- In the past few weeks, market joy over potential U.S. rate cuts turned to recession fears.

- We continue to monitor economic statistics, and the jury is still out as to where the U.S. economy is headed next.

- We are still in the soft landing camp, and will reside here unless there is compelling evidence to suggest a change is needed.

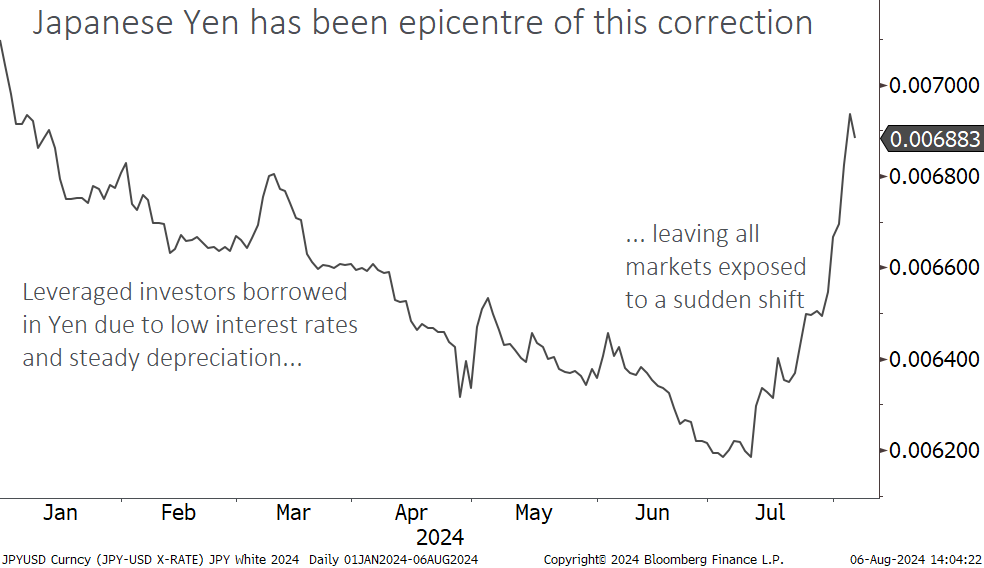

- For all the attention paid to the U.S. economy, we think the main culprit for heightened volatility lives halfway around the world.

- Japan’s continued ultra-low interest rates and steadily weakening currency made it an attractive place to borrow money to buy almost any asset.

- A jump in the Japanese yen exposed how much leverage has driven markets this year, and when those trades unwind, they are often swift and violent.

- This in our view is a “typical” market correction, the type of which we see nearly every year, and is a very different flavour than what we saw during COVID or in 2008.

- We run balanced and diversified portfolios designed to thrive in a wide variety of economic environments. This is not the most exciting strategy, but in a correcting market that is a feature not a bug.

