- An as expected 0.25% interest rate cut from the Federal Reserve prompted a reaction from markets that was anything but normal.

- Forecasts for stronger growth and inflation and less rate cuts in 2025 prompted a sharp selloff in stocks of all stripes.

- Markets have had a strong run so an uptick in volatility upon any disappointing news was bound to happen at some point.

- We will take higher interest rates and higher growth over zero interest rates and a recession any day.

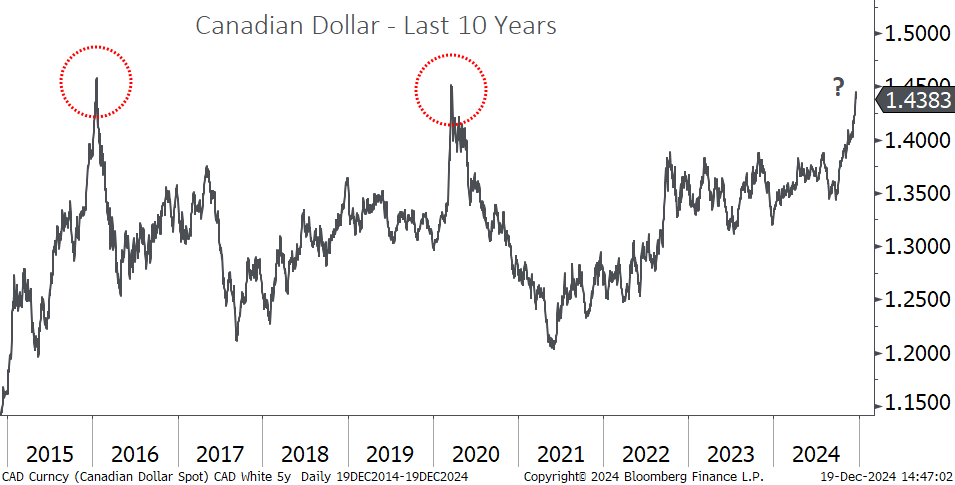

- The stronger U.S. dollar and chaos in Ottawa saw another leg lower for the Canadian dollar.

- While U.S. dollar valuations are reaching extremes, risks continue to accumulate for Canada and we would be reluctant to part with what has been a valuable portfolio hedge.

The December Federal Open Market Committee meeting was highly anticipated by investors, but this wasn’t unusual. Since the COVID crisis we have been told by the media that the next Fed meeting was “the most important in a decade” more times than we care to count. Now and then, however, the hyperbole is (somewhat) justified.

Rate cut came as expected…

To the casual observer, the Fed delivered what was expected in the form of a 0.25% interest rate cut. So far, so good, right? Not so fast. At this meeting the Federal Reserve also released their economic forecasts, and this is where the problems began. The Fed forecasted stronger employment and much higher inflation than markets had been expecting. As such, their estimate of how many rate cuts they expect in 2025 was halved to two 0.25% cuts from four. The fact that this is what markets were already pricing in made little difference. Hearing it from the horse’s mouth, as it were, had a sharp impact on markets, with bond yields up sharply (driving prices down) and stock prices of nearly all stripes sharply lower.

.. but the reaction from markets was anything but

Given how strong markets had been coming out of the U.S. election, disappointment when it comes to the trajectory of interest rates was hard for markets to swallow, but we can’t lose sight of the bigger picture here. This is yet another market decline that has been driven by higher growth expectations, not lower. For the past two years the U.S. economy has surprised to the upside and it has led to episodes much like this, as markets tend to believe the more rate cuts the better. In our view this falls into “be careful what you wish for” territory, as significant interest rate cuts are nearly always associated with economic recessions and the significant stock market corrections that come along with it. We have said it before and we will say it again - we would rather have less rate cuts and healthy economic growth than zero interest rates and a recession. We are more than willing to endure bumps in the road due to a less accommodative Fed policy if the tradeoff is stronger growth.

