Challenge Convention

It’s been said that everyone is entitled to their own opinions. Everyone is not, however, entitled to their own facts. In the financial services space, there is an abundance of “expert” opinions, and those opinions are often used to shape investment decisions. We take a more calculated approach by dismissing unfounded opinions, and relying instead on defensible evidence (facts). With that in mind, we frequently make use of the following resources to help clients better understand our position on various wealth management strategies.

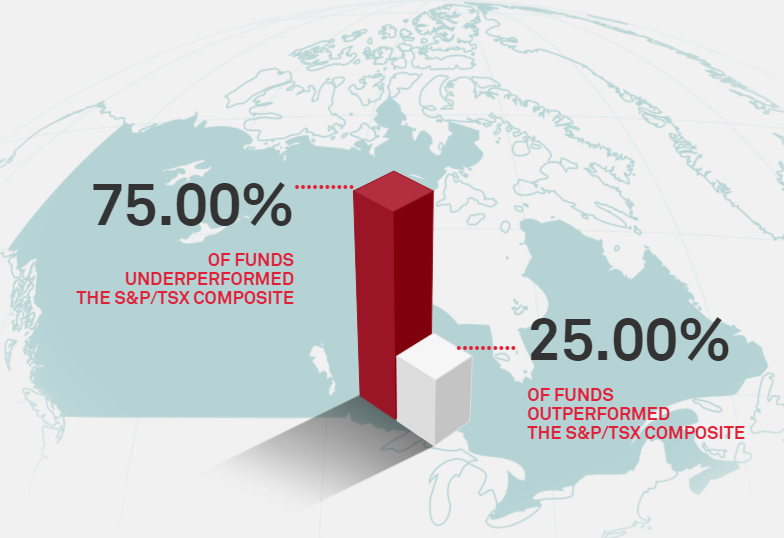

| The SPIVA Scorecard: Each year S&P Dow Jones Indices publishes a series of reports that compare the performance of actively-managed mutual funds to their corresponding benchmark(s). The reports are divided by geography and provide a fair, apples-to-apples, assessment by accounting for the impact of mutual fund management fees and correcting for survivorship bias. The most recent SPIVA US scorecard shows that 84.23% of U.S. actively-managed equity mutual funds have underperformed the S&P 500 index over the past five years, as of June 30, 2017. Similarly, the most recent SPIVA Canada scorecard shows that 75.00% of actively-managed Canadian equity mutual funds have underperformed the S&P / TSX Composite index, as of June 30, 2017. The SPIVA scorecard from other regions around the world (Europe, Australia, Brazil, etc.) also show underperformance for actively-managed equity funds. (Source: S&P Dow Jones Indices, SPIVA Canada Scorecard) |

The Mutual Fund Landscape:

Building on the SPIVA study, Dimensional Fund Advisors publishes an annual report titled, "The Mutual Fund Landscape". This report is based on analysis of Morningstar data, and documents the power of market prices by assessing fund manager performance relative to index benchmarks. Again, the evidence shows that the majority of fund managers in the sample failed to deliver benchmark-beating returns after costs. Going one step further, the report also highlights that past performance is not a likely predictor of future performance: the majority of top performing mutual funds historically, have failed to continue to outperform in time periods subsequent to a period of outperformance. We believe that the results of this research provide a strong case for relying on market prices.

To read the full report, please click here.