It’s understandable that investors remain scarred by memories of 2008–09 and that any word of bank failures brings fears. But several factors distinguish the current turmoil from the banking system crisis of 2008–09. We discuss the drivers of U.S. policymakers’ current approach to today’s stress, and the risks for investors in U.S. banks.

- With bank failures back in the headlines, investors are understandably concerned about the prospects of a return to the turmoil of 2008 and the global financial crisis.

- We believe that recent events are fundamentally distinct from the problems of 15 years ago and that policymakers’ existing toolkit is sufficient to bring stability to the sector.

- Our concerns are focused on potential unintended consequences from regulators’ attempts to assign losses and avoid moral hazard.

The stunning demise of Silicon Valley Bank sent shock waves across the banking sector and broader financial markets. We examine regulators’ fast action to stem the damage and what the “costs” of that may be, as well as highlight how the entire episode may cause the Fed to rethink its rate hiking plans. Click here for full article.

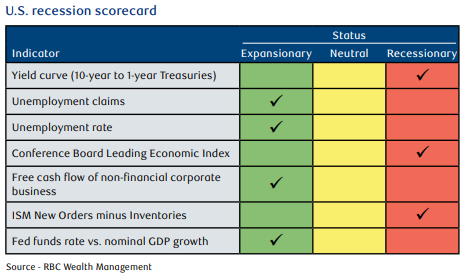

We expect a U.S. recession will get underway later this year, ushering in another period of challenging stock market performance with knock-on negative implications for economies and stock markets in other developed countries. We recommend a global balanced portfolio be Market Weight to equities for now with a focus on quality, resilient balance sheets, sustainable dividends, and business models that are not intensely sensitive to the economic cycle. More aggressive defensive positioning may be called for in coming months.

… and the market typically turns higher before the recession ends

That said, we believe bear markets can provide once-in-a-decade buying opportunities. The yield curve, when it normalizes, should give some idea of when the recession will end. Stock indexes would typically embark on a new bull market up turn some months/ quarters prior to that.

The Bank of Canada (BoC) has hiked interest rates eight consecutive times since March 2022, lifting the policy rate to a 16-year high in an attempt to tame some of the highest inflation readings since the early 1980s. That being said, the BoC has recently entered a new phase of monetary policy: A “data-dependent” conditional pause while it assesses the lagging economic impacts of the 425 basis points worth of hikes already delivered. Therefore, data releases such as retail sales, employment, the Consumer Price Index, and GDP are being closely dissected by market participants. This new phase of monetary policy has been conducive to heightened rates volatility, as the absence of BoC forward guidance has allowed investors more room to consider a variety of outcomes.

Given an unusually wide range of potential economic and monetary policy outcomes in the near term, we see the balance of risks as favoring short-to-intermediate-term investment-grade bonds that lock in historically attractive yields without taking on excessive interest rate risk or credit risk.

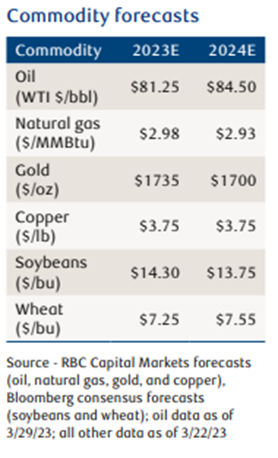

Crude oil: Contagion Oil prices broke below $70/barrel (bbl) following the collapse of select U.S. regional banks and the bailout of Swiss bank Credit Suisse. While near-term fundamentals have softened, RBC Capital Markets is still calling for tighter oil balances in the second half of 2023. The WTI retracement to the mid-$60/bbl level is pricing in a 2008-like recession, according to RBC Capital Markets’ commodity strategist.

Gold: Rallying Fears of financial instability and bearish sentiment propelled gold to fresh one-year highs, supported by a weaker U.S. dollar and lower real interest rates. The situation remains fluid and we believe gold will likely ebb and flow based on developments within the financial system, the path of major central bank policies, and global economic growth. Gold is trading within RBC Capital Markets’ commodity strategist’s high-end scenario.

Wheat: Balanced Looking into the 2022/23 season, the USDA expects global production to come in at approximately 789 million metric tons, relatively in line with the estimate for global consumption. Growing exports from key producing countries allowed prices to normalize to mid-2021 levels (i.e., pre-Russia Ukraine war). Prices are likely close to a floor, in our view.

Changes

Exposure to higher risk bonds have been liquidated in favor of holding cash bringing total cash balances in the portfolios to higher levels. While typically cash balances serve as a drag on portfolio performance in today’s higher rate environment, we feel more comfortable to take a wait and see approach. This served well as news of a possible banking crises unfolded in the middle of March.

A trim to non-core equities also in favor of cash and a new high quality government bond ETF (FGO) was also completed to reduce portfolio risk, cash balances providing us the ability to take advantage of future market volatility. FGO gives the portfolio an allocation to very high quality, liquid, government bonds and an actively managed duration strategy which will be necessary when trying to navigate the future direction of interest rates.

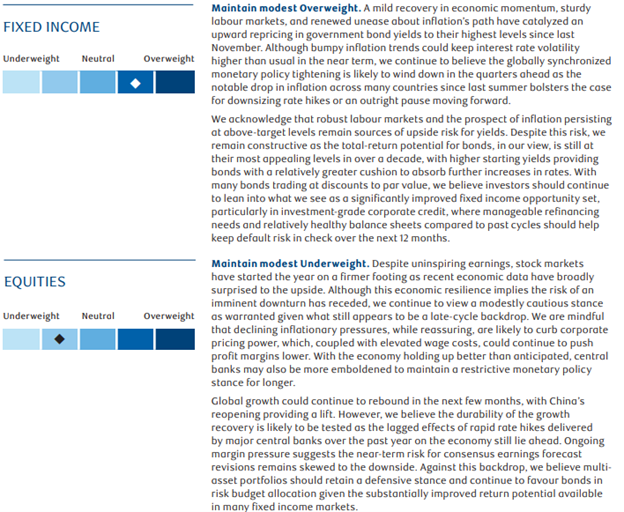

Asset Allocation Guide – this publication provides guidance and direction on asset allocation from the Canadian Investment Committee, including updated thoughts and recommendations for various asset and sub-asset classes. It can be used to help investors tilt their own strategic asset mix in a direction that reflects the 12-18 month investment view at RBC wealth management.

Cheers!