Markets not in a correction yet, but one will come sooner or later

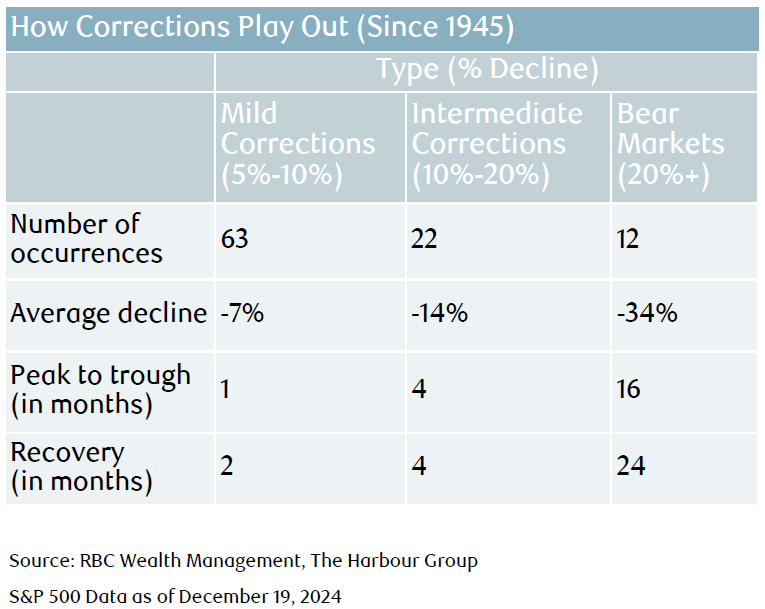

As of this writing, the S&P 500 and the TSX have yet to breach the 5% drop that typically signifies a mild market correction. As seen below, we should expect this to happen sooner or later, as market corrections are part and parcel of a normal market cycle. One thing we have noticed is that when corrections do come around nowadays, the velocity is often much higher, which we attribute to the increasing automation of stock trading and the large amount of money that is dedicated to short-term trading strategies. With expectations for U.S. economic growth increasing, recession risks are going down, which should actually reduce the chances of a correction morphing into something meaningfully worse. This is especially true now that central banks have ample ammunition to cut interest rates should economic growth disappoint, something that was not true for most of the 2008-2021 period.

Cabinet chaos further erodes confidence in the Canadian dollar

We wrote about the Canadian dollar last week, but in that short time things have continued to progress, with the U.S. dollar now changing hands above $1.43 Canadian dollars. The chaos in Ottawa started the loonie off on the back foot and the broad USD strength that resulted from this week’s Fed meeting only piled more wood on the fire. When we look at the Canadian dollar chart it looks an awful lot like the past to times that we saw the USD peak versus the Canadian dollar, in that chart has gone essentially vertical and we are rapidly approaching the previous two peaks in the 1.45 range. As we discussed last week, a near-record number of speculators are betting against the loonie, so at this point any news that is simply “less bad” than feared could spark a short-term rally. With all that said, there is a good reason the Canadian dollar is trading where it is, from lower interest rates in Canada to very valid trade concerns, so we are still inclined to hold onto U.S. dollars.

What is “fair value” and how often is it realized?

When we think about long-term fair value for the Canadian dollar, purchasing power parity (“PPP”) is the metric most often quoted in the economics community. If you have ever heard of the Economist’s “Big Mac Index”, which ranks currency value on what the famous hamburger costs in different countries, you have a basic understanding of the concept! Below we have a chart of an estimate of PPP using producer prices in blue, and the USD-CAD exchange rate in white. At the bottom is the differential between the two. As seen below, the estimate for fair value for the Canadian dollar is approximately $1.20 to buy a U.S. dollar. A word of caution here though - PPP is more of a weigh station on the way to over or under-valuation, i.e. you don’t often see a currency trading at “fair value” for long periods of time. We will note, however that todays’ deviation from fair value is among the largest in 30 years. Does this mean we should be aggressively buying the Canadian dollar? In a word, no. Periods of under and over-valuation can go on for many years, and as the old economists’ quote goes, “the market can remain irrational longer than you can remain solvent”.

Bottom Line

What has been a relatively smooth ride for investors in 2024 hit a speed bump this week, sending a stark reminder that enduring periods of volatility is the price we pay to earn the superior returns provided by equities over the long term. It is important to distinguish between what is happening now and the recession fears that typically prompt market weakness. As it stands today, U.S. recession looks less likely as opposed to more.

Come January 20, 2025 we can expect a steady cadence of announcements from the new White House team. Some of these will likely please markets, but some may not. While we typically avoid thinking about politics when crafting investment strategy, the possibility of significant changes to global trade policies has grabbed our attention. This has been one of the main drivers of Canadian dollar weakness, and this is why we remain reluctant to part ways with U.S. dollars and their strong portfolio hedging properties.

The Harbour Group

416-842-2300

Putting you first, every time, to help you navigate the complexities of managing your wealth. All of our team members, all of our resources, all of our collective insight: ALL FOR ONE: YOU™.

The information contained herein has been obtained from sources believed to be reliable at the time obtained but neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers can guarantee its accuracy or completeness. This report is not and under no circumstances is to be construed as an offer to sell or the solicitation of an offer to buy any securities. This report is furnished on the basis and understanding that neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers is to be under any responsibility or liability whatsoever in respect thereof. The inventories of RBC Dominion Securities Inc. may from time to time include securities mentioned herein. RBC Dominion Securities Inc. and its affiliates may have an investment banking or other relationship with some or all of the issuers mentioned herein and may trade in any of the securities mentioned herein either for their own account or the accounts of their customers. RBC Dominion Securities Inc. and its affiliates also may issue options on securities mentioned herein and may trade in options issued by others. Accordingly, RBC Dominion Securities Inc. or its affiliates may at any time have a long or short position in any such security or option thereon. Mutual funds are sold by RBC Dominion Securities Inc. There may be commissions, trailing commissions, management fees and expenses associated with mutual fund investments. Read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. RBC Dominion Securities Inc.* and Royal Bank of Canada are separate corporate entities which are affiliated. *Member CIPF. ®Registered Trademark of Royal Bank of Canada. Used under licence. RBC Dominion Securities is a registered trademark of Royal Bank of Canada. Used under licence. ©Copyright 2019. All rights reserved.