The latest rate hiking cycle has been the most aggressive cycle in the last four decades, creating a new paradigm of investment decisions. Prior to 2022, few people were interested in discussing fixed income; now, investment conversations have turned towards discounted bonds and the fixed income component of a balanced portfolio. In 2023, much of conversation was centered on interest rate trajectories and their potential impacts. The U.S. presidential election and the economic soft vs. hard landing will likely dominate investment discussions in 2024.

I recently had a memorable conversation with a client, who asked why the central bank had been increasing rates. It is a difficult question to answer because it has been so long since the inflation target of 2% has been challenged and has become a primary concern to central bankers. A main purpose for raising interest rates is to prevent higher inflation expectations from becoming anchored in the economy and becoming a destabilizing force. However, if higher inflation was entirely the result of supply side disruption due to the pandemic, there is a chance it could be resolved without intervention. On the other hand, given the substantial pandemic era’s government fiscal stimulus spending, there is a demand side contribution to higher inflation. All in all, third quarter GDP in the U.S. came in at a whopping 4.9% annualized growth rate, enough to prompt fears in the central bankers about an overheating economy.

In the end, higher inflation rates resulted in an aggressive series of interest rate hikes by most of the central banks around the world. It is under this set up that we entered 2023 with an expectation of an interest rate hike induced recession. The slow down in the economy was so widely anticipated that it was almost consensus that we would see a recession in 2023. However, the economy surprised forecasters yet again with U.S. consumers demonstrating an unexpected resilience in spending. Unemployment rates remained low, and consumers still had some pandemic savings in reserve. The question now is if recession is still in the works but is just delayed since it takes on average 18 months for the economy to feel the impact of change in monetary policies from the beginning of the first hike.

Two paths lie ahead for 2024. One scenario is that central banks spare us from the blunt impact of higher interest rates by cutting rates just as economies start to slow down. This is the much discussed ‘soft landing’ scenario. In a second scenario, central banks are late to the party and not able to time the interest rate cuts well, resulting in a deeper recession, increasing unemployment rate, and consumer delinquency rises.

While many economists still think there is the possibility of a recession in 2024, most believe it will not be a severe recession. Given the elevated interest rates of today, the central banks also have more room in their arsenals to reduce rates and stimulate their respective economies quickly as needed. There is no doubt there are many uncertainties in today’s environment both domestically and internationally. The path to a soft landing can be challenged by several disruptive events but there is also cause for optimism such as consumer tailwinds from declining mortgage rates and gas prices. Should inflation peak, we will see greater relief for consumers and businesses alike. We will continue to navigate the uncertainties with caution and be ready to listen when data shows us which is the more likely path.

