- After months of cooling, Canadian inflation ticked higher once again in May.

- The Bank of Canada remains sensitive to inflation, leading markets to push out the timing of the next interest rate cut.

- While disappointing to those looking for interest rate relief, it should provide savers with one last opportunity to lock in today’s higher yields.

- As the next expected Bank of Canada interest rate cut aligns more closely with what is expected of the Federal Reserve, the Canadian dollar may see a reprieve.

- Investors are betting against the Canadian dollar in near record numbers, making us wonder who is left to sell in the short term.

- This does not change our long-held positive view on the U.S. dollar, and we would be buyers on any weakness.

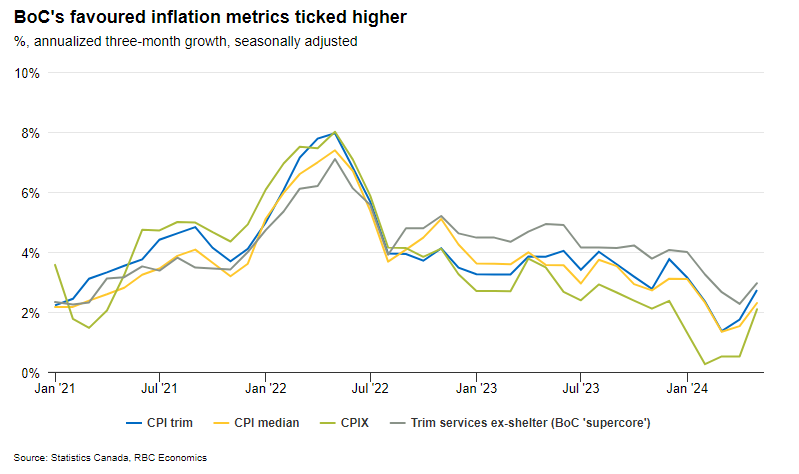

The first Bank of Canada interest rate cut this cycle was met with much fanfare earlier in the month, and the Bank’s commentary suggested more cuts could be on the way if inflation kept easing. We received Statcan’s latest inflation update this week, and it was not what the Bank of Canada was looking for. Headline inflation jumped to 2.9% year over year, while a deceleration to 2.6% was expected. The Bank of Canada’s preferred “core” inflation measures which strip out the most volatile components (see below) also ticked higher.

