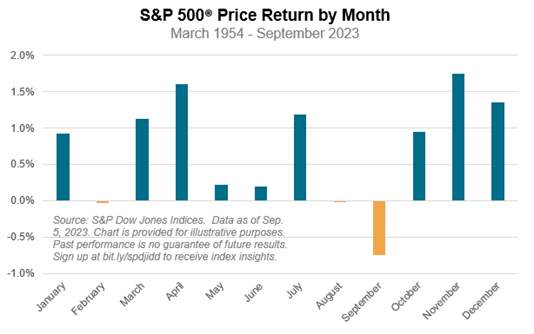

We’ve weathered through a difficult period in the third quarter of 2023. While August and September tend to be seasonally weak in the stock markets, they tend to be followed by rallies in October, this seasonal pattern was disrupted in part by the Israel -Hamas war.

The Israel – Hamas war and its associated contagion risk have introduced a new element of uncertainty and disrupted a fragile recovery at the beginning of October. A week following Hama’s attack on Israel, the U.S. 10-year yield briefly crossed 5%, marking a new high in over 16 years. Higher interest rates alone do not spell a doom scenario in the economy, especially when it is driven by strong economic growth. The latest GDP number for the third quarter in the U.S. was at a 4.9% annualized rate. GDP growth is expected to moderate into 2024 as U.S. consumers deplete their pandemic era savings. Compared to the U.S. third quarter GDP, the Canadian third quarter GDP growth was considerably weaker at a rate that was essentially flat.

S&P500 into correction territory

After three months of consecutive declines, the S&P500 is now officially in correction territory. Investor sentiments have shifted from optimism to pessimism with the Israel -Hamas war as a catalyst. On the other hand, S&P500 is now trading at 17x 2024 earnings which is much less demanding on the economy to deliver an upside surprise. If we can sustain a moderate GDP growth in 2024, there should be upside to the markets with potential tailwinds from interest rate cuts as inflation subsides. There are always wildcards that influence short term sentiments; geopolitical conflicts are now more frequent occurrences, and we must brace for higher volatility in this environment.

Emerging themes in AI and reshoring in Manufacturing

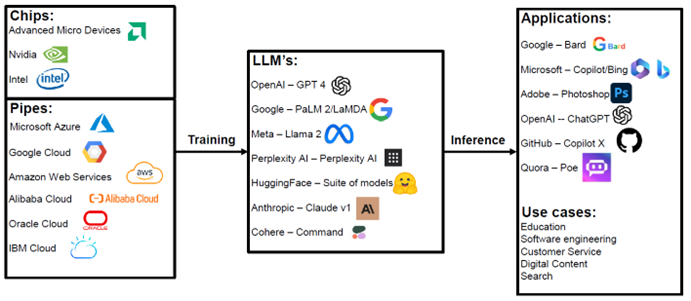

Optimism surrounding AI and AI-fueled efficiency was a strong driver in earlier gains in the markets in 2023. Many market observers dabbed the AI revolution as important as the invention and adaptation of the internet. In the recent U.S. Equity conference, our analyst shared their framework in analyzing Generative AI and they believe large language models (LLM’s) are the foundation of Gen AI.

Our internet analyst sees the Gen AI space in three broad layers: Chips (GPU’s), pipes (cloud) and apps.

Source RBC Capital Markets

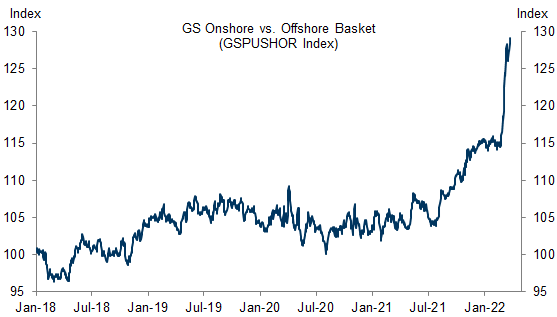

A second important thematic trend is the reshoring of manufacturing capability in the U.S. and its potential to revitalize the industrial landscape. There are excitements in the industrial sector that have not been seen in decades. Some of the exciting trends impacting the sector include Electronification/Smart Everything, Automation, Reshoring/Near-shoring and Energy Transition to name a few.

The Equity Market Expects Reshoring-Exposed US Companies to Outperform in Coming Years

Source: Goldman Sachs

The Bottom Line is that after the three months of consecutive decline in the broader markets, it is time to start looking for upside in the markets. If we start to see interest rates stabilizing in the backdrop of weakening inflation data, there is upside to the economy. Since the recent correct, valuation has come down considerably as well at 17x P/E for the S&P500 companies which leave room for surprise to the upside in a moderate growth environment.

Rita Li works with professionals, business owners and high networth families to provide tailored investment advice, risk management and financial planning. Her team comprises of professionals with in-depth taxation, insurance, and legal expertise, together, they deliver a high standard of service to clients. Rita is a Chartered Financial Analyst CFA® and Certified Financial Planner CFP®. Rita holds her MBA from Richard Ivey School of Business.