2023/2024: The Song Remains the Same-ish

We came into 2023 with a cautiously optimistic outlook. We would summarize our views as the following:

- We felt that the first half of the year was likely to be weak for stocks, but that the second half of the year would likely more than offset this weakness.

- We thought that for the first time in decades, bonds offered an attractive return primarily because of the sharp and painful reset in 2022 (The Rise of Income);

- We believed that inflation was likely to come down sharply driven by the rise in interest rates and a general slowdown in demand.

- We viewed the Bank of Canada and the U.S. Federal Reserve as largely done raising rates, but we did not believe interest rate cuts would occur in 2023 (Revisiting the Inflation Debate);

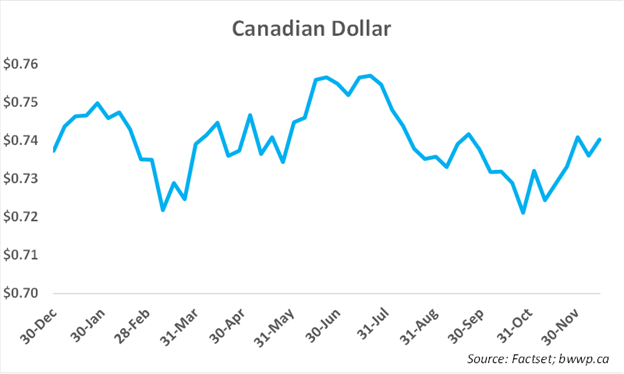

- The loonie was likely to spend the year range bound between $0.70 and $0.78 with a bias toward the low end of that range (Loonie Outlook).

So how did we do? As with most forecasts – there were some gives and takes. Let’s look at a few charts and comment as we go:

The first half of the year was indeed weak, at least in Canada; although, as you can see from the chart, the TSX did not actually experience the lows for the year until late October. The rally that began in late October has been enough to drive the TSX to a nearly 5% gain for the year. We would note that if we expand to the two-year picture, both indices are still negative; although, a good chunk of the damage done in 2022 has been offset by 2023’s late recovery:

The first half of the year was indeed weak, at least in Canada; although, as you can see from the chart, the TSX did not actually experience the lows for the year until late October. The rally that began in late October has been enough to drive the TSX to a nearly 5% gain for the year. We would note that if we expand to the two-year picture, both indices are still negative; although, a good chunk of the damage done in 2022 has been offset by 2023’s late recovery:

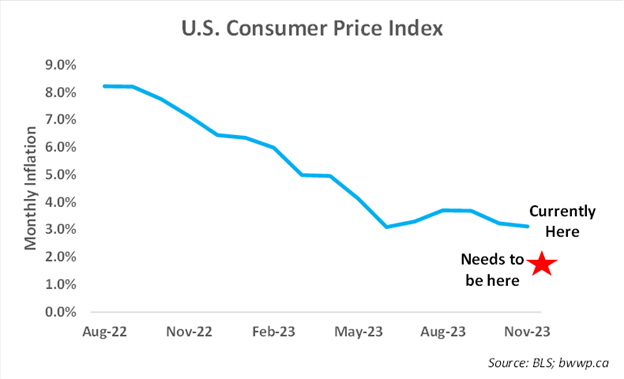

As for inflation, it has come down, but it remains stubbornly above the levels it needs to reach for Central Bankers to definitively sound the “all clear”:

As for inflation, it has come down, but it remains stubbornly above the levels it needs to reach for Central Bankers to definitively sound the “all clear”:

That said – inflation is definitely headed in the right direction and the U.S. Fed is now predicting three rate cuts in 2024. We remain somewhat skeptical of this as we would not be surprised to see rate cuts pushed into 2025 if the economy remains strong, but we at least appear to be approaching the long-awaited “pivot”.

Lastly, our call on the loonie for 2023 proved fairly spot on with the Canadian dollar enjoying one of its least volatile years on record, spending the entirety of the year between $0.72 and $0.76:

Major 2024 Themes

Let’s cover a few broad themes that will have a significant impact on the performance of stock and bond markets in 2024.

Rate cuts are coming. Our view is that the Bank of Canada is likely to act first, with cuts likely by the second quarter of 2024, with the U.S. Federal Reserve likely to begin easing policy by the fourth quarter of 2024. This view is predicated on Canada’s sensitivity to interest rates, which significantly exceeds that of the U.S. Let’s look at a chart and then comment:

Canada on most metrics has reached debt servicing levels (debt payments as a percentage of various metrics) that it has never been at before. Canadian’s have nearly twice the debt as a percentage of disposable income as do Americans, while debt servicing costs are ~50% higher with the gap continuing to widen. To put these gaps in perspective, coming out of the Global Financial Crisis, both countries looked similar on these and other metrics, but over the past 15-years, Canada saw a significant step up in private sector leverage, whereas the U.S. did not.

The U.S. is going to elect a President - at least we hope so. While it is hard to believe it has been 4-years since the last time we did this, the U.S presidential election cycle will kick-off in earnest (or something less than earnest) at the end of January with the first primaries. Joe Biden, who is currently older now than every other U.S. President that has served over the past 32-years, looks set to face off against Donald Trump, who was twice impeached, four times indicted and is himself older than every President but Joe Biden to serve over the past 32-years. That said - markets generally do not react all that differently to Presidential Election years:

Given the sharp divisions in the U.S. at present, we would not be surprised to see the election play some role in sentiment towards the markets. We would caution that while many would view a Donald Trump election as universally negative (and we would tend to agree on many fronts), we would note that equity markets might view such an outcome positively given his stance on regulation and taxes.

