Fall 2023

Canada’s economy surprised to the downside in Q2 as GDP contracted relative to the prior quarter, suggesting higher interest rates are constraining activity. Consumer spending advanced at its slowest pace since Q2 2021, and residential investment fell for a fifth straight quarter. We remain conscious that the full impact of the Bank of Canada’s tightening campaign has yet to be felt across an economy that is particularly sensitive to interest rates due to elevated household debt and housing’s outsized economic contribution.

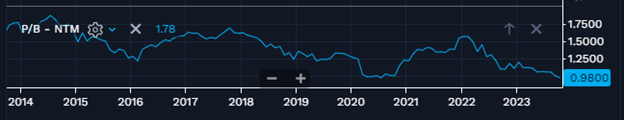

Several Canadian banks recently cited the risk of “higher for longer” rates when provisioning for future credit losses. Bank valuations continue to reflect the uncertain environment with the group trading at a steep discount relative to its long-term average and close to “noncrisis” troughs. While it is hard to identify a catalyst for why valuations should improve at this point in the credit cycle, we believe income-oriented investors with a long-term view can find opportunities.

A narrowing path

There continues to be a (diminishing) possibility the S&P 500 and perhaps other developed markets could post new highs in the next few months. As long as faith in a so-called soft landing for the U.S. economy can be supported by some plausible rationale, we think an ever-narrowing path to higher ground will remain open. However, beneath the surface the spending power and confidence of the U.S. consumer are under pressure, compressed by depleted savings, high and rising interest rates, a growing unwillingness of banks to lend, and rising energy costs. Next year is likely to feature a more challenging landscape for both the economy and equity markets.

For now, we recommend remaining sufficiently committed to stocks to take advantage of what we regard as a diminishing possibility of reaching a new high in the coming few months. However, we believe investors should consider limiting individual stock selections to companies they would be content to own through a recession, which, in our view, is the most probable economic outcome in the coming quarters. For us, that means high-quality businesses with resilient balance sheets, sustainable dividends, and business models that are not intensely sensitive to the economic cycle.

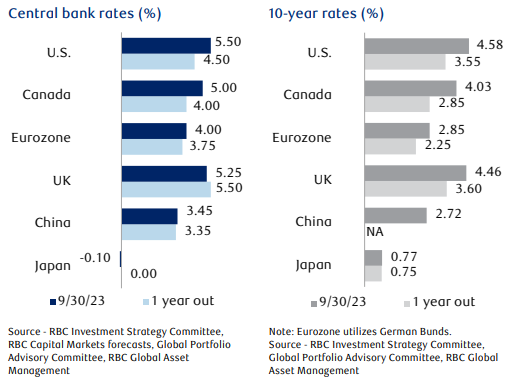

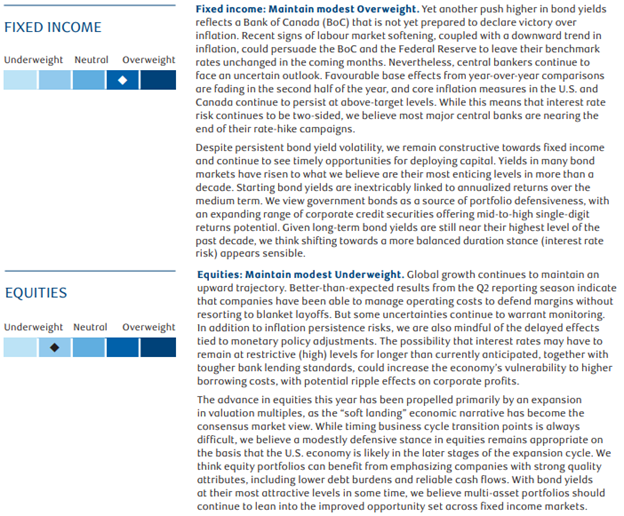

Higher bond yields

Higher yields—which push bond prices lower—continue to weigh on bond market performance. Returns on the Bloomberg US Aggregate Bond Index have turned negative once again, now down 1.0% year to date, while the Bloomberg Global Aggregate Ex-USD Bond Index is down 3.0%. But with global sovereign yields at historically attractive levels across most regions, and the end of rate hikes at the doorstep, the risk-reward setup for fixed income investors has rarely been better, in our view. For example, while Treasury performance remains negative this year, the U.S. 10-year yield would have to rise to 5.2% over the next year for the price decline to completely offset coupons earned over that stretch. Alternatively, should the 10-year yield fall back below 4.0%, the combination of coupons and bond price appreciation in that scenario would deliver U.S. investors returns of nearly 10%, with similar dynamics likely globally.

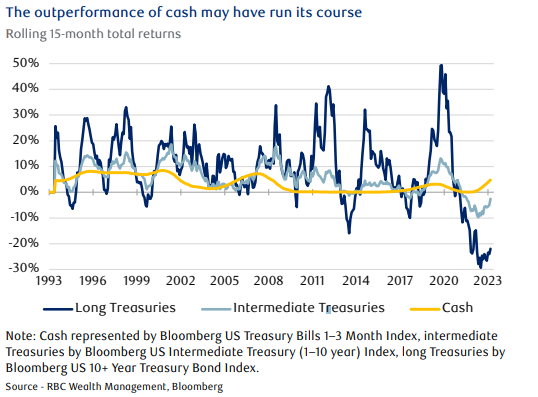

Cash may have run its course

The current yield environment presents a smorgasbord of opportunities for investors. As the final chart shows, cash has had its day in the sun since the Fed began raising rates in March 2022 delivering total returns of nearly 5% based on 1–3 month Treasury bills, while longer-dated Treasuries are still down by over 20%, one of the biggest performance gaps on record. But the tide may already be shifting, as longer-dated bonds are already clawing back returns with central banks appearing to be at or near peak rate levels. But attempting to time the market is only likely to mean that an investor will miss it altogether. So, we would simply employ a strategy in coming months and quarters of gradually moving out of cash and short-dated bonds in a higher for longer, but maybe not forever, rate environment.

Changes

For our growth oriented portfolio’s, we have reduced exposure to Asia Pacific as China economy continues to struggle. A new allocation to BMO equal weighted bank index will increase our exposure to Canadian banks which have come under pressure recently creating an attractive buying opportunity. Take Bank of Nova Scotia for example, currently paying a dividend of over 7% and price-to-book value not seen often as illustrated in the chart below.

A pension approach

For larger portfolios we’ve added exposure to private funds with higher investment minimums. Private funds give investors exposure to investments with lower volatility than realized in public markets and exposure to attractive income. This exposure is often used by large pension funds, take CPP for example which has increased exposure to alternative investments over the last decade.

Private credit is a timely opportunity with higher interest rates today giving investors a steady monthly income stream of approximately 9.8%. Managed by Brookfield Oaktree with over 40 years of experience in the private lending space giving you peace of mind in a basket of high-quality loans.

Our exposure to private real estate is done so through the partnership of the largest financial institution in Canada, the Royal Bank, and one of the largest pension plans in Canada, BC pension plan. This investment provides exposure to over 65 properties with tenants like Amazon, the Government of Alberta, PWC and the largest banks in Canada. Expect to receive a steady stream of income plus a growth component to help mitigate inflation risk in the future.

Asset Allocation Guide – this publication provides guidance and direction on asset allocation from the Canadian Investment Committee, including updated thoughts and recommendations for various asset and sub-asset classes. It can be used to help investors tilt their own strategic asset mix in a direction that reflects the 12-18 month investment view at RBC wealth management.

Cheers!