This week, as we do every year, we celebrate the birthday of Harrison Ruffin Tyler. For those not familiar with Mr. Tyler, he was a very successful businessman and preservationist, who has restored the Sherwood Forest Plantation on the shores of the St. James River in South Carolina. The Plantation has the distinction of being the only property in the United States that was home to two different and unrelated U.S. Presidents. Harrison, who turned 95 this week, was born in 1928.

Harrison’s father was Lyon Gardiner Tyler, who was (among other things), President of the College of William & Mary and quite an, umm, virile man (he was also not a good guy, so we do not in any way celebrate his life). He was, in fact, so, errr, prolific that his youngest son (the aforementioned Harrison) was born when Lyon had reached the age of 75. In case you are not good at math, Lyon was born in 1853.

Lyon’s father John Tyler was also quite accomplished and, you guessed it, virile (also not a good guy, in fact, a very bad guy, so we most certainly do not celebrate his birthday). John Tyler served first as Governor of Virginia and then as a U.S. Senator. Tyler’s next job, however, famously lasted only 32 days. On March 4th, 1841, William Henry Harrison took the oath of office and was inaugurated as the ninth President of the United States. Despite a very cold and wet day in Washington, the “hero of Tippecanoe” as Harrison was known, opted for no overcoat as he rode triumphantly down the streets of D.C. on horseback. Not a fit man to begin with, Harrison died on April 5th, 1841, from pneumonia, which was blamed on his inauguration day stunt - and his Vice-President – John Tyler - was sworn in as the tenth President of the United States.

Now, back to President Tyler’s virility. He was born in 1790, making him 51 when he assumed the Presidency and 63 when the last of his 15 (we didn’t make that up) children – the aforementioned Lyon Gardiner Tyler - was born.

So, in case you missed the path we were weaving above – there is a man alive today – Harrison Ruffin Tyler – whose grandfather - John Tyler - was not only President of the United States but was also born in the year 1790. To put 1790 in perspective – Napoleon was not yet 22, Queen Victoria would not be born for another 30-years, Joe Biden was only 4-years old, and George Washington had been President for less than a year.

While we have no evidence to back this up, we do wonder whether Harrison Ruffin Tyler is the only living person with a grandfather born as early as 1790. Someone alive today with a grandfather born in 1800 would be 100 years old if the combined age of their father and grandfather were 123 – which would make them each an average age of 61.5 years old – a not common occurrence today, but even less so looking back to the 1800’s. 1790 would put their average age at 66.5, which would probably winnow the field down to a handful of folks, or, perhaps, to just HRT. So, today, we celebrate the birthday of Harrison Ruffin Tyler (by all reports, a good guy, who is worth celebrating), still going strong at 95 - the grandson of a U.S. President born in the year 1790.

Speaking of 1790

Speaking of 1790 (you see what we did there?), it also happened to be the year that the first public trading of securities occurred – in this case U.S. War Bonds, which were issued to settle all debts related to the Revolutionary War (we have no evidence that John Tyler’s parents purchased their newborn son, future President, and future all around bad guy any of these war bonds, but we’d like to think they did). Anyway, aside from that fun factoid, we are going to pivot from this now tortured segue and get to some charts that explore some of the challenges Canada faces:

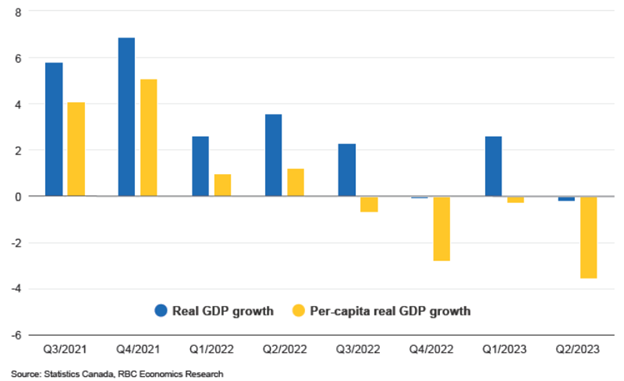

Here, we are looking at real GDP growth for Canada over the past 8-quarters (the blue bars), as well as real GDP growth on a per capita (per person) basis. As you can see, real GDP growth has been negative in two of the past three quarters (it got a lift in Q1 from the sharp run-up in energy prices), which fits our general narrative that the Canadian economy may already be experiencing a recession.