Given the sharp divisions in the U.S. at present, we would not be surprised to see the election play some role in sentiment towards the markets. We would caution that while many would view a Donald Trump election as universally negative (and we would tend to agree on many fronts), we would note that equity markets might view such an outcome positively given his stance on regulation and taxes.

AI Turns Two. 2023 was the year that Artificial Intelligence took hold of the markets. We spent some time discussing this back in October with our piece entitled Seven and the Ragged Tiger.

The emergence of AI helped to propel several large technology stocks to significant gains in 2023, which in turn helped to push the S&P 500 to a ~20% return. For most of the year, the “other” 493 stocks in the S&P 500 were flat to down on the year; although, a rally in November and the first part of December helped to lift most boats:

While 2023 saw strong returns for this AI-fueled group, most of the names are up only marginally or even negative since the end of 2021. How they fare in 2024 will likely be key to the overall performance of the U.S. market as growth has tended to lead the market for the better part of the past 15-years.

2024 Outlook

Given the title of this piece, you can probably predict where this might go. Here are our views on the economy and various assets for the coming year:

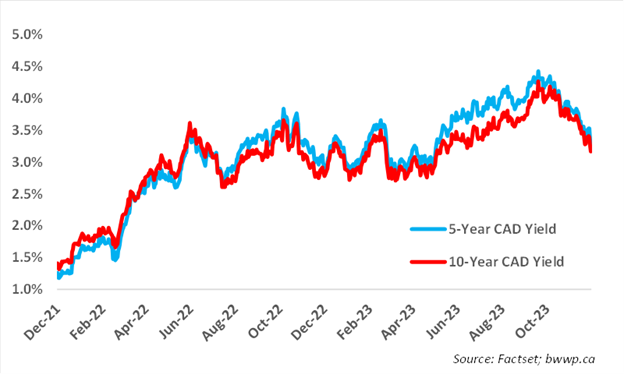

The Economy: The Canadian economy is currently in the midst of a major slowdown that could be termed a recession. The job market, while still growing, is not keeping pace with the influx of new workers and thus the unemployment rate has been on a steady rise since the early spring. In our view, this slowdown is likely to persist into the first half of 2024. However, the recent move lower in longer-term interest rates (see chart below) and the likelihood that the Bank of Canada is cutting shorter-term rates by the middle of 2024 should lift the Canadian economy in the second half of 2024 and into 2025.

As for the U.S. economy, it has managed to avoid recession propelled by massive government stimulus in 2021 and 2022 and a lower overall sensitivity to interest rates than most other global economies. That said – there is going to be a slowdown in 2024 as some of the stimulus rolls off and the cumulative effect of 500bps of tightening has some effect. The base case at this point is for a slowdown, not a recession (the proverbial soft landing), but recession risks remain.

As for the U.S. economy, it has managed to avoid recession propelled by massive government stimulus in 2021 and 2022 and a lower overall sensitivity to interest rates than most other global economies. That said – there is going to be a slowdown in 2024 as some of the stimulus rolls off and the cumulative effect of 500bps of tightening has some effect. The base case at this point is for a slowdown, not a recession (the proverbial soft landing), but recession risks remain.

Stocks: We have a more upbeat view on the Canadian stock market as we head into 2024; although, the strong performance over the last two months has dampened this enthusiasm to some degree. Just as the Canadian economy is sensitive to interest rates, so too is the Canadian stock market and the sharp rise in rates over the past ~2-years has weighed on a variety of sectors. With yields likely to continue their downward path in 2024, this should be supportive of the Canadian market, especially given valuations that are broadly below historic averages. High single digit returns should be achievable with perhaps more if the economy recovers faster than we suspect.

As for the U.S. market, we think broader averages may struggle given the strong returns in 2023 and the “stealing from the future” that likely took place. Beneath the hood – the average U.S. stock, which more closely resembles Canadian stocks – should enjoy similar returns to Canada in our view.

Bonds: 2024 should help bonds get out of their 3-year funk. Bond prices move inversely to interest rates and with rates likely to decline in our view, bonds should enjoy a good year. With yields now in the 4.5% to 5% for most investment grade credits, we continue to see a good opportunity set here.

Private Credit: Over the past year+, we have pivoted fairly aggressively to private credit in our discretionary client portfolios. This view was predicated on the sharp rise in short-term interest rates (most private loans are floating based off short-term rates) and the troubles in the U.S. regional banking space. The latter group were big lenders to private businesses, but because of the troubles in the banking space, which was unrelated to private loans, most regional banks have been forced to exit the lending. This has further enhanced the opportunity in private credit and thus our view remains constructive.

The Canadian dollar: Our call for 2024 is similar to 2023 with a slightly more favorable bias by year-end 2024. The loonie is still likely to be range bound between $0.70 and $0.78, but unlike last year, where we had a bias toward the low end of the range, we now have a bias toward the higher end. This is primarily based on a still strong commodity market and the fact that the Canadian dollar has not reflected this strength over the past 2+ years because of other factors. With interest rate relief on the horizon, one of the big negative factors that has weighed on the Canadian economy and in turn the loonie, pressure on the dollar should ease.

Final Thoughts

We see 2024 as a year that will be full of challenges, but also full of opportunities. With a U.S. Presidential Election on the horizon, much will be written, and the television pundits will be in high gear with statements and headlines designed to stoke fear and in some cases panic. While we acknowledge it is hard to completely ignore these things, we often point out that most of these things have little impact on corporate earnings (the single biggest driver of stocks) and the stock market.