Three People Walk into a Bar …

Stop us if you’ve heard this one before – A 15-year old girl, a Beach Boy and a masochist walk into a bar …

A 15-year old - On November 22nd, 1963, CBS ran a piece on its morning news about a band from Liverpool that was taking over Britain. CBS planned to rerun the piece that night on the evening news with Walter Cronkite, but, unfortunately, that same day, U.S. President John Kennedy was assassinated and for obvious reasons, any plans to re-run the piece on “Beatlemania” were shelved. Three weeks later, amidst a grim mood in the country, CBS and Cronkite decided they needed something more upbeat on the newscast and pulled the Beatlemania piece from the archives. Marsha Albert (no relation to Fat), then 15-years old, saw the Cronkite telecast on the Beatles (the mere fact that a 15-year old was watching Walter Cronkite may be the most amazing part of this story) and she then wrote a letter to a disc jockey at a Maryland radio station begging him to play Beatles music. A week later, the disc jockey – Carroll James – had Ms. Albert introduce “I Want to Hold your Hand” live on the air for the first known radio play of the Beatles in the United States. Phone lines at the station went berserk and James then sent the record to fellow disc jockeys around the country with their stations seeing similar “manias” when they played the record. Capital Records, which had planned to release “Hand” in mid-January of 1964, was forced to pull forward the release by nearly a month and within the next 12-months, the Beatles would chart no less than 30-songs in the Top 100 in the U.S.

A Beach Boy – Unlike what was taking place across the pond, the 1960s were not particularly kind to U.S. rock bands. The Beatles were soon followed by Dusty Springfield, the Kinks and then the biggest of them all – the Rolling Stones. U.S. acts were simply crowded out by the unique sound of the British Invasion. One of the lone exceptions to this were a California quintet consisting of three brothers – Dennis, Brian, and Carl Wilson – their cousin Mike Love and a friend – Al Jardine, collectively known as The Beach Boys. In their early years, The Beach Boys were known for a simple, more old school sound with hits such as “Surfin’ U.S.A.”, but this all changed with their 1966 release – “Pet Sounds”. Pet Sounds completely changed the Beach Boys sound with the iconic “Good Vibrations” and “God Only Knows”, vaulting the quintet from fun beach band to rock and roll Gods. Fast forward to 1968 and the band’s drummer – Dennis Wilson – became interested in a more bluesy sound when he came across a song called “Cease to Exist”, which fit what he was looking for. After meeting with “Cease’s” songwriter, Dennis altered the lyrics, while the band changed the musical arrangement. “Cease” became “Never Learn Not to Love”, which would find its way on to the album “20/20”, released in 1969.

The masochist - Now, “Never Learn to Love” was not particularly successful – it was a B-side to “Bluebirds over the Mountain”, which was also not particularly memorable or successful (it peaked at 61 on the charts). However, Dennis claimed a full writing credit for the song, which upset the writer of “Cease to Exist” as his song was clearly the inspiration for Dennis Wilson’s retitled version. For their part, The Beach Boys claim that the author of “Cease” was well compensated (some cash and a motorcycle) for giving up any credit for the song, but reports are that “Cease’s” author left the recordings in a huff after finding out he would not be credited. It is worth noting that Dennis had formed a strange relationship with this man - Charles Manson - and his followers, known as the Manson Family, with many of them living in Dennis’s house for periods during 1968. One month following the release of “20/20” in early 1969, several members of the Manson Family would go on one of the most notorious murder sprees in U.S. history.

We are now going to orchestrate an extremely awkward segue - speaking of never learning to love (see what we did there?), let’s take a random walk down Canada street.

A Random Walk Down Canada Street

The Economy: The Canadian economy is a bit of a muddled mess at present. The good news is that business optimism has begun to improve, especially as it relates to the outlook for the next year:

As we have noted in the past, Canada’s economy is very sensitive to interest rates (far more so than the U.S. economy) and with the Bank of Canada now aggressively cutting rates, business optimism for the next year has begun to improve. This has also led to the potential for more investment, which has been sorely lacking over the past two-years:

We would note that this survey does not fully capture the Trump effect (it was post-Election, but pre-tariff uncertainty), nor does it capture the proroguing of Parliament, so there is the potential for some weakening in the next survey, but at least things were moving in the right direction after ~2-years of general negativity.

