Inflation, down from last year’s highs, is progressing in the right direction.

The four key factors that drove inflation to its highest level in four decades are all turning. Commodity prices are well off their prior peaks, supply-chain problems have mostly abated, monetary policy has become restrictive and fiscal policy is starting to act as a headwind. Other indicators also point to fading inflationary pressures. Chinese producer prices are dropping, companies have reduced plans to raise wages and the share of products subject to rapid price increases has declined. There is, however, still some distance to go before inflation returns to levels targeted by central banks. The path to 3% inflation can likely be traversed in the next several months in North America but achieving the 2% target could take considerably longer. The biggest barrier to continued significant declines in inflation in the near term is service-sector inflation, which remains hot due to a strong labour market. A recession would likely be needed to cool price pressures in this sector. Taking all this together, we expect that inflation can continue falling and our inflation estimates are below the consensus.

The end of central bank rate hikes is coming into view.

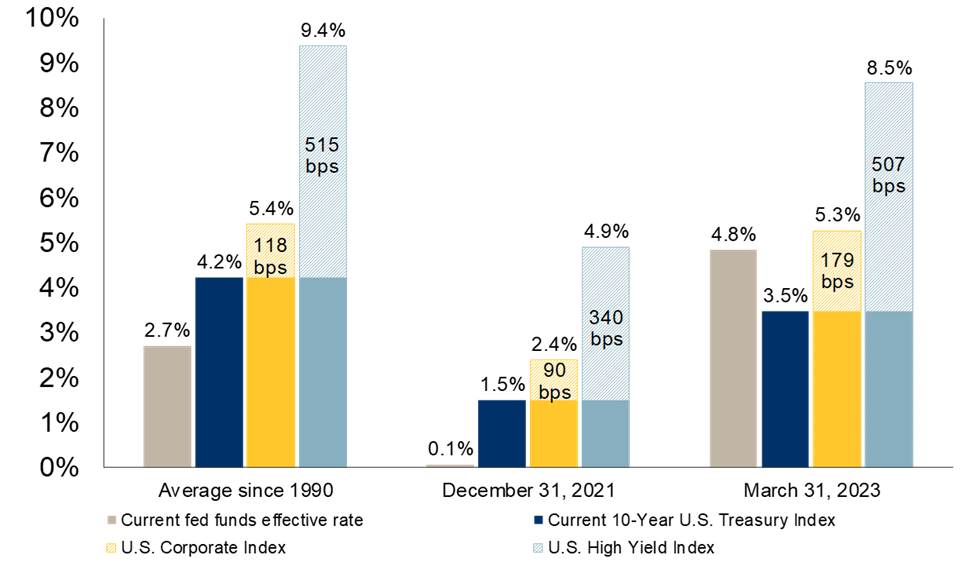

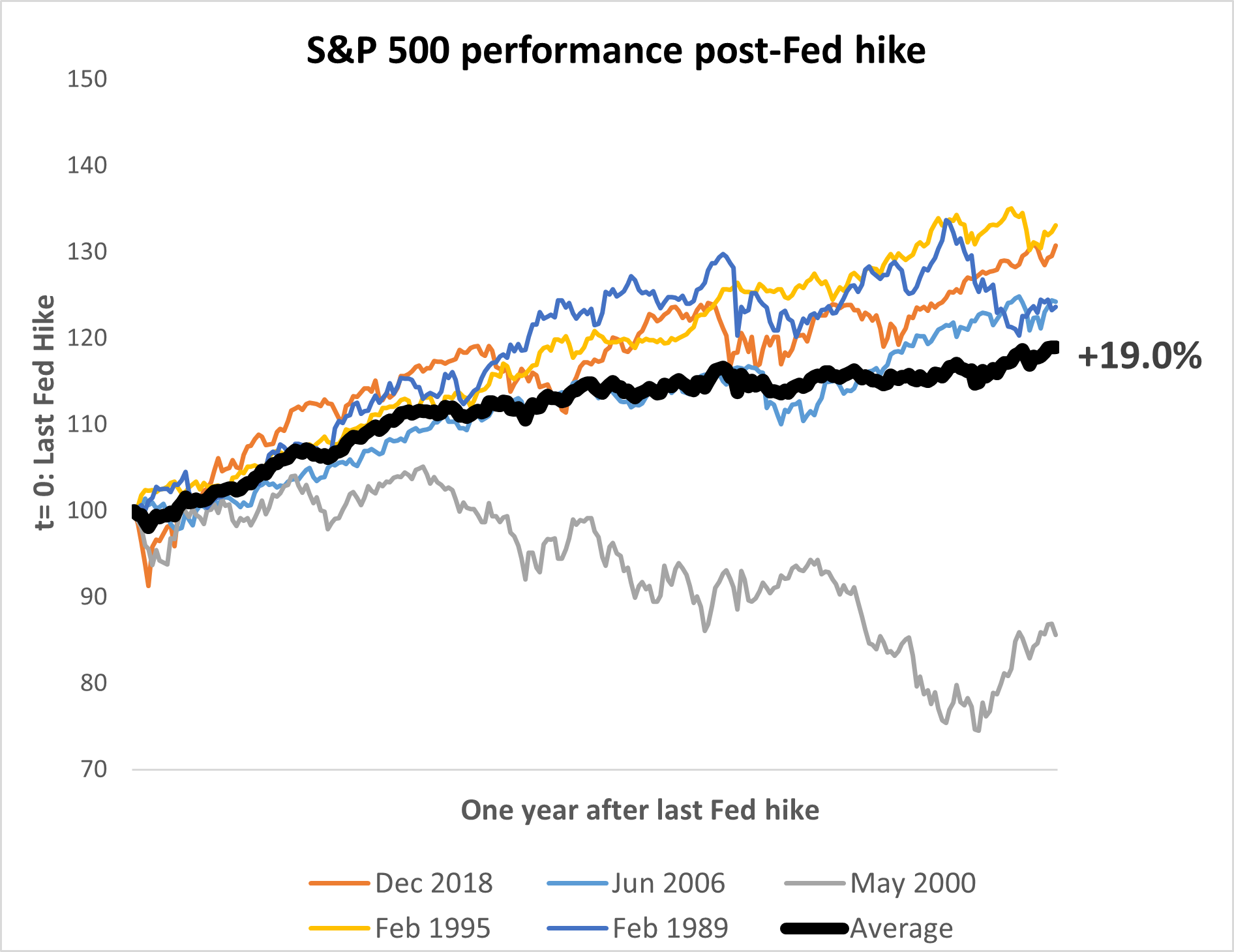

A massive amount of monetary tightening has already been delivered and policy rates are now restrictive in most major developed economies. As a result, further aggressive rate hikes are becoming less warranted and, while we could see rates inch a bit higher still, we are likely approaching the finish line in the current rate-hiking cycle. The near-term risks to this assumption tilt toward central banks raising rates a bit more than expected should inflation fail to come down and economies avoid recession. But in our view, the pressure to raise rates will continue to diminish and several central banks should be able to cut rates, if necessary, over the year ahead as economies weaken and inflation falls. We don’t think interest rates will retreat to the historic lows of 2020 or even the average of the post-financial-crisis era, but we do think that they will be suppressed in the years ahead by a combination of high debt, aging populations, and structurally slow economic growth.

Bonds offer attractive return potential; valuation risk is minimal

It appears that the relentless increase in bond yields from last year has eased and investors have been conditioned to a higher interest-rate environment. As inflation soared, investors embedded a higher inflation premium into bonds and our models suggest the reverse will be true as inflation moderates. The other piece of our fixed-income model is the real, or after-inflation, interest rate, which has been gradually climbing from negative levels. Over the longer term, we continue to expect real interest rates to rise slightly above zero as savers will ultimately need to be compensated for saving instead of spending. But any increase in real yields will likely be trivial in the near term compared to the significant expected declines in the inflation premium. As a result, we look for the 10-year Treasury-bond yield to fall to 3.25% over the next year, which would generate close to a 7% total return with minimal valuation risk. In addition, a variety of technical signals indicate support for bond prices.

