By now, a lot has been written in the media on the collapse of SVB bank. There were some unique attributes that did not impact the other banks that were more diligent in monitoring their risks. What is important for us is that the authorities such the Federal Deposit Insurance Corporation (FDIC) have transferred and protected all the depositors of SBV. These government entities are well equipped to deal with domestic banking crisis given they have access to the supply of domestic currencies.

Many of the smaller regional banks have been impacted by a loss of confidence and the winners are the bigger global systematically important banks. If we believe the banking crisis is contained, then the recent sell off in the banking group represent a long-term entry opportunity.

Key trends in earning revisions

Typically, by end of April most of the earning revision will be done. Our earnings estimate for 2023 is significantly lower than the consensus, however, it is still our base case scenario that we will experience a shallow recession and therefore the markets may look through the weak 2023 earnings.

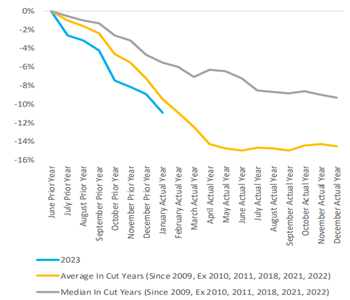

Changes in bottom-up S&P500 EPS forecasts from June of prior year through December of actual year 2023 vs. average & median of all years with cuts since 2009

Source: RBC US Equity Strategy, Haver, S&P Capital IQ, Through January 2023

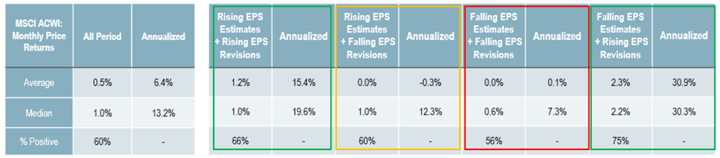

Institutional investors closely monitor consensus analyst estimates in their processes for developing outlook on equity markets. We developed a framework that explored the relationship between the net revisions, EPS estimates and equity market returns.

Source: RBC Wealth Management, monthly data back to 1995, Bloomberg, data through 03/23/2023

Each highlighted regimes illustrate the peak and troughs of market forecasts in economic cycles. The red box illustrates an environment where EPS estimates are falling along with revisions. Should 4Q22 seen a bottom in falling EPS revisions and estimates, we may see an environment where EPS is falling but revisions start to pick up. That can be a very supportive environment for equities.

What if inflation remain elevated for longer?

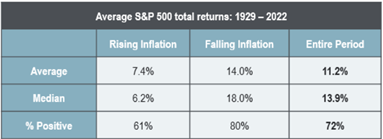

Source: RBC Wealth Management, Bloomberg; data through 12/31/22

Historical data supports equities perform better in a falling inflationary environment vs. a rising environment. It is worth noting equities have been one of the few asset classes that can keep up with inflation over the long run. It is also a resilient asset class. Even in a recessionary environment, equities were positive over 50% of the time.

For people who are worried about the current cycle and a potentially more severe recession, it is good to adjust accordingly. Fixed Income such as discounted bonds are great instruments in reducing the overall volatility of the portfolio in times of greater uncertainty. There are more tax advantages associated with discounted bonds given the capital gains component in addition to interest income.

In deciding on the asset allocations of a personalized portfolio, some of the important considerations and guideposts are investment time horizon, liquidity needs, and overall comfort with portfolio volatility.

Rita Li works with individuals and business owners and healthcare professionals to provide tailored investment advice, risk management and financial planning. Her team comprises of professionals with in-depth taxation, insurance and legal expertise, together, they deliver a high standard of service to clients. Rita is a Chartered Financial Analyst CFA® and Certified Financial Planner CFP®. Rita holds her MBA from Richard Ivey School of Business.