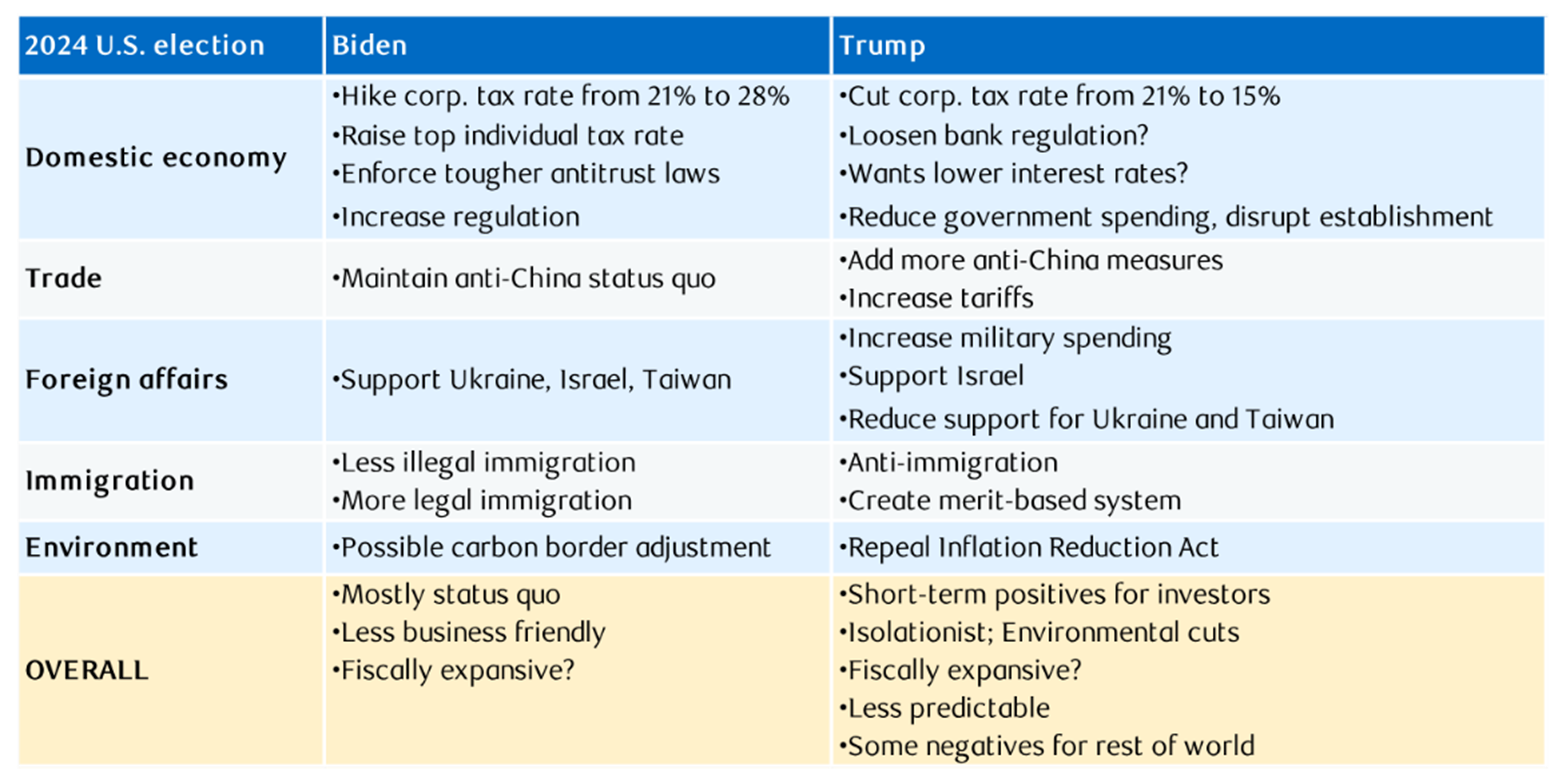

The U.S. election will likely be the biggest macro event in 2024 as both parties dig in for a long campaign period. Many Wall Street analysts have pulled out their playbook from the previous Trump presidency and have begun analyzing some of the central issues between Democrat and Republican candidates.

Here is a preview of the U.S. election platform:

Note: As of 01/22/2024. Source: RBC GAM

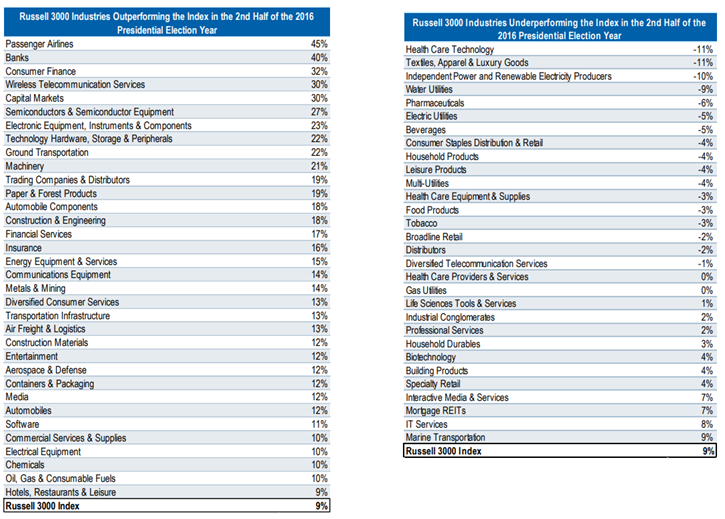

Best and Worst Performing Industries around Trump's 2016 Victory

Source: RBC US Equity Strategy, S&P Capital IQ/Clarifi

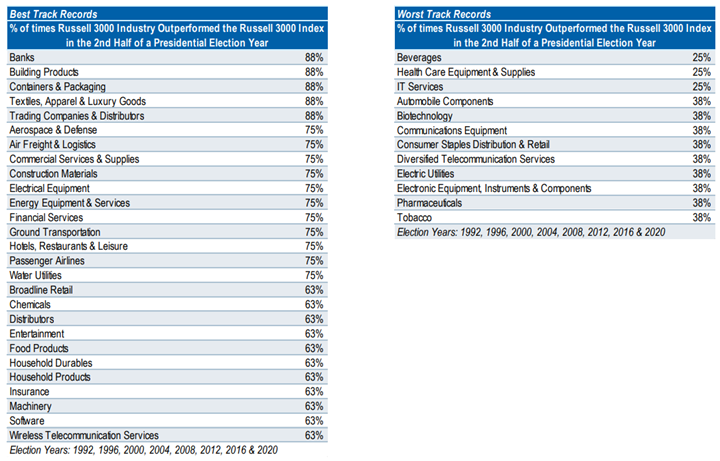

Best and Worst Performing Industries around the Past 8 US Presidential Elections

Sources: RBC US Equity Strategy, S&P Capital IQ/Clarifi; only includes industries for which we have data in each of the last 8 presidential election years

Banks have been clear winners in the second half of previous presidential election years. Political agendas do have an impact on sector performances. Themes such as U.S. manufacturing reshoring, political directives on taxation, energy, and healthcare as well as foreign policy are key factors we will closely monitor.

Rita Li works with professionals, business owners and high net worth families to provide tailored investment advice, risk management and financial planning. Her team comprises of professionals with in-depth taxation, insurance, and legal expertise; together, they deliver a high standard of service to clients. Rita is a Chartered Financial Analyst CFA® and Certified Financial Planner CFP®. Rita holds her MBA from Richard Ivey School of Business.