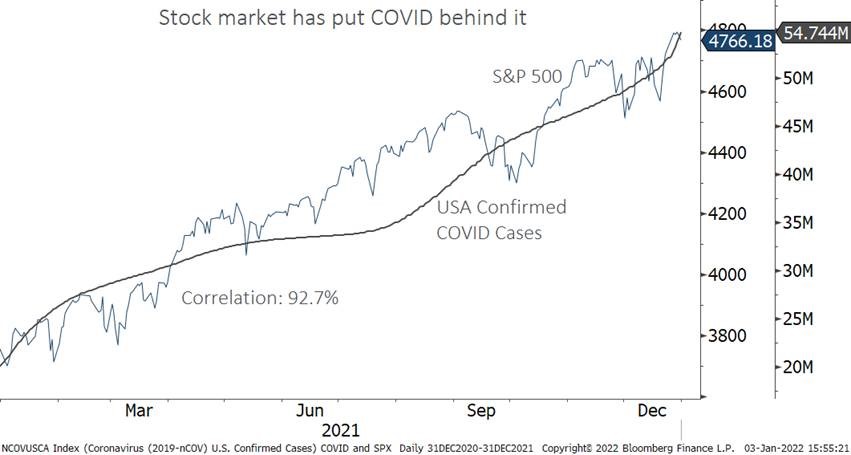

- Equity markets have largely ignored COVID developments of late.

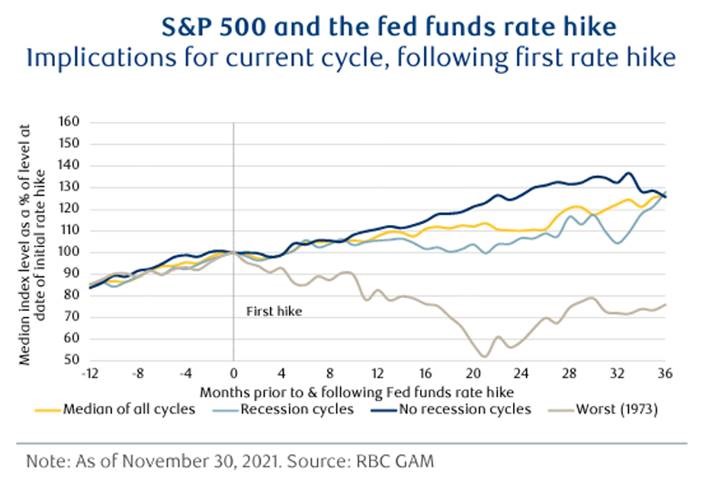

- Central banks are another matter – the volatility seen in November was just as much about the Fed as it was Omicron.

- Rate hikes are widely expected from the Federal Reserve and the Bank of Canada this year.

- While these events may spark short term volatility, performance tends to be healthy into and out of the first hike.

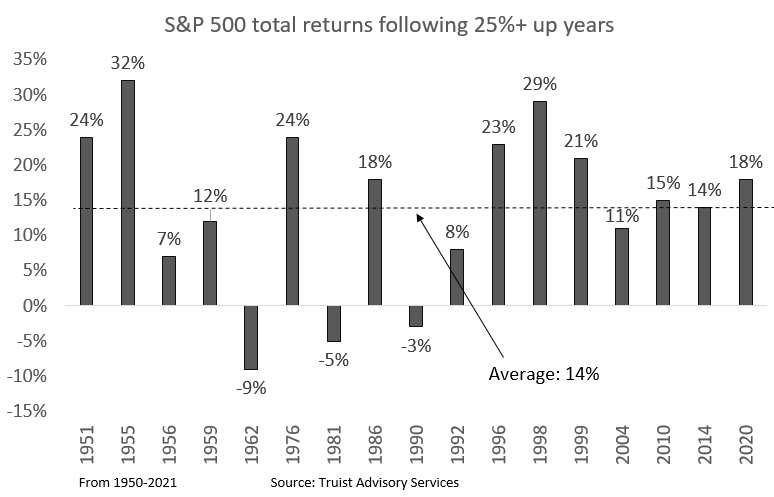

- After a year of strong returns, many investors fear the best days have passed.

