adams on radio and MTV. But it was not until his 1984 release Reckless that Mr. Adams would become a megastar. Reckless featured six top-15 singles (only the third album to that point to include that many top-15 bangers), including Heaven, which went all the way to number one and Run to You (my personal fave), which peaked at number five.

Also on the album and peaking at number six was the song Summer of ‘69. Even though Summer had less success than the aforementioned Heaven and Run to You, it has become the song that Adams is best known for (we ignore anything related to the movie Robinhood, Prince of Thieves, as we do not count drivel as music). Now, in Summer of ‘69, Adams alludes to the band that he and the boys from school had formed and how hard they tried to make it work. Unfortunately, the band broke up apparently because one bandmember named Jimmy chose to quit (unclear on what Jimmy chose to do after he quit), while another bandmember named Jody decided to get married (although to whom is not clear). This all happened in the summer of 69.

Here’s the rub – Bryan Adams was born on November 5th, 1959. Now, we are not mathematicians, but if Mr. Adams was born in November of 1959, then in the summer of 1969, he would have been nine-years old. Okay – is it possible he was in a band at the age of nine? Sure, we can imagine a world in which a bunch of fourth graders put together a garage band and dream big (for the record, I built a submarine in my garage at age nine, but never tested its seaworthiness). But a nine-year old getting married? This would have been completely illegal in Canada, even in 1869, let alone 1969. Thus, while we love the song and the album that is stems from, Mr. Adams is clearly telling a bubbameister.

Cuts Like a Knife

Putting untruths aside, we focus this week on cuts, as for the first time in roughly four years, the Bank of Canada (BoC) lowered its benchmark lending rate. The BoC reduced the rate by 0.25% to 4.75%, after standing pat for the past 11-months. The move was not a big surprise (markets had priced in a near 100% certainty that the cut would come either in June or July), but as RBC Economics describes – this move is more of an “easing off the brake” as opposed to “stepping on the gas”. In other words, while interest rate relief is desperately needed, given Canada’s over-leveraged consumer, the quarter point move still leaves monetary policy in restrictive territory.

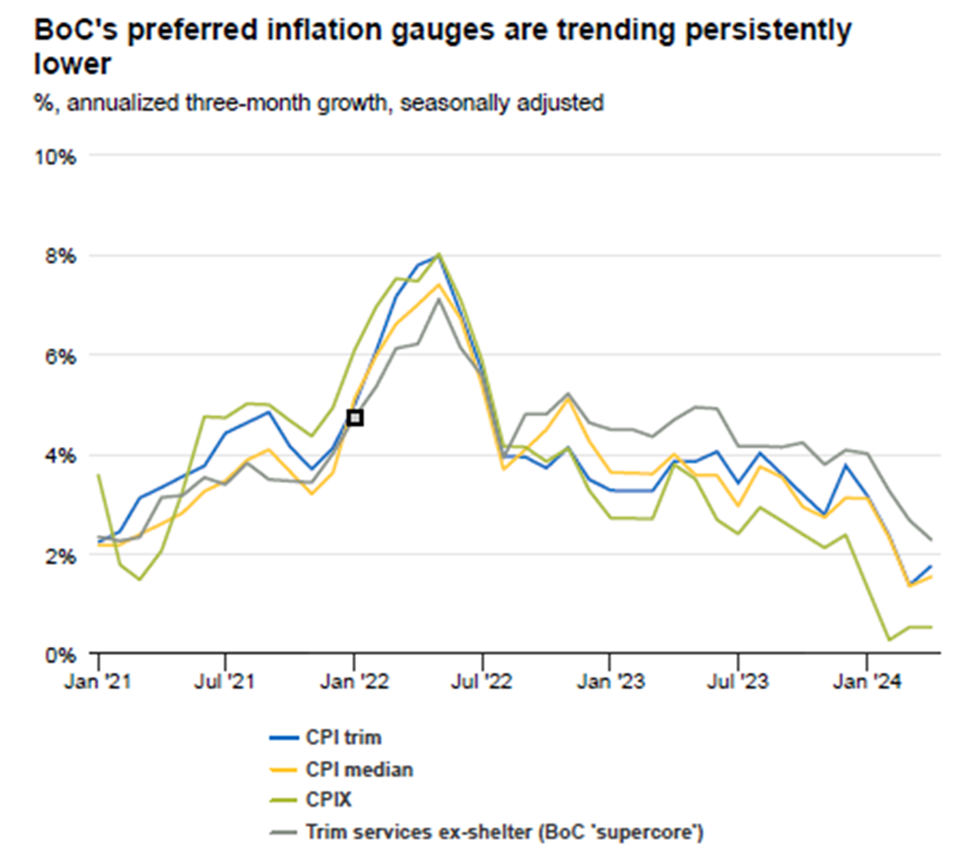

From here, RBC Economics expects three more rate cuts from the BoC in 2024, which would bring the benchmark rate to 4% by the end of the year. Enabling the first cut was a marked decline in some of the key inflation gauges that the Bank focuses on:

Source: RBC Economics

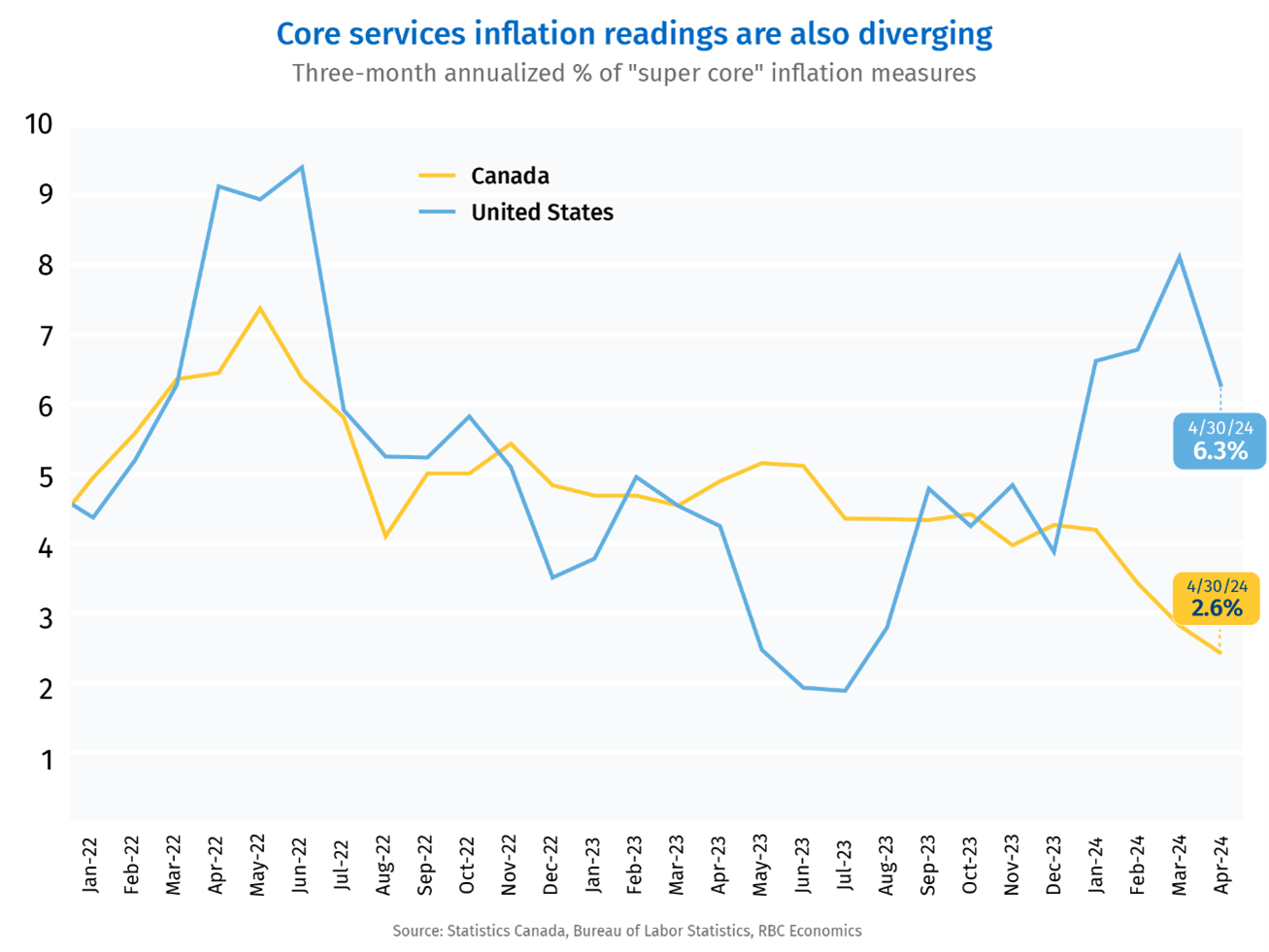

The cut by the BoC stands in stark contrast to south of the border where the U.S. Federal Reserve is showing no signs of planning to cut rates anytime soon. Inflation remains “stickier” down south, which has driven a sharp diversion in the two countries:

