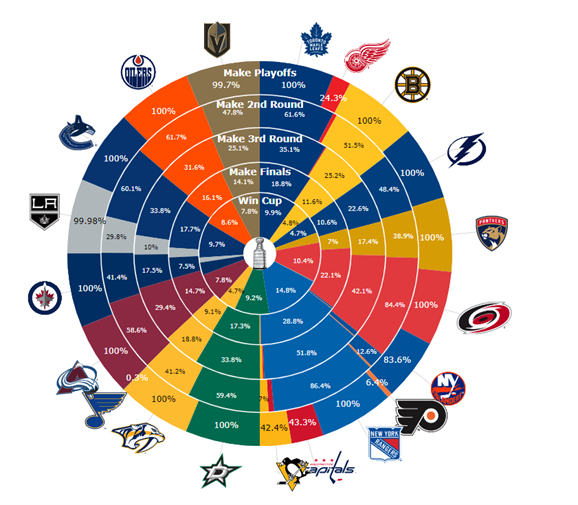

Spring is here and you know what that means, the NHL Stanley Cup Playoffs are around th e corner! After an abysmal start to the season my Edmonton Oilers are fighting to clinch the Pacific division title and are one of the favorites out of the Western Conference to make it to the finals according to the work illustrated by Moneypuck.com. This year four Canadian teams will advance to the playoffs. Both the Canucks and Oilers on top of the Pacific division duking it out for the title and home ice advantage which could prove beneficial down the stretch should either team go deep. The Jets & Leafs clinching their spots although I don’t like the potential first round match-up for either of the two teams. The Leafs will have their hands full with the Panthers, this will most likely be one of the better series in the first round to watch. I also think the Jets will have an uphill battle against Colorado. Will 2024 be the year a Canadian team can bring it home?

e corner! After an abysmal start to the season my Edmonton Oilers are fighting to clinch the Pacific division title and are one of the favorites out of the Western Conference to make it to the finals according to the work illustrated by Moneypuck.com. This year four Canadian teams will advance to the playoffs. Both the Canucks and Oilers on top of the Pacific division duking it out for the title and home ice advantage which could prove beneficial down the stretch should either team go deep. The Jets & Leafs clinching their spots although I don’t like the potential first round match-up for either of the two teams. The Leafs will have their hands full with the Panthers, this will most likely be one of the better series in the first round to watch. I also think the Jets will have an uphill battle against Colorado. Will 2024 be the year a Canadian team can bring it home?

