Midsummer Check-In

With the summer roughly half over, we thought now would be a good time to check-in and see where things currently stand on some key indicators and discuss where they are likely to go. Let’s start with a chart that we have referenced several times over the past year:

Now, we realize the chart is a busy one, so let’s walk through it. The gold bars are where monthly inflation was in the U.S. a year ago, while the blue bars are what we have been replacing those readings with. As you can see, the gold bars were pretty chubby from October through June (inside the green circle), meaning that as long as monthly inflation stayed fairly low, we were likely to see annual inflation (the red line) come down as we were replacing higher monthly readings with lower ones. This played out as we expected with monthly inflation going from an average of 0.81% from October of 2021 through June of 2022 to an average of 0.27% from October of 2022 through June of 2023. This helped to push annual inflation from 7.8% in October of 2022 to 3.1% now.

So, inflation has headed in the right direction; however, we would note two things here: 1) while the monthly readings have been much better than they were a year ago, the monthly average of 0.27% is not quite low enough (it would equate to ~3% annual inflation) to get the U.S. Federal Reserve to declare that inflation has been beaten; and 2) the monthly readings we are going to be replacing going forward are going to be much lower (note the gold bars beyond the green circle) and thus it is going to be harder to bring annual inflation down from where it is right now. In fact, we may have a couple of months where annual inflation ticks higher as we replace last July’s negative monthly reading with something higher.

Thus, the Federal Reserve once again raised interest rates this week (to 5.375%) as its targeted 2% inflation rate remains somewhat elusive.

What’s the likely path from here?

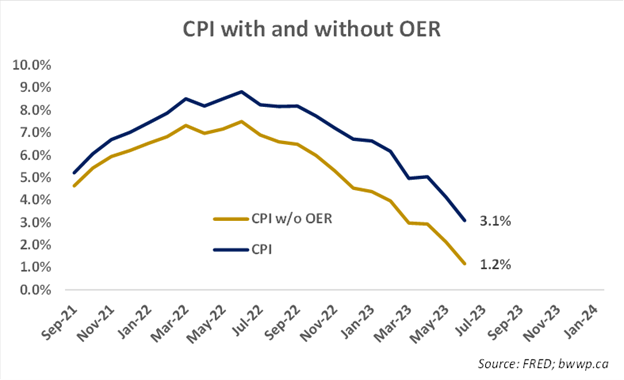

We will admit that inflation has remained far stickier for far longer than we expected. That said – we would continue to point to the importance of shelter (Owner Occupied Rent (OER)) and its impact on the inflation data. Let’s add a chart and then comment:

As you can see, shelter is contributing a massive amount of inflation with inflation ex-shelter running at closer to 1%. There continue to be signs that OER is coming down and this should help (along with interest rates) to push inflation back toward the targeted 2% as we head toward 2024. In our view, the Federal Reserve remains close to the end of its rate hiking cycle (potentially one more rate hike to come); however, it may be mid to late 2024 before we begin to see any rate cuts.

As you can see, shelter is contributing a massive amount of inflation with inflation ex-shelter running at closer to 1%. There continue to be signs that OER is coming down and this should help (along with interest rates) to push inflation back toward the targeted 2% as we head toward 2024. In our view, the Federal Reserve remains close to the end of its rate hiking cycle (potentially one more rate hike to come); however, it may be mid to late 2024 before we begin to see any rate cuts.

What about Canada? Interest rate sensitivity is high

After a pause in the Spring, the Bank of Canada raised interest rates 25 basis points in June and July, bringing the overnight rate to 5%. As with the U.S., inflation has come down a lot, but remains above the 2-3% range that the BoC targets. That said – the Canadian economy is significantly more sensitive to higher interest rates than is the U.S. economy. This is the case mainly because the vast majority of U.S. mortgages are fixed for 25-30 years, while most Canadian mortgages are fixed for only 3-5 years.

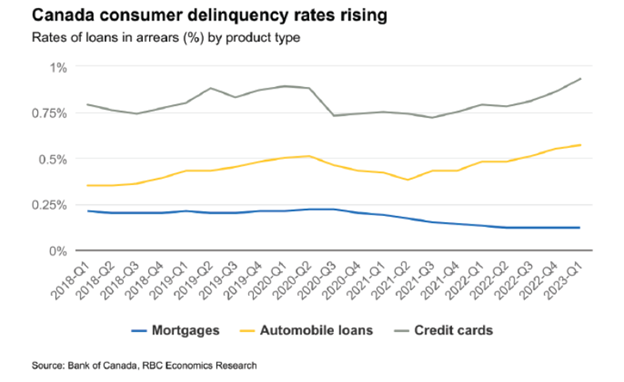

As a result of higher rates, we have begun to see some signs of problems for the consumer; although, the housing market (mortgages) remain unaffected as of yet:

The challenge for the Bank of Canada has been that while consumer demand has begun to slow (key to bringing down inflation), the job market remains strong, which has helped to offset some of the economic pressures that higher interest rates and higher inflation have caused. RBC Economics believes that while the economy has certainly been more resilient than expected (given all the rate hikes), the BoC’s July rate hike was likely the last of the cycle as there is enough evidence that the economy is slowing to push the Bank to the sidelines.

The challenge for the Bank of Canada has been that while consumer demand has begun to slow (key to bringing down inflation), the job market remains strong, which has helped to offset some of the economic pressures that higher interest rates and higher inflation have caused. RBC Economics believes that while the economy has certainly been more resilient than expected (given all the rate hikes), the BoC’s July rate hike was likely the last of the cycle as there is enough evidence that the economy is slowing to push the Bank to the sidelines.

Final Thoughts

Markets, especially in the U.S., have positioned for a soft-landing scenario in which recession is avoided (or very mild). While we have some hope that this will be the case, we continue to believe that the lagged effect of interest rate hikes has still not been fully felt by the economies on either side of the border. This is mainly because while higher rates impact new demand – folks wanting new mortgages, businesses needing new loans - it takes time for higher rates to impact existing demand as most loans do not immediately re-adjust to higher rates, but rather when the loans come due. This is especially the case in Canada where most of those 3–5 year mortgages taken out in 2020 and 2021 will not begin to truly feel the impact of the BoC rate hikes until 2024 and 2025. Thus, while we have scooped up some good bargains at distressed prices over the past 6-12 months, we remain overall cautious.