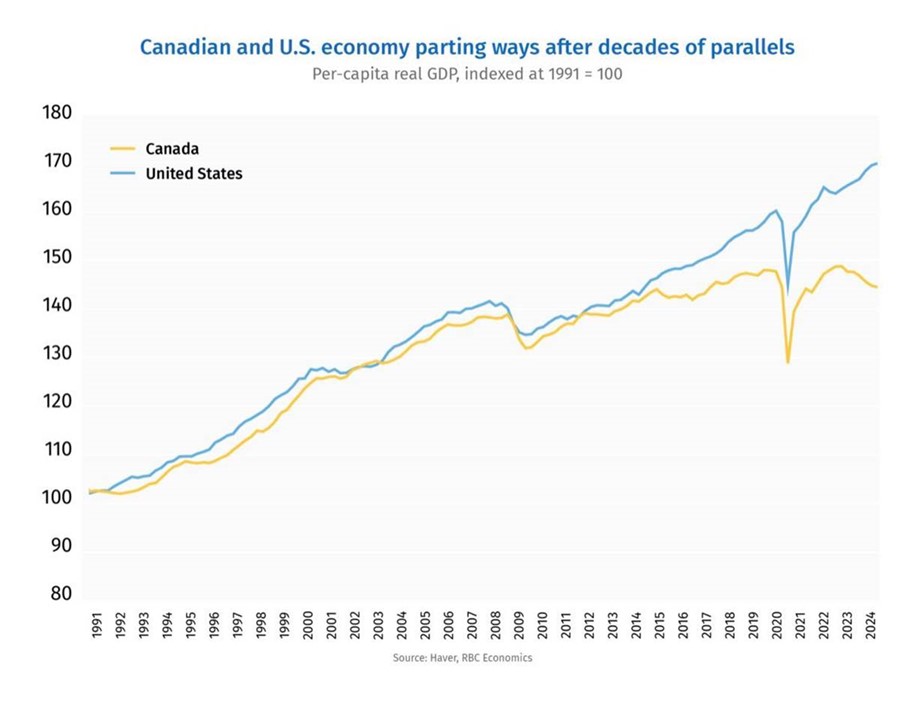

This diversion, which we have touched on repeatedly over the past year, is also manifesting itself on the growth and employment side, with U.S. growth far outpacing Canadian growth:

Meanwhile, on the employment side, the U.S. economy continues to churn out jobs with 272k jobs created in May, which was significantly above consensus (185k). Canada did create 27k jobs of its own in May; however, this was entirely driven by part-time jobs, with full-time employment falling by 36k.

Implications - CAD

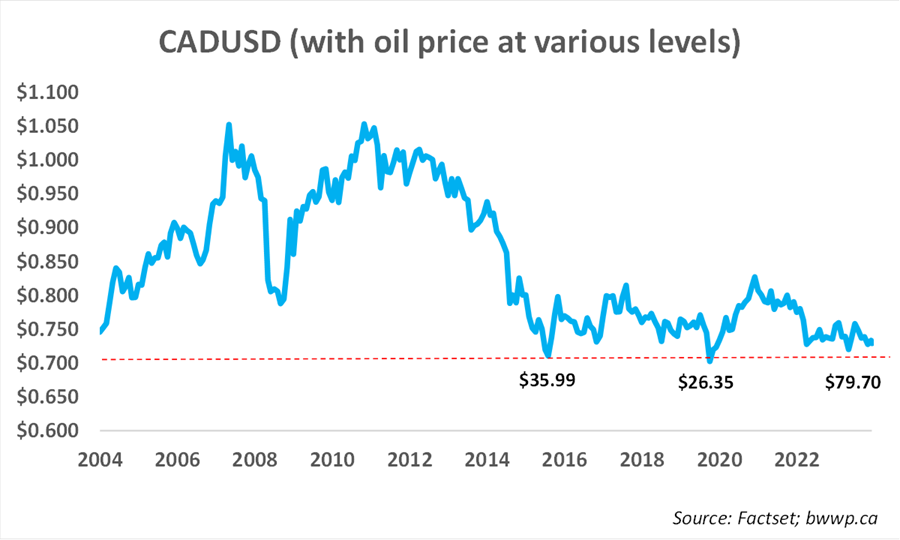

Given debt levels in Canada, any rate cuts are welcome relief at this point. There is roughly $2 trillion of mortgage debt outstanding in Canada and every quarter point reduction in interest costs amounts to ~$5 billion of annualized savings. The bigger issue to potentially keep an eye on is the Canadian dollar, which will tend to be sensitive to the relative rates of growth and interest rates versus the U.S. Let’s take a look at another chart and then comment:

As you can see, CAD is close to the low end of the 20-year range vs. the U.S. dollar. However, when we add in the oil price (which should theoretically help drive CAD higher) at these various low points, unlike the 2015 and 2020 episodes when CAD last approached the ~sub-$0.72 level, the oil price is far from distressed levels; although, it is off from recent highs. In other words, in these past episodes, when we could point to oil as a driver (or in the case of March of 2020 – global fear) of CAD weakness, it appears to be playing much less of a role in the current weakness.

And with interest rate disparity (and potentially growth disparity) likely to grow over the next 6-12 months, we would not be surprised to see some further downside in CAD.

Implications – Stocks

We have noted in the past that the Canadian stock market is significantly more rate sensitive than is the U.S. market because of the TSX’s heavy concentration of Financials, Utilities, REITs, Telecoms and Pipelines. Thus, rate cuts should be a positive catalyst. However, the economy matters and in many ways is likely to trump rate cuts, at least for a time, as the Canadian economy continues to struggle under the weight of a lack of productivity growth and too much debt. Thus, while we can start to see the set up for better times ahead, we think it is premature to expect one rate cut to dramatically change the narrative.