One of the things we would want to do if we had a really dumb idea that would almost certainly cause more harm than good is come up with a catchy name for it that gave people a different impression of that idea. So, for example, if we wanted to do away with puppies, which would probably be unpopular given that puppies are generally awesome, we would probably call it “Clean Sidewalks Day” or “Unchewed Shoe Week”, which most people would be in favor of, and then when people realized there were no more puppies, well, it would be too late.

With that in mind, we were given “Liberation Day”, which was a moniker for – get ready for tariffing the daylights out of everyone and this is very likely to be painful for the U.S. and the global economy for [insert uncertain timeframe]. Let’s start with the level of liberation that was outlined yesterday:

Okay, so this looks really bad an in need of some serious liberation! Cambodia, for example, is apparently charging the U.S. 97% tariffs on goods, which is a lot. If McDonalds wants to sell a Big Mac in Phnom Penh, the price instantly goes from 11,992 Riels to 23,544, which enables CambodiBurgers (Cambodia’s answer to McDonalds) to undercut Mickey D’s. We laud Trump and his team for doing the work necessary to go country by country and figure out what the tariffs each country charge are. This is not easy work and would likely take a team of folks working around the clock for several months to figure it all out.

[Apologies, we have someone whispering in our earpiece} Wait what?

So, it turns out that there was not much actual work done determining what the tariffs were, but rather, some mathematical chicanery. While we are concerned that eyes may glaze over, we will give you the basics – if you take the trade deficit that the U.S. has with each of the countries above (labeled E) and divide that by the amount each country exports to the U.S. (labeled C), you get column F (second most to the right). Column G is the difference between F (that math chicanery) and A, which is the tariff each country is allegedly charging the U.S. Notice that the differences in G are essentially zero, except when they are sharply negative (we will get to the negative ones in a moment).

Basically, rather than doing actual work to determine what tariffs were – the Trump team decided – if you have a surplus of goods, we are going to divide that by what you export to us, and we are going to say that is the tariff you are charging. However, if you don’t have a surplus, but rather we export more to you than you send to us, we are just going to say 10%, because, well, 10% is a round number (we are guessing on this last part, but zeroes are round, so we feel good about this one). Now, is it possible that it just so happens that the tariffs these countries charge is identical to the math described? We suppose – wait, sorry, no, of course it’s not possible.

Make America Great Depression Again

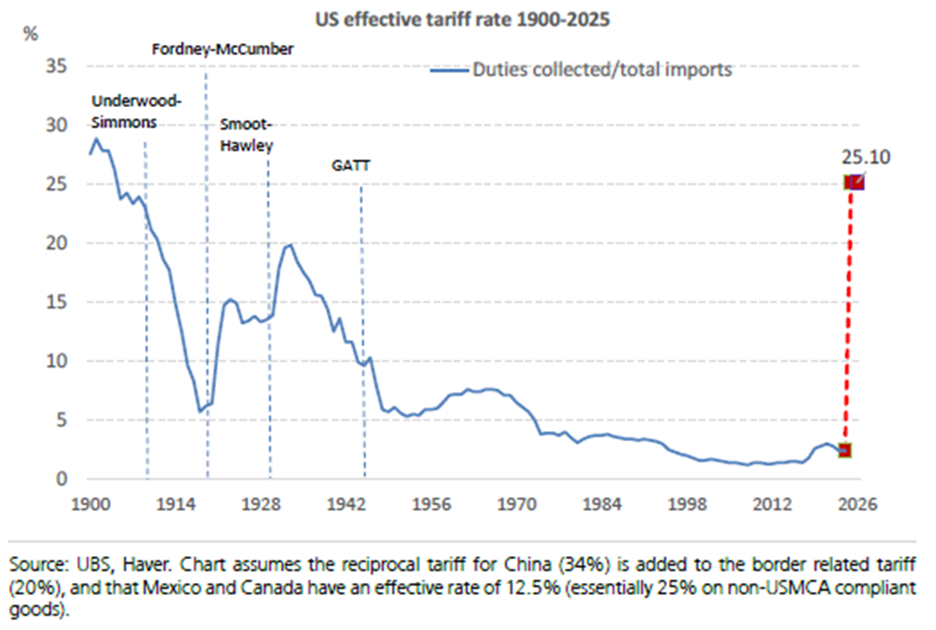

One of the things that made the Great Depression so great was what was known as the Smoot-Hawley Tariff Act of 1930, named after Senators Reed Smoot and Willis C. Hawley. Smoot-Hawley, as the name may give away, imposed tariffs on the rest of the world in an effort to protect the U.S. economy. Liberation Day, assuming no adjustments, has the following impact:

Now, we do not think anything like a Great Depression 2.0 is coming, but the economic impact is likely to be sudden and severe. We would expect in the coming days that there will be retaliatory tariff announcements, while we would also expect to see stimulus responses both from central governments in the form of spending and tax cuts and from central banks in the form of interest rates cuts. We would note that one of the delicate balancing acts here will be interest rate cuts and inflation as tariffs are inherently inflationary, but they are also negative for growth. Thus, while we expect some cuts to come, this is going to be akin to landing a 3-iron into a crosswind on a narrow fairway with water on the right and the left (for non-golfers, this is hard).

One Silver Lining: Some have argued, and we do not necessarily disagree, that the methodology used was so inherently silly that this is all pure negotiating theater. In other words, come with a big stick and then negotiate for something far less onerous. We saw this repeatedly in Trump 1.0 where there were big announcements that eventually led to deals that benefitted the U.S., but one generally had to squint a bit to see any real benefit to the economy.

Impact on Canada

While there were no new tariffs announced on Canada as part of Liberation Day, we, for now, are still contending with those that were previously announced. Ironically, the biggest negative for Canada from Liberation Day will likely be the impact that Liberation Day has on the U.S. economy. RBC Economics expects the U.S. economy to slow down as a result, which would likely shrink the overall import pie to the U.S. As we have written for some time, the Canadian economy is in desperate need of a radical rethinking and the current crisis provides the impetus for such a rethinking. While we expect there to be economic pain in the days to come, we are optimistic that Canada ultimately emerges much the better for it in the years to come.

Market Implications

Markets have reacted swiftly to the Liberation Day announcement with all major assets selling off to varying degrees. As of publishing, the TSX is down 2.8, while the S&P 500 has lost 3.6%. Oil has been hit particularly hard (down 7%) largely because of global growth concerns. We have had a cautious stance for some time, and we expect that to continue for the days and weeks to come. Markets have faced crises before – COVID the most recent example – and panicking is never the answer, especially when the focus is on owning good businesses.

There is a considerable amount of uncertainty and even panic out there. If you have friends or family who could benefit from a more measured perspective, feel free to share this blog with them or have them give us a call.