Rally in stocks features narrow leadership, upside is limited

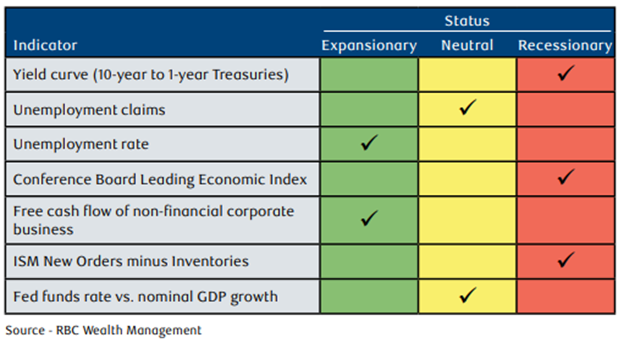

The stock-market rebound in late 2022/early 2023 was propelled by diminishing investor concerns regarding inflation and less worry about the sustainability of economic growth. The rally was initially broad-based across regions but returns in recent months have been concentrated in a narrow set of U.S. mega-cap technology stocks. Apart from the U.S. large-cap market, which has been fueled by excitement about artificial intelligence, most major indices were flat or down for the quarter. In fact, even within the S&P 500 Index, performance has been lackluster beneath the surface. While the S&P 500 rose 8.9% in the five months ended May 31, 2023, the equal-weighted version, which neutralizes the impact of large technology names, was down 1.4% in that period. We would prefer to see expanding breadth alongside a rising stock-market index to confirm a healthy, durable, bull market. The bigger threat to the stock market is now the sustainability of corporate profits which have been struggling and will be vulnerable if the economy falls into recession. S&P 500 earnings growth has currently stalled as rising costs weigh on profit margins. Moreover, earnings are situated above their long-term trend and we’ve never seen a contraction in the economy that didn’t force profits at least back to their long-term trend line. In a slowdown scenario, S&P 500 profits could fall as much as 15% from their peak, limiting the upside potential for stocks.

Changes

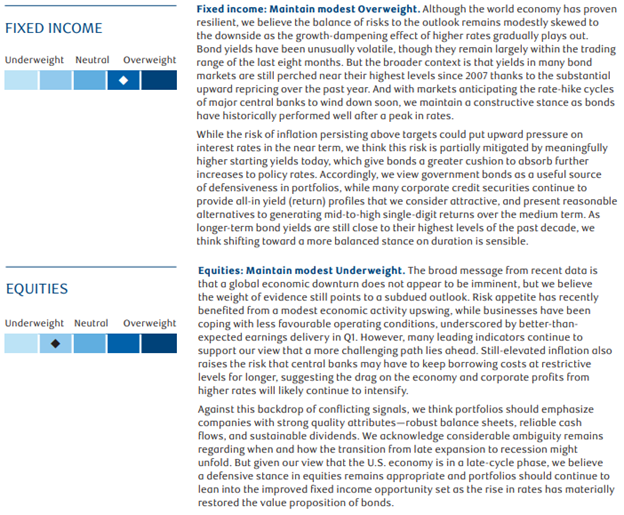

Throughout the second quarter we reduced cash balances, adding into a basket of high-quality government bonds under ticker FGO. Bonds offer an acceptable return for anybody who wants protection against the volatile stock market. This is especially true if economic growth is slowing and there is some near-term risk to stocks.

In our bond portfolio we also transitioned to focus on higher quality, removing Purpose Strategic Yield which focused on high yield bonds. High yield bonds tend to get pounded in a recession which could mean a sharp loss for investors. Adding into a globally diversified bond portfolio managed by RBC which also gives us exposure to emerging market debt & currency. Emerging market bonds and currencies benefiting from signs the Fed is nearing the end of its rate hiking cycle. In 2022 global bonds reached yields highest since 2008, now offering their most compelling return potential in over a decade especially as inflation cools and economic activity slows.

Asset Allocation Guide – this publication provides guidance and direction on asset allocation from the Canadian Investment Committee, including updated thoughts and recommendations for various asset and sub-asset classes. It can be used to help investors tilt their own strategic asset mix in a direction that reflects the 12-18 month investment view at RBC wealth management.  Cheers!

Cheers!