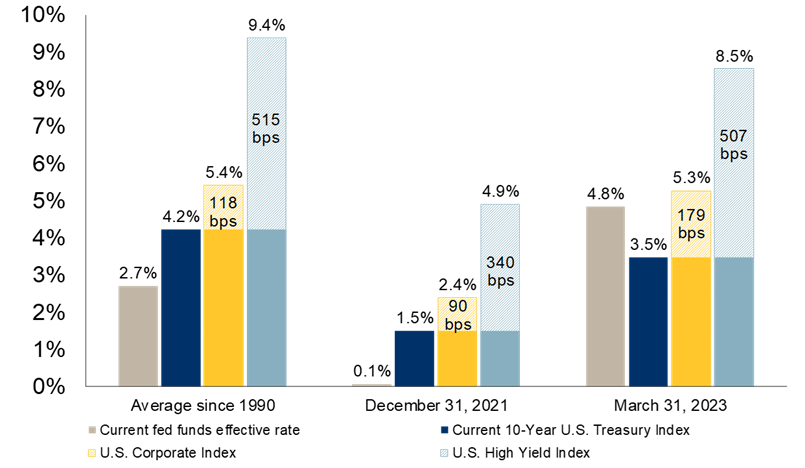

Bonds are close to their most appealing levels in nearly two decades

Bonds are near their most attractive levels in two decades after selling off from a state of overvaluation that had not been seen in 150 years. The fixed-income bear market of 2020-2023 rapidly pulled yields above 5% for the first time since 2007 and erased all of the overvaluation that had built up since the 1980s, which was accentuated by the pandemic. While the U.S. 10-year yield has declined from its October 2023 peak, at 4.25% it remains near the upper end of the historical range excluding the 1970s and 1980s, a period that featured extreme inflation. Taking everything together, our models suggest that the appropriate level for bond yields is lower, as long as inflation continues to fall as we expect. In addition to the positive fundamental backdrop, there are a variety of bullish technical measures that suggest a solid outlook for bonds. Our own forecast is for a 4.00% yield on the U.S. 10-year bond a year from now, which would result in mid-to high single-digit returns over the year ahead and, importantly, with little valuation risk.

been seen in 150 years. The fixed-income bear market of 2020-2023 rapidly pulled yields above 5% for the first time since 2007 and erased all of the overvaluation that had built up since the 1980s, which was accentuated by the pandemic. While the U.S. 10-year yield has declined from its October 2023 peak, at 4.25% it remains near the upper end of the historical range excluding the 1970s and 1980s, a period that featured extreme inflation. Taking everything together, our models suggest that the appropriate level for bond yields is lower, as long as inflation continues to fall as we expect. In addition to the positive fundamental backdrop, there are a variety of bullish technical measures that suggest a solid outlook for bonds. Our own forecast is for a 4.00% yield on the U.S. 10-year bond a year from now, which would result in mid-to high single-digit returns over the year ahead and, importantly, with little valuation risk.

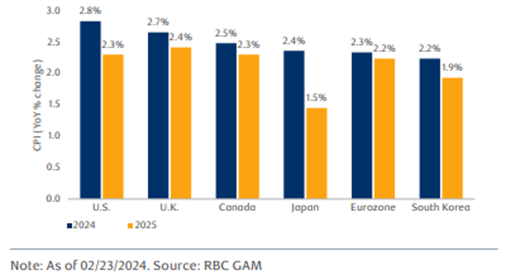

Further improvement on inflation will likely be slower

Inflation has fallen significantly from its 2022 peak as the commodity shock faded, supply-chain challenges were resolved, and extraordinary central-bank stimulus was removed. While there has been tremendous progress so far, the journey from the current range of 2.75%-3.50% down to the 2.00% level targeted by most major central banks will be more difficult. Consumer prices could be supported by elevated fiscal deficits and the economy’s general resilience. Given that our base case forecast no longer incorporates a recession, we have increased inflation forecasts from last quarter, and these forecasts are no longer below the consensus. We still believe that inflation is more likely to fall than rise over the next year, as wage pressures gradually abate, goods inflation subsides and service inflation, which is still too high, declines. Shelter costs, the largest driver of inflation today, may also be set to decline, and the range of products and services affected by high inflation is narrowing.

Given that our base case forecast no longer incorporates a recession, we have increased inflation forecasts from last quarter, and these forecasts are no longer below the consensus. We still believe that inflation is more likely to fall than rise over the next year, as wage pressures gradually abate, goods inflation subsides and service inflation, which is still too high, declines. Shelter costs, the largest driver of inflation today, may also be set to decline, and the range of products and services affected by high inflation is narrowing.

