- It has been a challenging year for the Canadian dollar, which has fallen nearly 7% so far this year.

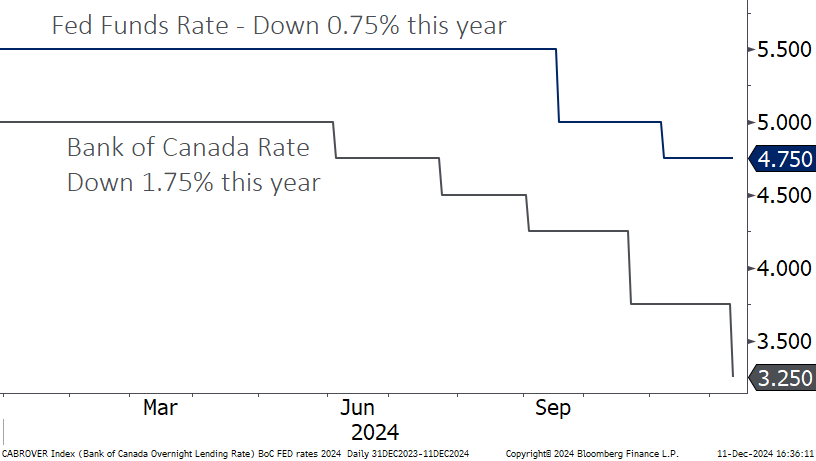

- A quicker pace of rate cuts in Canada compared to the U.S. has dampened global appetite for the loonie.

- Tariff threats post-election turbocharged the weaker Canadian dollar, taking it to post-COVID lows.

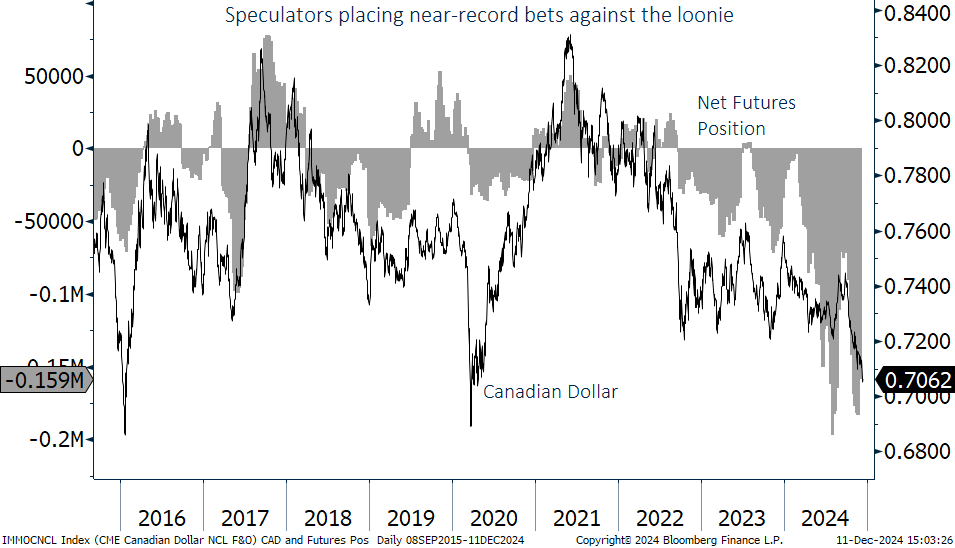

- The silver lining here is that investors are already betting heavily against the loonie, suggesting some near-term reprieve.

- As we look to 2025, however, we think the benefits of holding U.S. dollars should tariffs come or markets correct outweigh the potential for a Canadian dollar recovery should our economy surprise to the upside.

The last Canadian dollar bill rolled off the presses on April 20, 1989 to make way for the one dollar coin, which came into circulation nearly two years earlier on June 30, 1987. We all know the $1 coin is called the loonie because of the aquatic bird printed on it, but did you know that if not for a shipping snafu, the loonie would never have been? After nearly a decade of planning and consultation, the original plan had been to debut a dollar coin similar to the “voyageur” silver dollar from the 1930s (seen below).

The loonie was not the Royal Canadian Mint’s first choice…

With the master dies produced, everything was set to go, but these dies were lost during transit from the Royal Canadian Mint’s facility in Ottawa to Winnipeg, where the coins were to be produced. After a quick search for a new design the loon was authorized, resulting in the dollar coin we are all familiar with. That wasn’t it for the voyageur though - it made a brief appearance as a special edition coin on the 30th anniversary of the loonie’s introduction in 2017.

… and it hasn’t been the choice of investors in 2024 either

Who knows what kind of metaphors we would be using today had the Voyageur coin been introduced as intended? Instead of the broken wing referenced in the title here, perhaps a cracked canoe or broken paddle? The possibilities are endless, but the result today is the same – the Canadian dollar is under significant pressure, and unlike previous periods of weakness, we are not in the midst of an oil crash or stressed financial markets. It is all about interest rates. All else equal, currency investors go where they can earn a higher rate of interest on their deposit, and while the U.S. has had an advantage on this front since 2022, it widened materially this year. After the Bank of Canada’s 0.5% rate cut this week the USD now yields 1.5% more than the Canadian dollar, though this is expected to narrow a bit should the Federal Reserve cut its interest rate by 0.25% next week as widely expected.