Next rate cut has been pushed out…

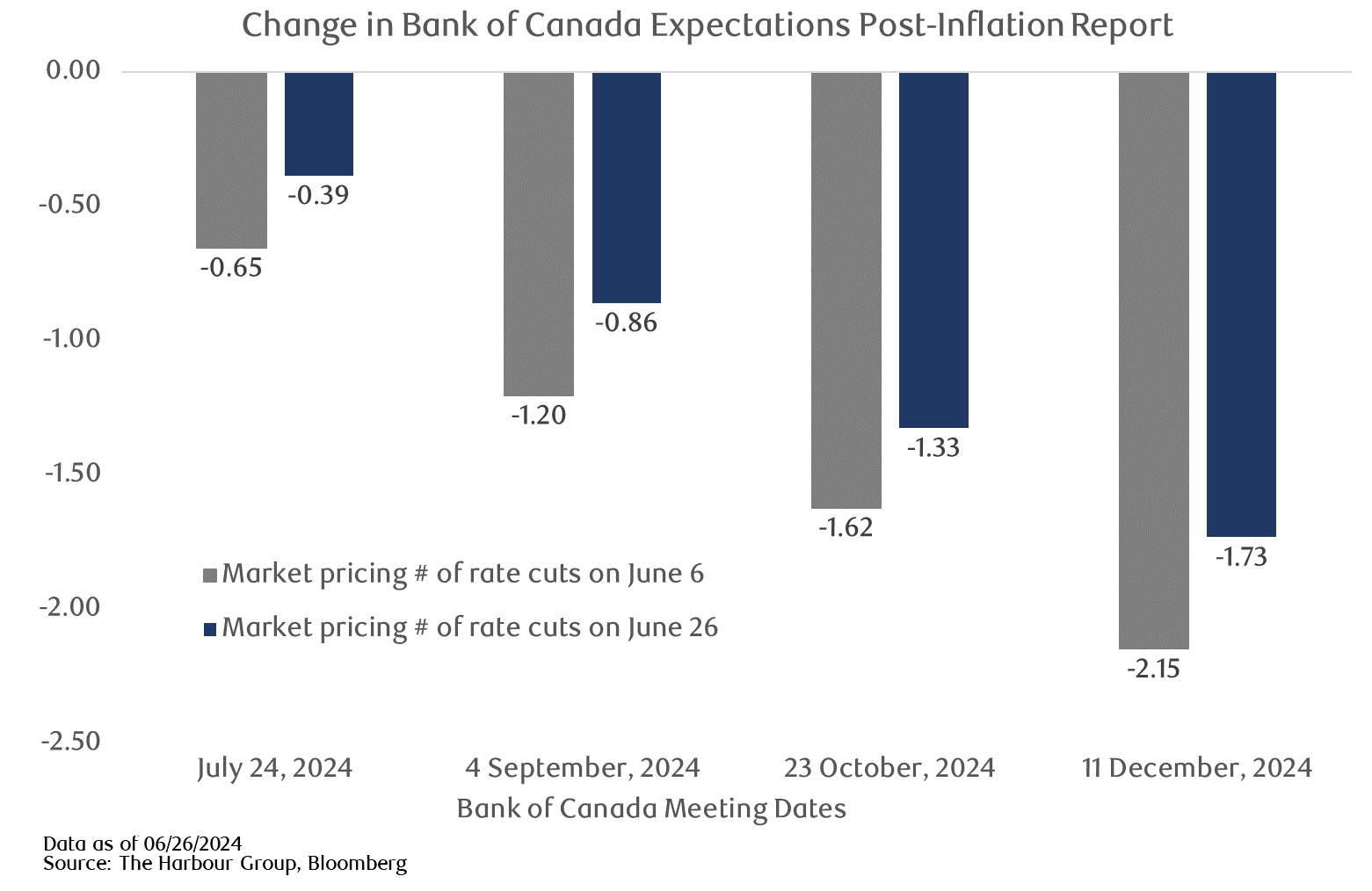

With further rate relief from the Bank of Canada contingent on lower inflation, it is no surprise that markets reacted to the hotter than expected report. The day after the Bank of Canada cut rates, markets saw better than 50/50 odds that we would see another cut in July. A full cut was expected by September, and a third cut of the cycle by year end. We now don’t have a full cut priced in until October, with the third cut of the cycle not expected until 2025.

…extending the opportunity to lock in today’s bond yields

The net/net of this for investors is that bond yields have trended higher in recent weeks, up nicely off their lows. After a prolonged period of high yields, investors often get caught in the “cash trap”. They are reluctant to lock in their investments for even a year or two because cash has treated them so well. Don’t get caught! Every rate cutting cycle sees investors yearning for the yields available a few months prior, and by then it is too late. The time to lock in higher yields is today, and the market has given us a bit of a gift in that we have reversed a good amount of the drop in bond yields seen ahead of the Bank of Canada rate cut. Typically when a rate cut cycle starts, we get more than one rate cut – often 2% of cuts or more. Those who would like to maintain today’s higher yields need to act now.

Will the Canadian dollar catch a break?

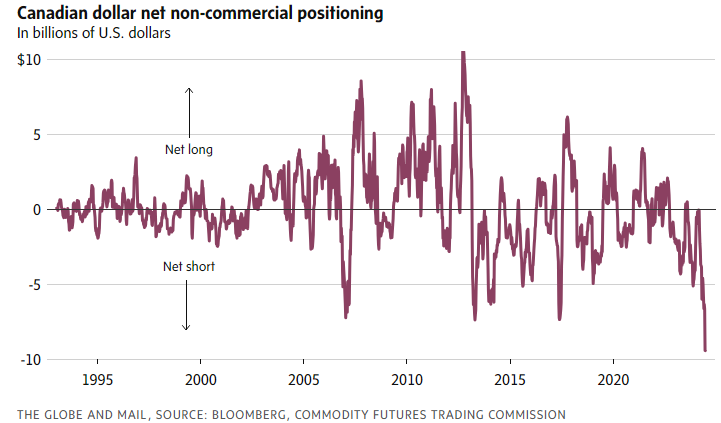

With 2024 seeing a divergence between the Bank of Canada (cutting rates) and the U.S. Federal Reserve (pushing out rate cuts), the Canadian dollar has been the main victim, losing about 3% so far this year. We would note that negative sentiment toward the loonie is an extremely widely held view. As seen below, speculators are betting against the Canadian dollar to a degree not seen in at least 30 years.

This leaves us wondering who is left to sell the Canadian dollar? Make no mistake, we still believe in holding a strategic position in U.S. dollars in portfolios, but in the short term we may get an opportunity to purchase them at a more attractive level. When the market is “all-in” on a position, very often the opposite can happen in the short term. Longer term, we still believe the Bank of Canada will need to cut interest rates faster and sharper than the Federal Reserve, which should benefit the U.S. dollar all else equal.

The Harbour Group

416-842-2300

Putting you first, every time, to help you navigate the complexities of managing your wealth. All of our team members, all of our resources, all of our collective insight: ALL FOR ONE: YOU™.

The information contained herein has been obtained from sources believed to be reliable at the time obtained but neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers can guarantee its accuracy or completeness. This report is not and under no circumstances is to be construed as an offer to sell or the solicitation of an offer to buy any securities. This report is furnished on the basis and understanding that neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers is to be under any responsibility or liability whatsoever in respect thereof. The inventories of RBC Dominion Securities Inc. may from time to time include securities mentioned herein. RBC Dominion Securities Inc. and its affiliates may have an investment banking or other relationship with some or all of the issuers mentioned herein and may trade in any of the securities mentioned herein either for their own account or the accounts of their customers. RBC Dominion Securities Inc. and its affiliates also may issue options on securities mentioned herein and may trade in options issued by others. Accordingly, RBC Dominion Securities Inc. or its affiliates may at any time have a long or short position in any such security or option thereon. Mutual funds are sold by RBC Dominion Securities Inc. There may be commissions, trailing commissions, management fees and expenses associated with mutual fund investments. Read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. RBC Dominion Securities Inc.* and Royal Bank of Canada are separate corporate entities which are affiliated. *Member CIPF. ®Registered Trademark of Royal Bank of Canada. Used under licence. RBC Dominion Securities is a registered trademark of Royal Bank of Canada. Used under licence. ©Copyright 2019. All rights reserved.