With 2024 fast approaching, we thought we would provide some early thoughts on the outlook for Canada and specifically interest rates. Before we get to that, 2024 also happens to be a leap year, so we thought we would start with some fun factoids about this quad-annual occurrence:

- Four Million Strong: There are an estimated 4 million “leap” babies or leaplings (OK) or leapers (not so much) in the world. Considering one has a 1 in 1,461 chance of being born on February 29th, this is actually less than what should statistically occur. The world’s population in 2020 (the last time we replenished the leaplings) was ~7.8 billion, which implies we should have ~5.3 million folks born on February 29th. Even with 2024’s replenishment (approximately 400,000 babies are born each day), we are still likely to be well below the statistical amount we should have.

- Et tu, Brute: We owe the leap year to Julius Caesar, who used the Egyptian model of a 365-day year but recognized (or at least his scientists and mathematicians did) that a year is not in fact 365-days long, but rather 365.24 days long (more on the “0.24” in a moment). To fix this, the Romans added an extra day every four-years, giving us the leap year.

- Not actually every 4-years: While all people currently alive in the world today have never experienced more than a 4-year gap between leap years, there is actually an 8-year gap between some leap years. Wait what? Let’s go back to the “0.24”. If you multiple 0.24 by 4, you get 0.96 and not 1. Thus, we are adding 0.04 extra days every 4-years when we add the leap day. While this does not sound like a lot, it adds up over time. In fact, every 25-leap years, we are essentially adding one-day too many. To make up for this, there is no leap year celebrated in any turn of the century year that is not also divisible by 400. So, while we celebrated a leap year in 2000 (because it is also divisible by 400), we will not celebrate one in 2100, 2200, or 2300.

- All hail the Keoghs: A few weeks back, we told the amazing tale of the Tylers, but the Tylers do not hold a candle to the Keoghs. Peter Anthony Keogh was born in 1940 on a leap day. His son Peter Eric Keogh was born in 1964 on a leap day and Peter Eric’s daughter Bethany Wealth Keogh was born in 1996 on, you guessed it, a leap day. Making the Keoghs the only known leap day “triple”. We are keeping tabs on Bethany, who has yet to have children, and we will report back on whether or not she keeps this amazing streak alive.

Canada interest rate thoughts for 2024

2023 has been a struggle for Canada. The combination of higher interest rates, a wave of mortgage renewals, and dwindling savings have weighed on Canadian consumers. The key for 2024 (as it was for 2023) is going to be inflation and how quickly it gets to a level that allows the Bank of Canada to begin to process of unwinding the monetary tightening of the past 2-years. Let’s start with where we are in the inflation fight and provide our thoughts:

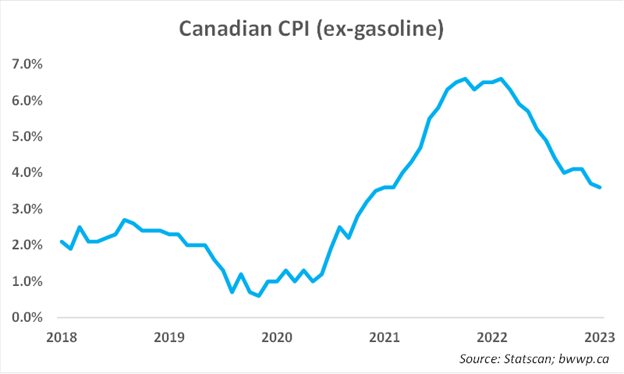

CPI has come down by a bit less than half over the past year. Ultimately, it needs to be on the path to ~2% for the Bank of Canada to declare victory, but we would note some serious flaws in the Bank’s measure of CPI. Before we get to these flaws, let’s look at a chart that will shed some light on the CPI calculation:

CPI has come down by a bit less than half over the past year. Ultimately, it needs to be on the path to ~2% for the Bank of Canada to declare victory, but we would note some serious flaws in the Bank’s measure of CPI. Before we get to these flaws, let’s look at a chart that will shed some light on the CPI calculation:

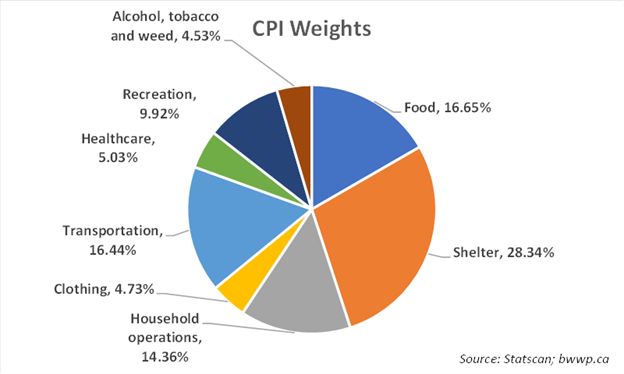

Here, we are looking at the weights of the various inputs into calculating CPI. Shelter at ~28% is the largest component, while “sin” stuff is the lowest at ~4.5%. One way to think about the above is that a 1% change in the pricing of shelter would have ~1.75x the impact on inflation as a 1% change in food would and ~2x the impact that a 1% change in household operations would. Now, for the month of October, CPI was up ~3.1% year-over-year. Over the same period, shelter, which again accounts for ~28% of the CPI basket, was up ~6.1%. To put this in perspective, the 6.1% change in the shelter component contributed ~55% to the overall change in inflation year-over-year. Put another way, if shelter were taken out of the calculation, inflation would have been less than 2%.

Okay, but the obvious response would be – shelter matters a lot, so why take it out? Well, when we look at the components of shelter, we get an interesting picture. Mortgage interest accounts for ~13% of the shelter component. Of course, mortgage interest is directly (as in nearly 100%) connected to what the Bank of Canada does with interest rates. Over the past 12-months, the mortgage interest sub-component is up 30.5% (because, umm, the Bank of Canada has been raising interest rates), which has contributed ~4% of the ~6.1% (or ~2/3rds) that shelter has inflated over the past year. So, in other words, the Bank of Canada is trying to fight inflation by raising interest rates, but its measure of inflation is largely being driven higher by the Bank of Canada’s raising of interest rates.

Now, the Bank of Canada, regardless of the silliness of cutting off one’s own nose to spite one’s face, is probably not going to change its approach to interest rate policy because of our bi-weekly rant. However, with rate hikes very likely in the rear-view mirror and interest rates and mortgage rates starting to creep lower, it is easy to see a path in which CPI comes down sharply over the next 6-12 months simply because the Bank of Canada is not raising rates anymore and thus not contributing to its own challenges.

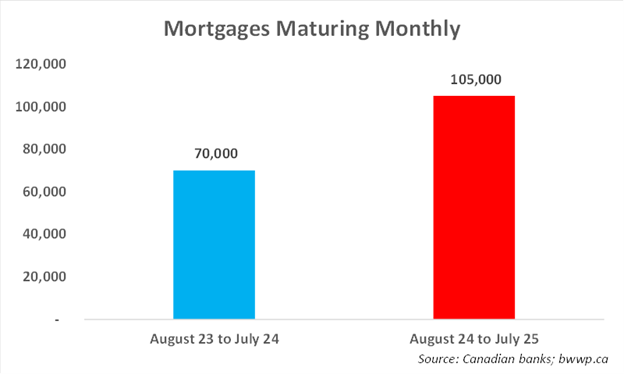

With the above in mind, we think there is a strong likelihood that the Bank of Canada begins to cut interest rates by the first or second quarters of 2024. Not only will the CPI data likely give the Bank cover to do this, but also, there’s this:

Unlike the U.S., in which ~90% of all mortgages are long-term (25-30-years) fixed rate mortgages, the Canadian mortgage market has a “renewal problem.” Roughly 15% to 20% of the 7-million outstanding mortgages in Canada will renew between August of 2024 and July of 2025. With the average rate on these mortgages sitting at ~3%, the Canadian economy, which may already be in recession, could be in for a significant shock if these mortgages are forced to renew at double that rate or even higher. In our view, with CPI relief likely coming for the reasons discussed above, the Bank of Canada is likely to look to pivot on rates to provide as much relief as possible to this “wall of renewals”.

Bottom Line: By the middle of next year, we are likely to see the Bank of the Canada reducing interest rates. Unlike the U.S., which is less sensitive to higher rates, the Canadian economy would suffer significant damage were rates to be left higher than needed for too long of a period of time. With CPI likely to come down and with the economy already having slowed significantly, the Bank of Canada is likely to have all the cover it needs to cut rates, potentially even by a significant amount. This will, of course, have implications for other markets – stocks, bonds, housing. In the coming weeks we will dive deeper into our outlook for these as well as provide some thoughts on some other topics.