Hello,

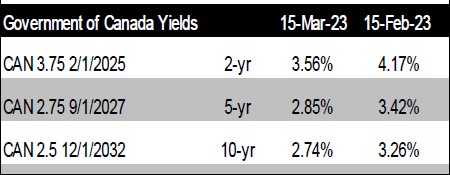

I mentioned this morning that bond rates had fallen. To add some explanation to those words, let's look at 3 bonds: Canada, February 2025 / Canada, September 2027 / Canada, December 2032 (so 2, 5 and 10 years).

Compared to a month ago (i.e. February 15th) interest rates have really dropped. This means that the price required per bond has increased (the yield being the coupon in $ divided by the price).

It is this increase in price that is currently helping our portfolios. That's why we recommend buying bonds when we we’re asked to sell everything and just go into cash.

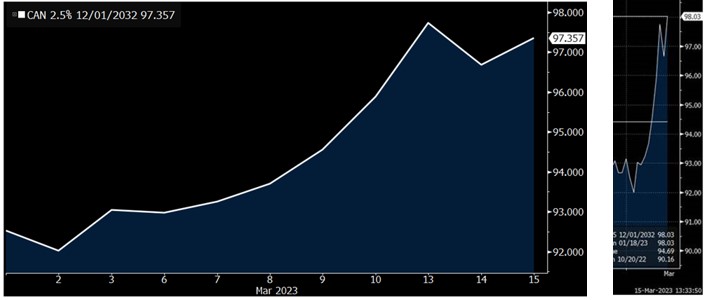

In an extreme case, this graph explains the significant increase in the price of a bond when there is a financial crisis or a turnaround in financial markets. From $92 to $98 in a few days… Flight to safety in one image.

This is why Rita and I insist on buying these bonds and why we think they are good insurance policies in a portfolio. Despite the drop in rates, we still think a traditional government bond has a place in a balanced portfolio, for its liquidity and safety.

We look forward to hearing from you,

Charles F. Lasnier, MBA - CIM