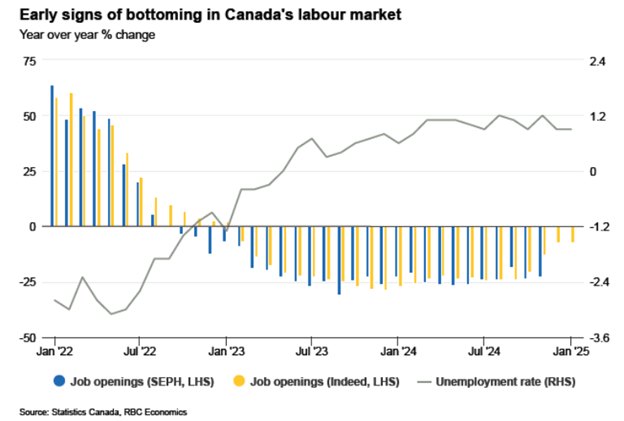

Further, along with business sentiment, the labor market has begun to show signs of improvement:

The unemployment rate rose sharply from mid-2022 through early 2024. Since then, it has been fairly stable with modest improvements over the past two months. The slowdown in immigration has likely played a role in this, as the pool of labor has shrunk, but overall, things appear to be moving in the right direction.

Overall: Things are likely to remain rocky, at least until we get some clarity on tariffs and the Election. That said – we remain more optimistic than most as it relates to the medium-term outlook for the Canadian economy as a combination of lower interest rates and a more pro-business government have the potential to thaw what has generally been a moribund economy for the better part of the past decade.

Housing: Let’s start with a chart and the comment:

A recent sharp rise in new listings - +11% in January – has helped to push the housing market into almost perfect balance. Now, we would note that new listings rising sharply in January is unusual, as generally speaking – people tend to list their homes in the Spring as opposed to the dead of winter. With this rise in supply, houses for sale are now at their highest level since pre-pandemic. At the same time, sales have declined over the past two-months, so we would not be surprised to see some decline in prices over the next quarter or two - prices have generally been flat, despite the shifts in supply and demand:

RBC Economics sees affordability continuing to improve as the year plays out driven by declining interest rates and a balanced market. However, it is worth noting that even with affordability improving, the sharp rises in prices post the pandemic will still leave affordability ~10% worse than it was in early 2020.

Overall: We continue to see risks to the upside on housing, especially if mortgage rates continue to come down. While immigration has slowed sharply, the surge in new immigrants in 2022 and 2023 coupled with the slowdown in housing sales brought on by the rise in interest rates, has likely left significant pent-up demand.

The Loonie: We recently had a chat with Jim Allworth, Chief Portfolio Strategist for RBC Dominion Securities, in which he discussed a variety of topics. One of the topics that came up was the Canadian dollar and its outlook in the era of Trump 2.0. Jim mentioned a variety of things, but one of the main things he pointed to was the relationship of CAD to Purchasing Power Parity (PPP). Before looking at CAD and PPP, let’s first define what PPP is:

PPP Explained: Let’s say we had a basket of goods and services in the United States and the same basket of goods and services in Canada. PPP is essentially the exchange rate between Canada and U.S. that would make these two baskets cost roughly the same in both countries. If the exchange rate got too far out of whack – i.e. CAD got too cheap or expensive relative to USD, then eventually behavior would change. That is – if CAD became too cheap, Americans would come to Canada in search of this basket, while if CAD became too expensive, Canadians would go to the U.S. for the basket. We saw a version of this from 2007 to 2011 when many Canadians took advantage of the strong loonie (we called it to the Condor back then, as we did not feel the loon captured the mojo CAD was feeling) and bought clothes and cars and other stuff in the U.S. because it was much cheaper to do so than buying those things in Canada. Eventually, if enough people change their behaviour, demand for the cheaper currency will increase and this will cause it to rise back toward PPP.

Now, deviations from PPP are normal. That is – a currency is almost never going to trade at exactly its PPP. This is because: 1) there are lots of factors that drive currencies such as interest rates and foreign investments and how easy/hard a country makes it for foreigners to invest in the country; and 2) it takes more than a little deviation from PPP to change behaviour. That is – just because the hypothetical basket is cheaper, it doesn’t mean it is cheap enough to actually prompt people to hop borders in search of the discounted items or services.

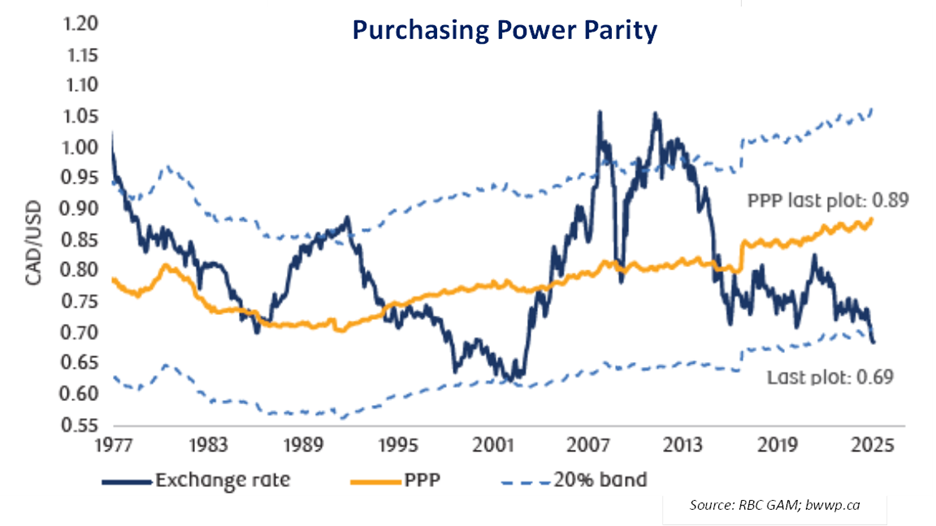

Okay, now that we have defined PPP, let’s take a look at a PPP chart:

According to RBC Global Asset Management, PPP for CAD vs. the USD currently sits at around $0.89. We have seen estimates that range between $0.84 and $0.89, so this is at the high end of the range, but it is probably safe to say that fair market value of the loonie sits somewhere in the high $0.80s. Now, as we said, CAD rarely trades at its PPP, but rather it will tend to fluctuate over long periods of time in a range between 20% above PPP and 20% below PPP. Those 20% bands tend to be the extremes as outside of those bands, we are probably going to start to see behaviors change – first through increased/decreased travel to the cheaper/pricier locale and later through changes in purchasing behavior. As you can see from the chart, the recent move lower in CAD has pushed the currency beyond the 20% lower bound.

So, does this mean it is time to get more bullish on CAD? While we are outside the consensus in having a more positive view on CAD, we think any meaningful recovery is going to need some things to fall into place. Let’s explore a few of those:

- Clarity on tariffs: During Trump 1.0, Trump threatened big tariffs and derided the North American Free Trade Agreement (NAFTA) as very unfair to the U.S. Eventually, a new deal was struck – The U.S.-Mexico-Canada Agreement (USMCA) – which Trump declared was “one of the most important deals, and the most important trade deal we’ve ever made by far.” The reality was, perhaps, a bit different than that as USMCA was not really all that different than NAFTA, especially from Canada’s perspective (Mexico felt more of a negative impact as minimum wage rules in the auto sector were much more of an issue for Mexico). So far, Trump 2.0 appears to be following the same playbook – he has threatened big tariffs, but has largely walked them back for now, while also deriding USMCA as unfair to the U.S. (even though it was one of his first term’s signature achievements) with a potential reopening of USMCA in 2026. We While we would not be surprised to see the ultimate bite of all these tariff threats to be less than feared (across the board tariffs would do significant damage to Canada but would also deal a severe blow to U.S. economic growth), we also think CAD is unlikely to enjoy sustained upward momentum until the tariff picture becomes clearer.

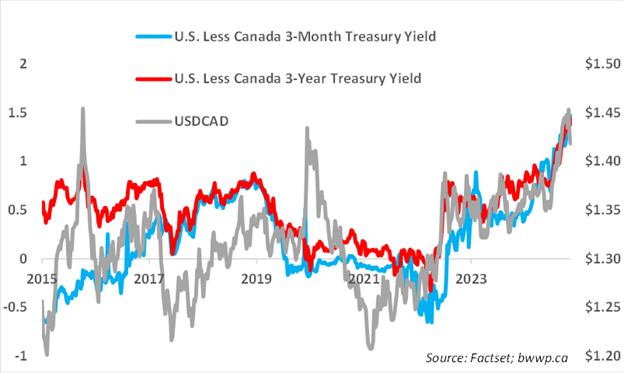

- U.S. rates: While PPP provides a good framework, relative interest rates also matter a lot to exchange rate direction. The easiest way to think about this is – if rates in one country are significantly higher than those in another, there is going to be a powerful draw to convert money to the higher yielding currency and to invest in bonds, which will pay you more than your native currency. The chart below highlights this relationship:

So, when might we see the above gap narrow? Between Trump’s tariff threats, potential large U.S. stimulus via tax cuts (although, many of these are just extensions of existing policy), and a tightening supply of labor, the U.S. is faced with a much stickier inflation situation than is Canada and most of the rest of the world. Thus, we would not be surprised to see U.S. rates remain higher for some time to come with the potential of even rate hikes by the U.S. Fed by year-end.

Outlook: Purchasing Power Parity does not tell us much about how the Canadian dollar will perform over the next week, or the next month or even the next year. But it does tell us something about how undervalued the Canadian dollar is relative to the U.S. dollar and what the likely glide path will be over the next decade. With tariff and political uncertainty, we would not be surprised to see some shakiness over the next several months; however, we are confident that PPP and extreme positioning will prevail in the longer-term and we will ultimately see a reversion back toward its fundamental value.

Final Thoughts: Canada is at a difficult crossroads. Not only does it face an election at some point in the next 8-months, an election that could re-cast the economic picture for the next several years, but it also faces the uncertainty of Trump 2.0. Against this backdrop, we are seeing early signs of a recovery that we think has the potential to unfold over the next several years. This recovery is likely to face some near-term headwinds, but we see significant potential for improvement as lower interest rates and a more pro-business approach help to unlock the economy.