January had been a month of rebound in most indices across the globe. There are a few contributing factors to the rallies. The top one is continued decline in inflation. Declining inflation prints have provided optimism in the markets to anticipate a pause in rising interest rates. The second is China reopening after a prolong locked down period. Lastly, there is a seasonal effect of stronger market performance in January, especially after a wave of tax loss selling in December last year.

It is difficult to say if we are out of the woods as we begin to see cost pressures erode reporting companies’ profit margins. It is possible in the scenario of a soft landing, markets will look ahead to the 2024 earnings and discount the short term weakness. But first, let’s take a deeper dive into the recent inflation prints.

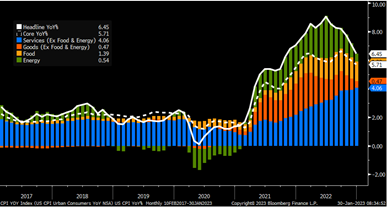

CPI peaked in June 2022 at 8.1% in Canada and 9.1% in the US. Markets have enjoyed consistent decline in CPI prints since then. The current market expectation is one that will see us return to the 2% target rate in the near term. Mechanically, this is very likely given the base effect of coming down from a recent peak level of inflation but the markets may be overly optimistic to price in a permanent decline of headline inflations back to 2%. Looking under the hood, headline inflation has declined much more rapidly than core inflation. Inflation prints from goods and services have been sticky.

Source: Bloomberg

The US debt ceiling

Over the coming months, we will likely hear more about the US debt ceiling. Historically, political parties were able to resolve their differences and increase the self-imposed debt ceiling to avert a crisis. This year, however, given the deeper divide ideology, it could prove to be more difficult to reach an agreement. While we view the likelihood of a US default as very low, it still makes sense to examine the market impact when the last time US came close to a default.

The last significant standoff over the debt ceiling was in 2011. It was also when US treasury was downgraded to AA+, losing its ‘risk free’ status. An argument can be made that given the higher level of political risk, the borrowing cost for the US government debt should be higher, however, the exact opposite happened and the yield on the 10 year US Treasury dropped after the downgrade announcement was made. One thing for sure, volatility as measured by the VIX index spiked during this time period and we will likely see more volatility as the debt ceiling debate becomes more prominent in the news cycle.

Volatility spiked during the 2011 debt ceiling raise

Source: RBC Wealth Management, Bloomberg, data range 12/13/10-12/30/11

Rita Li works with individuals and business owners and healthcare professionals to provide tailored investment advice, risk management and financial planning. Her team comprises of professionals with in-depth taxation, insurance and legal expertise, together, they deliver a high standard of service to clients. Rita is a Chartered Financial Analyst CFA® and holds her MBA from Richard Ivey School of Business.