In the quieter summer months, we observed headline inflation trending lower while central banks on both sides of the border remained cautious and reiterated their commitment to bring down inflation to target, through rate increases as well as more vigilant communication in forward guidance. Economic data such as GDP growth has been stronger than anticipated fueled primarily by consumer spending.

Despite an inverted yield curve, a staunch recession indicator, Janet Yellen, the now U.S. Treasury Secretary, recently announced she does not expect U.S. to enter into a recession. U.S. economy has been resilient against rising interest rates; part of the explanation is households and corporations have refinanced their debt by locking in lower rates for longer. Therefore, it will take longer for higher rates to impact and slow down the real economy. In the scenario of a soft-landing, the U.S. central bank would be able to bring down inflation and lower benchmark rates again before expectations of higher inflation rates become entrenched in the economy.

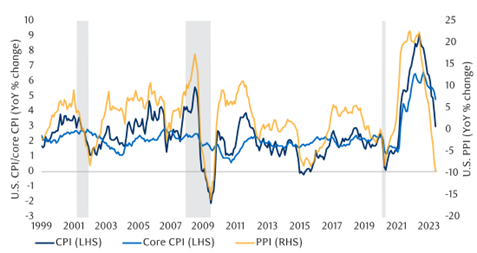

With economies normalizing against the backdrop of pandemic disruptions and geopolitical tensions, the U.S. and Canadian central banks have done most of the heavy lifting. Their future decisions will be more data dependent, meaning it will hinge on continued trajectory of inflation rates trending lower toward target. We have seen great progress made in headline CPI and PPI (Producer Price Index), but core CPI, which is an inflation measure given the most weight by central banks in decision making, remains well above their historical target rate of about 2%. While headline inflation has been coming down as expected, the next leg down in core inflation will likely be stickier and more difficult to materialize.

U.S. inflation is declining

Source: U.S. Bureau of Labor Statistics, Macrobond, RBC GAM

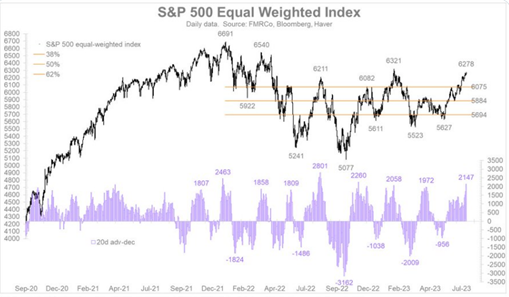

Investor sentiment has become gradually more bullish as signals of recession are pushed back further. The market recoveries however are led by a handful of mega cap stocks and further fueled by speculations of an AI boom. The advancement of broader stock markets as measured by the equal weighted index is much more modest. For the market rally to be sustainable, we will need to see much broader participation by more than just a handful of names.

Source: Fidelity, FMRCo, Bloomberg, Harver Analytics, FactSet. Data as of 07/23/2023

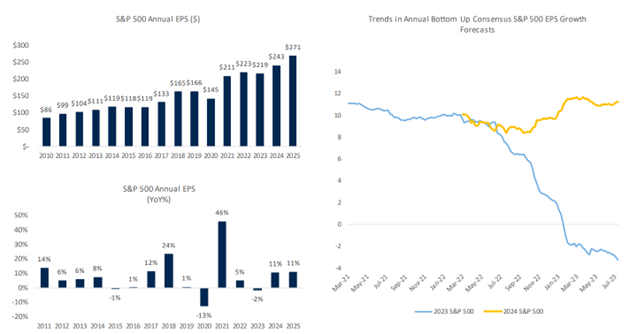

The stock markets experienced a significant pull back in 2022 due to the threat of tighter financial conditions and a pending recession. Markets have then subsequently rebounded so far this year on the prospect of a soft landing and earnings recovery in 2024. For stock markets to continue their rally, heathy growth in corporate earnings will be an important part of a bullish outlook.

2023’s Bottom-up consensus EPS forecast is trending lower while 2024’s has been stable

Source: RBC US Equity Strategy, Bloomberg; as of July 20, 2023

The Bottom Line is that much of the resilience in the economy and the scenario of a soft landing in the U.S. is priced into the stock markets today. For the rally to continue, we will need to see forecasted earnings recovery come to fruition. From a valuation standpoint, the earnings yield on S&P500 is around 4.8% while the yield on investment grade corporate debt is around 5.5%. The risk reward balance between stocks and bonds are in favour of bonds, especially if we are indeed in an environment where inflation is trending lower.

Rita Li works with professionals, business owners and high networth families to provide tailored investment advice, risk management and financial planning. Her team comprises of professionals with in-depth taxation, insurance, and legal expertise, together, they deliver a high standard of service to clients. Rita is a Chartered Financial Analyst CFA® and Certified Financial Planner CFP®. Rita holds her MBA from Richard Ivey School of Business.