Speculators leaning hard on the Canadian dollar, a potential source of future strength

As the Canadian economy has underperformed the U.S. we have seen speculators increasingly betting against the Canadian dollar in the futures market on the expectation of accelerated rate cuts from the Bank of Canada, which have indeed materialized. The silver lining here is that current positioning is about as extreme as it gets, i.e. we are running out of sellers. In the short term, we have often seen the loonie bounce higher as selling is exhausted and these speculators all try to take profit on their short positions at the same time, driving up the currency in the process.

Longer term, tariffs loom

Make no mistake, we think these speculators were leaning against the Canadian dollar for good reason – as mentioned above, our economy has been weaker and interest rates were always likely to come down faster here. But all of these reasons have been trumped (pardon the pun) by the looming threat of U.S. tariffs under the new administration, and unfortunately those threats came fast and furious following election day. All else equal, a weaker currency is required to keep exports competitive if tariffs do end up getting levied, and currency traders have been pricing that in. On the other hand, should Canada be able to negotiate away this risk or sharply diminish what ends up getting implemented, we may see loonie’s broken wing start to mend.

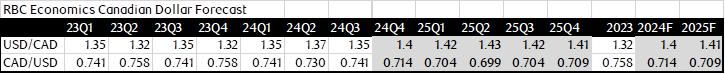

RBC forecasts relative stability from here

We will preface these comments with the fact that currency forecasts are anywhere and always subject to revision. With that said, RBC’s forecasts for the Canadian dollar show relative stability near today’s levels through 2025, but this is subject to change for the worse should tariff threats turn into reality. If our economic growth surprises to the upside and the Bank of Canada finds itself curtailing its rate cutting campaign, we would expect to see a retracement of some of 2024’s losses.

Hang on to your hedges

One of our key themes for 2024 has been to maintain U.S. dollar exposure and consider adding on any weakness, and that hasn’t changed. In a year that has been relatively void of equity market volatility the hedging capability of the U.S. dollar for Canadian investors (it tends to go up when everything else is going down) hasn’t been tested but holding the greenback has been a benefit nonetheless. We know that at some point volatility will return, and we wouldn’t be surprised if U.S. trade policy proves to be a trigger. In that scenario, we think we would be doubly glad to hold U.S. dollars, we believe the downside to the loonie in that scenario is much greater than any upside we may see if the Canadian economy improves.

The Harbour Group

416-842-2300

Putting you first, every time, to help you navigate the complexities of managing your wealth. All of our team members, all of our resources, all of our collective insight: ALL FOR ONE: YOU™.

Please note: This article may contain strategies, not all of which will apply to your particular financial circumstances. The information in this article is not intended to provide legal, tax or insurance advice. To ensure that your own circumstances have been properly considered and that action is taken based on the latest information available, you should obtain professional advice from a qualified tax, legal and/or insurance advisor before acting on any of the information in this article. This document has been prepared for use by the RBC Wealth Management member companies, RBC Dominion Securities Inc. (RBC DS)*, RBC Phillips, Hager & North Investment Counsel Inc. (RBC PH&N IC), RBC Global Asset Management Inc. (RBC GAM), Royal Trust Corporation of Canada and The Royal Trust Company (collectively, the “Companies”) and their af liates, RBC Direct Investing Inc. (RBC DI) *, RBC Wealth Management Financial Services Inc. (RBC WMFS) and Royal Mutual Funds Inc. (RMFI). *Member-Canadian Investor Protection Fund. Each of the Companies, their af liates and the Royal Bank of Canada are separate corporate entities which are af liated. “RBC advisor” refers to Private Bankers who are employees of Royal Bank of Canada and mutual fund representatives of RMFI, Investment Counsellors who are employees of RBC PH&N IC, Senior Trust Advisors and Trust Of cers who are employees of The Royal Trust Company or Royal Trust Corporation of Canada, or Investment Advisors who are employees of RBC DS. In Quebec, nancial planning services are provided by RMFI or RBC WMFS and each is licensed as a nancial services rm in that province. In the rest of Canada, nancial planning services are available through RMFI, Royal Trust Corporation of Canada, The Royal Trust Company, or RBC DS. Estate and trust services are provided by Royal Trust Corporation of Canada and The Royal Trust Company. If speci c products or services are not offered by one of the Companies or RMFI, clients may request a referral to another RBC partner. Insurance products are offered through RBC Wealth Management Financial Services Inc., a subsidiary of RBC Dominion Securities Inc. When providing life insurance products in all provinces except Quebec, Investment Advisors are acting as Insurance Representatives of RBC Wealth Management Financial Services Inc. In Quebec, Investment Advisors are acting as Financial Security Advisors of RBC Wealth Management Financial Services Inc. RBC Wealth Management Financial Services Inc. is licensed as a nancial services rm in the province of Quebec. The strategies, advice and technical content in this publication are provided for the general guidance and bene t of our clients, based on information believed to be accurate and complete, but we cannot guarantee its accuracy or completeness. This publication is not intended as nor does it constitute tax or legal advice. Readers should consult a quali ed legal, tax or other professional advisor when planning to implement a strategy. This will ensure that their individual circumstances have been considered properly and that action is taken on the latest available information. Interest rates, market conditions, tax rules, and other investment factors are subject to change. This information is not investment advice and should only be used in conjunction with a discussion with your RBC advisor. None of the Companies, RMFI, RBC WMFS, RBC DI, Royal Bank of Canada or any of its af liates or any other person accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or the information contained herein. ®/TM Registered trademarks of Royal Bank of Canada. Used under licence. © 2024 Royal Bank of Canada. All rights reserved. NAV0281