- Historically these high return years are followed by healthy gains when the economy is growing.

Stock market has COVID in the rear view mirror…

If we had to go back and think of 2021 predictions, we are pretty sure none of them said that the amount of confirmed COVID cases in the U.S. would more than double and stocks would put up strong returns – at least not both in the same prediction! That is what happened as the stock market, forward looking as ever, seems to have put the COVID-19 crisis behind it and is forecasting better days ahead. While the initial reports of the Omicron variant (coupled with talk of higher interest rates from the Federal Reserve) triggered some volatility in November, the S&P 500 ended the year just off of its record high. This performance largely stems from the view that another round of lockdowns is highly unlikely in the United States, and were it to come to that, we think these lines would start to diverge.

…with the Fed rapidly approaching

Just as soon as markets stopped worrying about COVID, they have begun to worry about interest rate increases from the Federal Reserve. The don’t call it a wall of worry for nothing! The good news is that central banks typically engage in rate hiking cycles when the economy is strong and in a position to handle a reduction in stimulus. Historically, stocks have performed well in the months leading into the first rate hike and for the year after, even if the tightening cycle leads to a recession. That is not to say that a change in monetary policy will not be accompanied by volatility – it almost certainly will, but so long as economic growth continues markets are likely to weather this shift in good shape.

Time to lock in gains after a good year?

Human nature being what it is, many investors have an instinctual impulse to take money off the table after a string of healthy returns, such as those delivered in 2021. We completely understand this urge, but the empirical data suggests holding tight is the more profitable strategy. In years following 25% total returns for the S&P 500, the index was up 14% on average the following year, with only three losing years, two of which were accompanied by our old nemesis, economic recessions. In the event the economy continues to grow (the overwhelming view for 2022) investors are typically better off sitting tight.

Bottom Line

With a high likelihood of higher interest rates this year, central banks are topping a lot of investors’ worry lists. The funny thing is, it is rarely the thing most people are worried about which cause the biggest problems. It is almost always the event that nobody saw coming that provides the biggest jolt to markets. Unpredictability is part and parcel of equity investing, and it is that higher level of volatility that allows us to earn higher returns. We often call living through corrections the “price of admission” for earning the historically superior return from equities versus bonds or cash. While there are some rare years where the admission is waived and stocks take a steady ascent, we go into each year assuming that is not going to happen. We think the combination of expected strong economic and earnings growth, valuations that were tamed in 2021 and historical trading patterns around Fed rate increases all bode well for 2022, but we know that it is how we react to the unexpected which will determine our success as investors.

The Harbour Group

416-842-2300

Putting you first, every time, to help you navigate the complexities of managing your wealth. All of our team members, all of our resources, all of our collective insight: ALL FOR ONE: YOU™.

The information contained herein has been obtained from sources believed to be reliable at the time obtained but neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers can guarantee its accuracy or completeness. This report is not and under no circumstances is to be construed as an offer to sell or the solicitation of an offer to buy any securities. This report is furnished on the basis and understanding that neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers is to be under any responsibility or liability whatsoever in respect thereof. The inventories of RBC Dominion Securities Inc. may from time to time include securities mentioned herein. RBC Dominion Securities Inc. and its affiliates may have an investment banking or other relationship with some or all of the issuers mentioned herein and may trade in any of the securities mentioned herein either for their own account or the accounts of their customers. RBC Dominion Securities Inc. and its affiliates also may issue options on securities mentioned herein and may trade in options issued by others. Accordingly, RBC Dominion Securities Inc. or its affiliates may at any time have a long or short position in any such security or option thereon. Mutual funds are sold by RBC Dominion Securities Inc. There may be commissions, trailing commissions, management fees and expenses associated with mutual fund investments. Read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. RBC Dominion Securities Inc.* and Royal Bank of Canada are separate corporate entities which are affiliated. *Member CIPF. ®Registered Trademark of Royal Bank of Canada. Used under licence. RBC Dominion Securities is a registered trademark of Royal Bank of Canada. Used under licence. ©Copyright 2019. All rights reserved.