After months of speculation, the arrival of sweeping tariffs on Canadian exports to the U.S. are now imminent (probably). The roller coaster of “will they won’t they” headlines is an important reminder to put far less weight on “reports” leaked by insiders versus what Trump himself is saying – after all, his advisors can make their case as passionately as they’d like, but he’s the one ultimately making the decisions. Nonetheless, developments on this are changing almost by the minute.

Currently the plan is for 25% tariffs across the board for Mexico and Canada (except energy at 10%), with a short delay before oil tariffs are implemented. However, every piece of this picture is changing rapidly – just this morning the Mexican president announced that Mexican tariffs will be delayed by a month, which has reversed much of the negative price action we saw in North American markets so far. This fast-changing landscape with conflicting information reinforces just how important it is to think about the situation in probabilistic rather than absolute terms. We must accept that there is a great deal of inescapable uncertainty out there right now and look through the volatility to focus on fundamentals.

The good news is that this morning’s reaction reveals that much of the tariff threat was already in the price of Canadian equities. In fact it was the tech-heavy Nasdaq that was the worst performer among major North American indices early this morning, down nearly 2.5% at one point before rebounding on the news of a delay in Mexican tariffs. As of mid-day Monday, US and Canadian markets are both down roughly 1%. It’s yet another example of how markets don’t necessarily react to news the way conventional wisdom suggests they would.

It's also a lesson in the importance of being proactive rather than reactive – we’ve spent a great deal of time thinking about our exposure to Trump and tariffs even before he was elected. Our conclusion during this process was that the US dollar would offer good protection against tariffs, and that our favorite sector – Canadian energy producers – is well positioned to prosper even if Trump were to tax the critically important energy exports Canada provides. With that in mind, we’ve been gradually increasing USD exposure in recent months (either directly or indirectly), and we’re just as bullish on Canadian energy as we were three months ago. We’ve also added a bit of duration in bonds, which we expect to act as a further cushion in the event of a protracted trade war. So far, both Canadian bonds and the US dollar have reacted in a way that has mitigated much of the impact, and we expect that to continue if the trade relationship deteriorates further. The chart below shows how the loonie and Canadian bond yields have declined in lockstep in recent weeks (falling yields increase the market value of existing bonds).

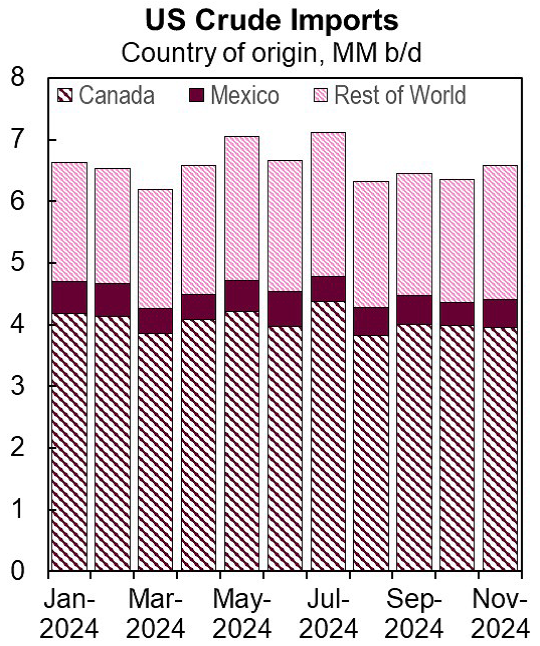

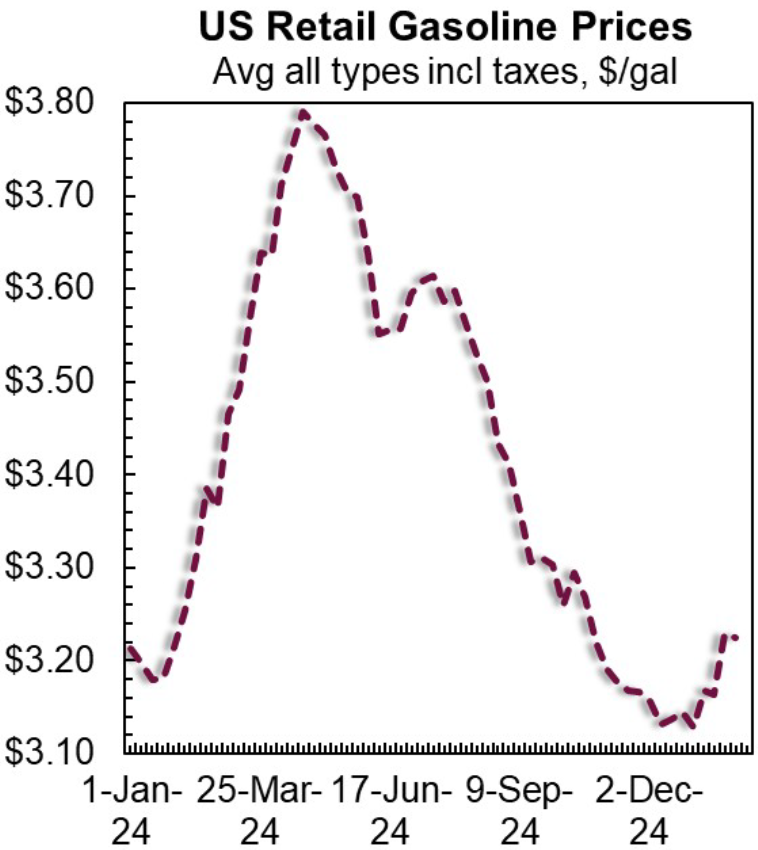

Turning to energy, our research suggests a 10% tariff would add at least $0.16/gallon to gasoline and diesel prices in the US, with the impact felt disproportionately in the Midwest where refiners are particularly dependent on heavy crude imported from Canada. We believe most of the impact of tariffs would be passed on to the US consumer. This is because American refineries do not have good alternatives to replace Canadian oil, in part because the supply-demand picture is already very tight globally, but also because a substantial portion of US refining capacity is set up for heavy crude from Canada rather than the light crude produced domestically. Shifting refining capacity is *extremely* expensive and time consuming. Refiners will do everything they can to avoid that outcome.

This is exactly why the narrative of the US being energy independent is not entirely accurate – there’s a good reason the country imports over a hundred billion dollars in Canadian energy every year.

Without Canadian crude, many US refineries would not be able to find alternative supplies and would be forced to shut in production. Gasoline prices could rise much more than just 16 cents in this scenario, which is something Trump would not be happy to see – after all, gasoline is the single largest energy outlay for American consumers.

When Trump states that America doesn’t need Canada’s oil, he’s demonstrating a key misunderstanding of the domestic energy industry. While it’s true that the US is one the largest energy exporters in the world, it’s also one the largest importers. This apparent contradiction is not a coincidence, but instead a product of the complex mechanics of the global oil market, refining economics, and regional supply imbalances.

Ultimately our view is that a 10% tariff on Canadian oil will make US refinery feedstock 10% more expensive, which in turn will be a cost born by the US consumer. For better or worse, the North American energy landscape is highly integrated, and it’s simply not feasible to cut off Canadian energy without incurring significant knock-on effects for American consumers.

When you combine our changes to portfolio strategy regarding USD exposure and bond duration, we’re confident that our investment strategy is well-positioned to see this volatility through. This situation will continue to change rapidly, and we’ll be watching closely, but so far we’re encouraged by the market reaction to this weekend’s developments.