The Miracle at the Meadowlands

For those non-football acolytes, when a team has a lead and the other team is going to run out of time before getting the ball back, the team with the lead will have the quarterback take the snap of the football and then quickly take a knee, thus conceding a yard, but also running precious time off the clock. This is essentially a risk-free move and is now commonplace in games that are both close and blowouts. But, prior to November 19th, 1978, taking a knee in the NFL was not really a thing. In fact, the NY Giants offensive coordinator (OC) at the time – Bob Gibson – viewed the idea of a QB taking a knee as “unsporting”.

Anyway, on 11/19/78, the 5-6 Giants faced off against the 6-5 Philadelphia Eagles (their division rivals) in a game at the New Jersey Meadowlands. The Giants led for the entire game and found themselves with the ball and a 17-12 lead with under two minutes to play. The game was for all intents and purposes decided – as the Eagles were out of timeouts and, one would think, hope. On first down, despite the OC’s misgivings, Giants’ QB Joe Pisarcik dropped back to pass, but then quickly took a knee. However, on second down, the play came in from the sidelines – 65 Power-Up – which called for Pisarcik handing the ball off to future Hall-of-Fame running back Larry Csonka. In the huddle, Csonka was apparently irate, while other players begged Pisarcik to change the play to a kneel-down. Pisarcik, only two years in the league, refused for fear of sparking the OC’s rage and the rest played out like this:

- Pisarcik took the snap and bobbled it – however, he managed to secure the ball and turned to hand it off to Csonka.

- The ball never reached Csonka’s hands, but instead bounced off his hip as Pisarcik desperately tried to give it to him.

- Pisarcik tried to fall on the loose ball, but Herman Edwards, a defensive back for the Eagles, came sprinting across the line of scrimmage and picked up the ball on one bounce.

- Edwards sprinted 26-yards for the winning score.

- Bob Gibson was fired the next day and never worked in the NFL again – instead, he opened a bait shop in Florida.

In the aftermath of what came to be known as “The Miracle at the Meadowlands”, kneeling became an accepted practice in the NFL with the late game hand-off not surprisingly losing its luster.

Speaking of unsteady hand-offs, let’s get to this week’s missive.

Rickety Pillars

The last two weeks will go down as some of most volatile on record. We saw losses on three separate days of 3.5%, 4.8% and 6% on the S&P 500, while we also saw gains of 1.8% and 9.5% on two other days. To put these in perspective, the three down days were among the 83 worst trading days of the past 75-years (there have been more than 19,000 trading days over this period), while the 9%+ day ranked as the third best trading day over that period.

We came into 2025 with the U.S. economy resting on three pillars:

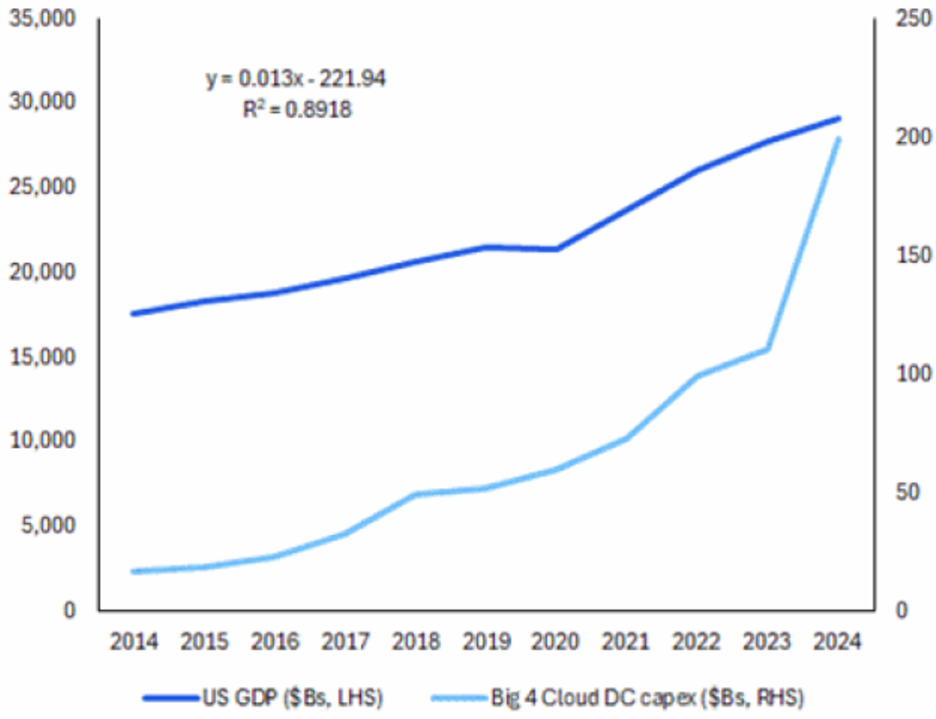

- AI Investment: The launch of ChatGPT in late 2022 kicked off an unprecedented investment frenzy in Artificial Intelligence. While technology investment had been a positive contributor to U.S. GDP for many years, the AI investment wave took this to another level:

- Fiscal Spending: A combination of COVID stimulus and the Inflation Reduction Act pushed a lot of U.S. government spending into the economy. Since the end of WWII, the U.S. had only run deficits greater than 5% of GDP on two occasions – briefly in the early 1980s as Reagan ramped up defense spending and the Global Financial Crisis. However, since COVID, the U.S. deficit has persistently been above 5% of GDP:

- The Wealth Effect: Strong stock markets have helped higher income earners, which has helped to keep consumer spending at decent levels, despite high prices and higher interest rates than the recent past.