We would also point to the sharp downturn over the past four-quarters in per capita GDP growth, which adjusts the changes in GDP for the growth in the Canadian population. RBC Economics estimates that Canada’s population has risen by ~1.2 million over the past year, which creates a glass half full/half empty narrative as it relates to the economy. On the one hand, Canada’s economy would not be growing at all without such robust population growth (each of these 1.2 million new Canadians is spending money and thus contributing to GDP); however, the country overall continues to tread a downward path as it relates to productivity. Let’s follow this up with another chart that looks at employment:

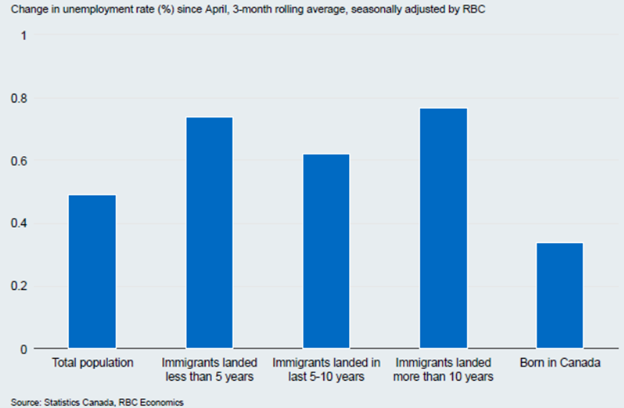

As you can see, Canada’s unemployment rate has been on the rise over the past six-months. However, this rise has been more acute for new Canadians vs. those born in Canada. So, while Canada desperately needs this population infusion to keep GDP growth positive, it is struggling to create enough jobs to absorb the growth in population.

Okay, let’s pivot again (with the passing of the great and tragic Matthew Perry this past month, we would note that when we use “pivot”, we are always reminded of Ross, Rachel and Chandler moving that couch) and look at the U.S. employment and productivity pictures:

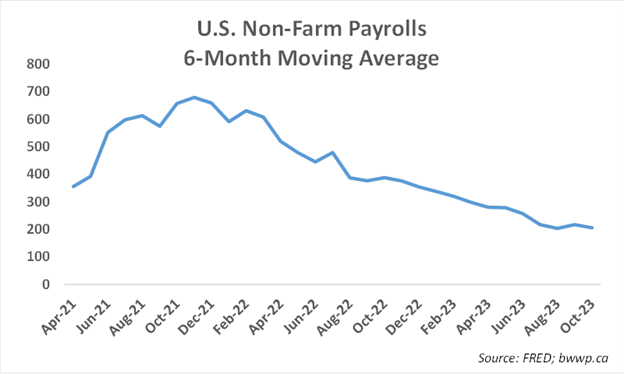

We are now looking at the U.S. jobs picture with a steady decline in monthly payrolls over the past two years. This paints a picture of a job’s market that has slowed significantly; however, with jobs still averaging ~200k/month, the U.S. jobs picture still looks reasonably healthy (an average of ~125k would be enough to offset the growth in the labor force, while anything less than that would suggest the U.S. was not creating enough jobs to meet labor force growth). Let’s add another chart, which provides a bit more color:

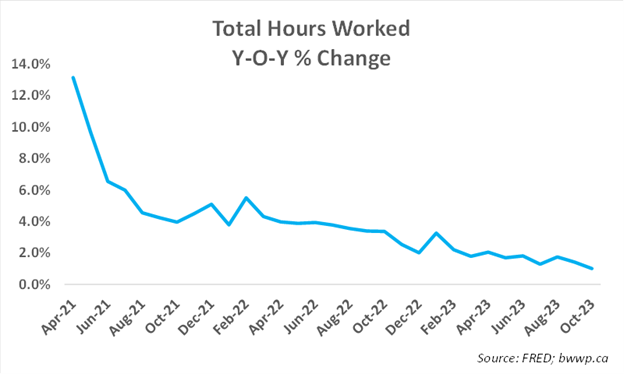

While job creation has still been okay, we would note that the average work week has been in decline. When the two metrics are combined together, we get a slightly different picture – the U.S. work force is working ~1% more hours year-over-year, which when adjusted for population growth, would suggest general stagnation in the labor force. Okay, let’s look at one more labor-related chart:

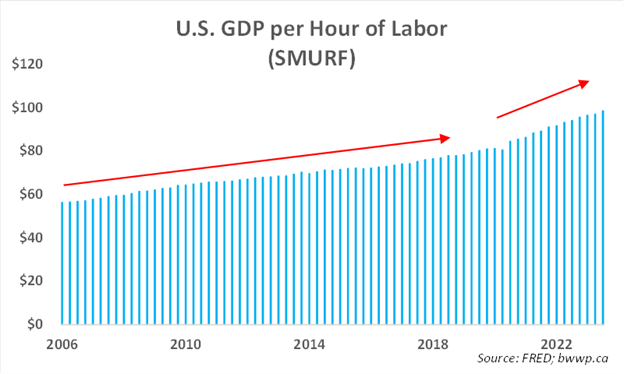

Here, we have combined some things to create a new metric we call “GDP per Hour of Labor”. Since we lack a good acronym for this and since our go-to chart color is light blue, we will simply call it “SMURF”. SMURF takes nominal GDP and divides it by the total annual hours worked by the labor force. As you can see, U.S. SMURF rose gradually from 2006 through the COVID lockdowns, but SMURF has since inflected onto an even steeper upward trajectory. This is the result in part of the pick-up in inflation, as nominal GDP has gotten a big lift from inflation in the past ~2-years. However, it also speaks to the increasingly greater productivity the U.S. is able to get out of its labor force. Let’s compare Canada and U.S. SMURF:

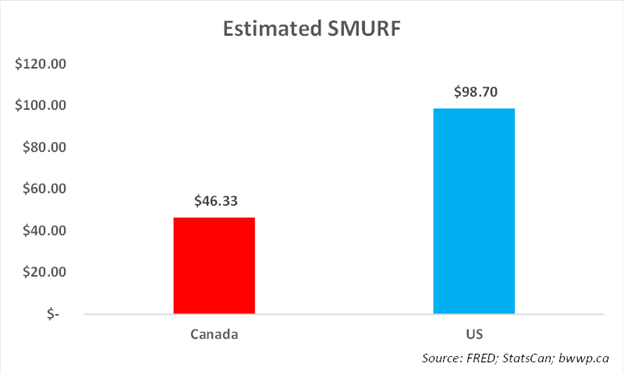

As you can see, Canada is getting less than half the output per hour as that of the U.S. This is supported by a more simplistic measure – GDP per person – which is ~$45k per Canadian resident and ~$81k per U.S. resident.

Bottom Line

We don’t really have one other than stuff that we have harped on for years (back when I was Chief Canadian Equity Strategist for RBC CM, I wrote a detailed piece on the subject that we would be happy to share) – Canada needs to take steps to improve the productivity of its economy. For years, low interest rates helped to mask the inherent problems in the Canadian economy – too many regulations and wrong-headed economic policies have stifled innovation, which has weighed greatly on productivity. Now, with rates up sharply and Canadians no longer able to “borrow to grow”, a new plan needs to be put in place to attract capital to this country and to boost growth beyond simply growing the population. We don’t have a tremendous amount of faith that this is going to happen, but we remain forever hopeful.