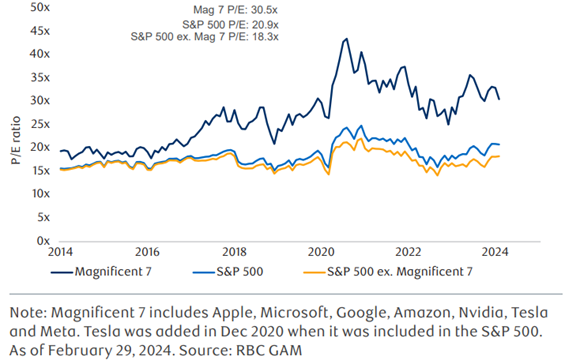

Stocks extend gains to new records, valuations are increasingly demanding

Global equities have enjoyed a powerful rally in the past quarter, with many major markets reaching record highs. Most of the recent gains, however, have been delivered by a narrow set of mega-cap technology stocks. The “Magnificent 7” in the U.S. was up 82% last year and has risen another 10% so far this year. The equal-weighted S&P 500 Index, which neutralizes the impact of these seven stocks, was up only 11.6% in 2023 and 3% this year, which is more consistent with returns in the rest of the world. Given more moderate returns, most major equity markets outside of the U.S. are trading at attractive levels relative to our modeled fair value. With respect to the U.S., many investors are concerned that the “Magnificent 7” is in a bubble given the group’s extraordinary gains. We note that these stocks are benefiting from trends in artificial intelligence and are not necessarily overpriced, as long as their earnings can continue to grow at a fast pace. Our work suggests that the “Magnificent 7” would have to grow their aggregate earnings by 23% each year for the next 15 years to justify their current valuation premium versus the rest of the market. Elevated valuations in U.S. large-cap stocks in general means that achieving decent returns on the S&P 500 will now require that solid earnings growth and heightened investor confidence be sustained.

of the recent gains, however, have been delivered by a narrow set of mega-cap technology stocks. The “Magnificent 7” in the U.S. was up 82% last year and has risen another 10% so far this year. The equal-weighted S&P 500 Index, which neutralizes the impact of these seven stocks, was up only 11.6% in 2023 and 3% this year, which is more consistent with returns in the rest of the world. Given more moderate returns, most major equity markets outside of the U.S. are trading at attractive levels relative to our modeled fair value. With respect to the U.S., many investors are concerned that the “Magnificent 7” is in a bubble given the group’s extraordinary gains. We note that these stocks are benefiting from trends in artificial intelligence and are not necessarily overpriced, as long as their earnings can continue to grow at a fast pace. Our work suggests that the “Magnificent 7” would have to grow their aggregate earnings by 23% each year for the next 15 years to justify their current valuation premium versus the rest of the market. Elevated valuations in U.S. large-cap stocks in general means that achieving decent returns on the S&P 500 will now require that solid earnings growth and heightened investor confidence be sustained.

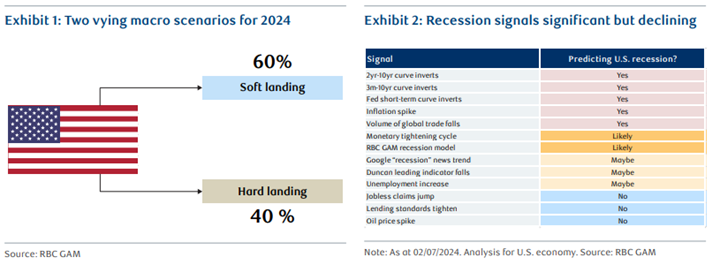

Upgrading our economic outlook

A variety of factors have motivated us to upgrade the likelihood of a soft landing for the U.S. economy to 60% from 40% last quarter, and we now look for modest growth in the first half of 2024 instead of recession. We have also boosted our 2024 forecast for real U.S. GDP growth to 2.4% from 0.3% and project further moderate growth in 2025 that could be even stronger if central-bank rate cuts unfold. Our 2024 growth forecasts are now roughly in line with the consensus for most countries, and even slightly above for the U.S. and Canada. Although the soft-landing scenario is now the most probable outcome, we recognize that a recession remains possible given that higher rates represent an economic headwind, mostly affecting regions outside of the U.S., and several important recession signals remain in place.

Changes

In light that a hard landing scenario is less likely than previously indicated we sold a government bond index in favor of higher income from investment grade and high yield bonds using the Lysander Corporate Value Bond fund which is currently on our recommended list. The Lysander fund gives us a yield to maturity of 6.1% which is slightly higher than the government bond index, also with more flexibility with an unrestricted mandate both geographically and by credit quality.

Today’s portfolios also have a higher allocation to cash or money market instruments or what I like to call ‘dry powder’. Having some cash on the sidelines will give us the opportunity to invest once a better opportunity presents itself. Given the sticky inflation environment today and higher market valuations, it’s prudent to have a little dry powder.

Take care!