But the election of Donald Trump has brought about a shift in this narrative – some by choice and some because forces beyond the U.S.’s control have arisen. As we discussed back in January, the launch of DeepSeek, which is a Chinese version of a Large Language Model (LLM), has somewhat derailed the enthusiasm for AI and AI-related investment. While AI investment is expected to remain robust, the “we will spend whatever it takes, no matter what” mentality has taken a bit of a hit. Meanwhile, while DOGE has proven to be somewhat of a “nothing-burger”, there seems little doubt that the U.S. is going to reckon with its deficit problem in some way, which weakens what has been a very supportive pillar to growth over the past few years. Lastly, we have this:

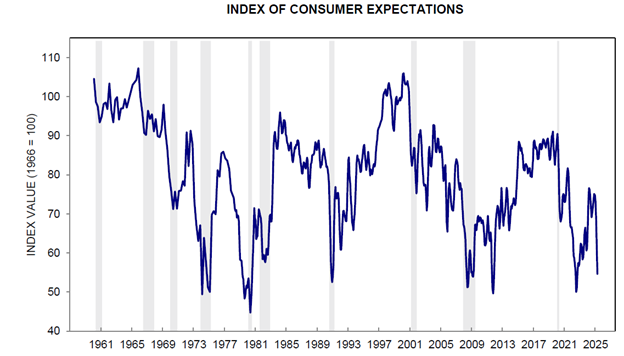

Consumer confidence and expectations have fallen sharply since the start of the year as a combination of tariff uncertainty, volatile stocks and persistently high prices have weighed on animal spirits. When animal spirits are down, people tend to spend less, which can have profoundly negative effects for the economy.

Hand-Offs are Tricky

Economies and markets often go through transition periods when a series of drivers (or headwinds) give way to a new set of influences. Sometimes, these transitions happen rapidly. For example, in 2020, we went from COVID/the world is shutdown to massive government and central bank stimulus in a matter of weeks. March of 2020 was painful with markets falling by a third and economic activity resembling a second Great Depression, but because of these unprecedented stimuli, the turnaround for markets and for the economy was rapid.

Conversely, in 2007-09, it took more than a year for the market and the economy to transition from a long period of rapid credit expansion fed by housing to a massive credit crisis that shattered trust in the system to massive stimulus that helped to rescue the banking system and ultimately the economy.

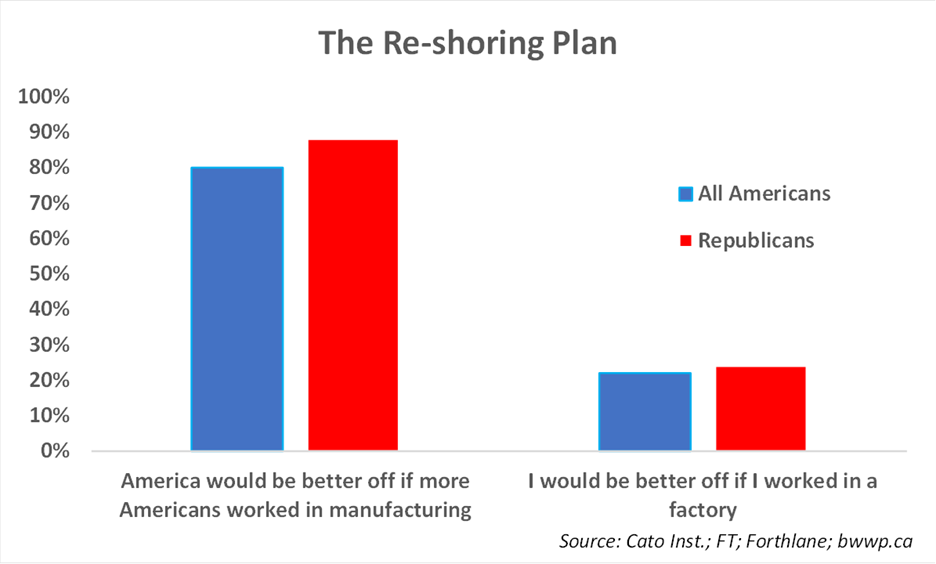

This time – we are seeing a transition from fiscal stimulus, consumer spending to new support mechanisms. Trump and his team are trying to transition the U.S. and the global economy from a system of comparative advantage in which productive capacity is located where it makes the most economic sense to a system in which countries control their own manufacturing capacity – at least across a range of industries. We would note that the dreams of the U.S. becoming a manufacturing powerhouse once again sounds great on paper, there are reasons to believe that it may not prove to be as effective as hoped:

An uneasy backdrop

While the new pillars take root, we (and the market) are skeptical. For the better part of 15-years, the U.S. has provided international investors with: 1) a strong U.S. dollar; 2) strong relative stock performance; 3) a stable bond market that generally offered a yield pick-up vs. domestic bonds.

We have obviously seen the equity side take a hit in the first part of 2025, but this has also been exacerbated by a sharp selloff in the U.S. dollar:

As you might have guessed – with stocks down and the U.S. dollar down, the other pillar for foreign investors – stable U.S. bond markets – has also been challenged. In fact, the U.S. 10-year rose 46 basis points last week (when yields rise it indicates that bond prices are falling), which was second biggest weekly rise in bond yields in the past 35-years.

How long will this transition take? While it is impossible to know for sure, we would suspect that the transition to a tariff-based system in which eight decades of globalization is rolled back is going to take time. Even if we ignore the haphazard way in which the tariffs have been rolled out (and it’s hard to ignore), going from a system of relative free trade to a system in which there is likely to be significant trade friction is likely to prove challenging. Against this backdrop, we think it is going to be a struggle for markets to find solid footing with the likelihood that there is going to be more choppiness to come.