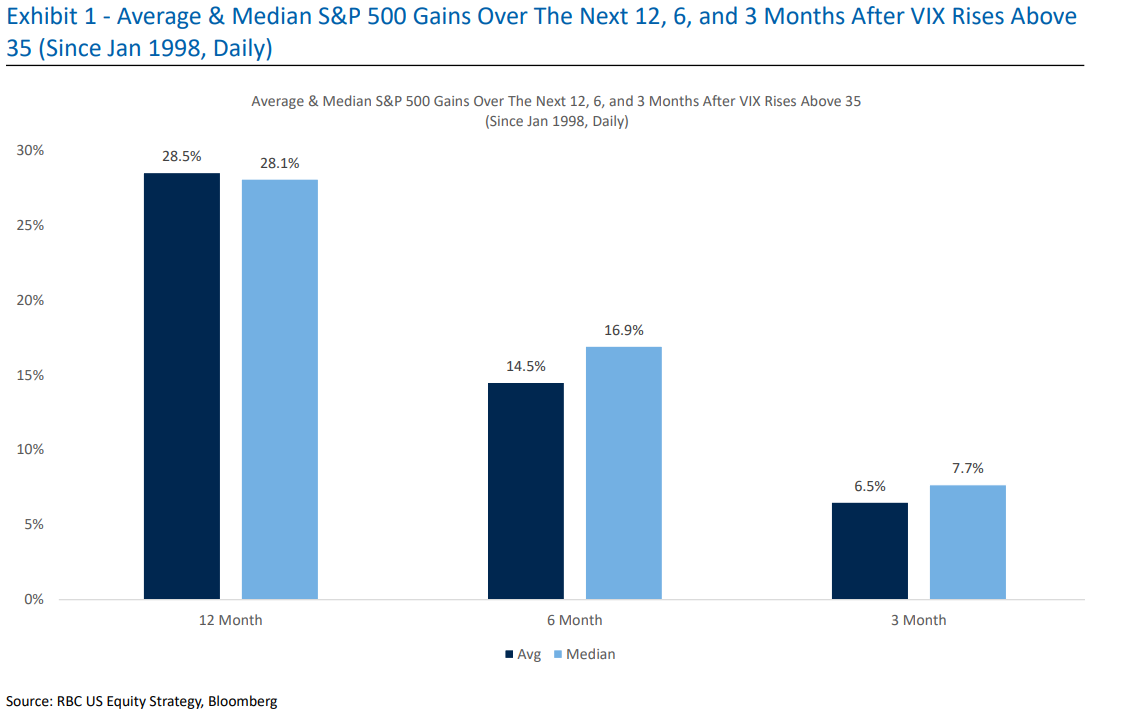

- Large spikes in volatility like we saw Monday have historically been a harbinger of future gains.

- Volatility is to be expected and is part and parcel of a well-prepared financial plan, but upending asset allocation during a correction has the potential to derail it.

With the S&P 500 recently on its longest run without a 2% loss in a single day since 2007, it is always jarring when such a streak is broken. A weaker than expected U.S. employment report tilted the scales from “bad news is good because it means rate cuts are coming” to “bad news is bad because a recession is coming.” We would caution putting too much weight with any one economic indicator. Even though the agency that reported the number said weather was not a factor, there are multiple indicators that suggest Hurricane Beryl led to a big jump in joblessness in Texas, and we wouldn’t be surprised to see that number revised higher, as is often the case. At the same time, layoff notices remain low, not something we would expect to see if we are in the midst of a recession. When it comes to the U.S. economy, we remain in the soft landing camp, and plan to stay there unless compelling evidence to the contrary emerges.

What is the “Yen carry trade”?

If you are reading the financial media, you are probably seeing a lot of talk about the “yen carry trade” as the main culprit for the sharp volatility seen in the past few days. It may have a fancy name, but really it is pretty simple. While the U.S., Canada, and European Union were raising interest rates from near-zero levels, the Bank of Japan barely budged, only exiting negative interest rates in March of this year. Hedge funds and other leveraged investors love a low interest rate, and the ability to borrow money in Japan near zero and buy U.S. bonds at 5% or stocks that were rising proved irresistible. All the while, the Japanese yen was depreciating to boot, meaning investors were making money on both sides of the ledger.

This type of unwind means share prices are moving much more than fundamentals

These types of strategies tend to grow larger and larger while they are working, only to end in tears when the trend changes. After depreciating relentlessly for over 18 months the yen turned sharply higher, causing investors to abandon this strategy en masse, which in effect meant buying the yen and selling nearly everything else. In our view, much of the trading in the past few days has had little to do with fundamentals and much to do with risk management on the part of these investors. Put another way, prices have moved much faster than fundamentals, typically the type of trading that opens up opportunities for long-term investors.

This feels like a “typical” correction

As we said in our July 26 post, market corrections are normal and healthy, but never feel that way when we are living through them. A 5-10% correction tends to happen every year, and sometimes twice. What we are going through now is a world apart from the turmoil experienced in the early stages of COVID or the Great Financial Crisis, where uncertainty was off the charts and we truly did not know what was coming next. While many investors spend a lot of time worrying about corrections and wondering how to prepare, in our experience they are almost impossible to time, and as the great investor Peter Lynch said: “Far more money has been lost by investors trying to anticipate corrections, than lost in the corrections themselves.” In other words, if we change our asset allocation to be more defensive because we are worried or have a bad feeling, or are constantly buying insurance against portfolio declines, the missed upside from those activities will nearly always outweigh the short-term pain of a market correction.

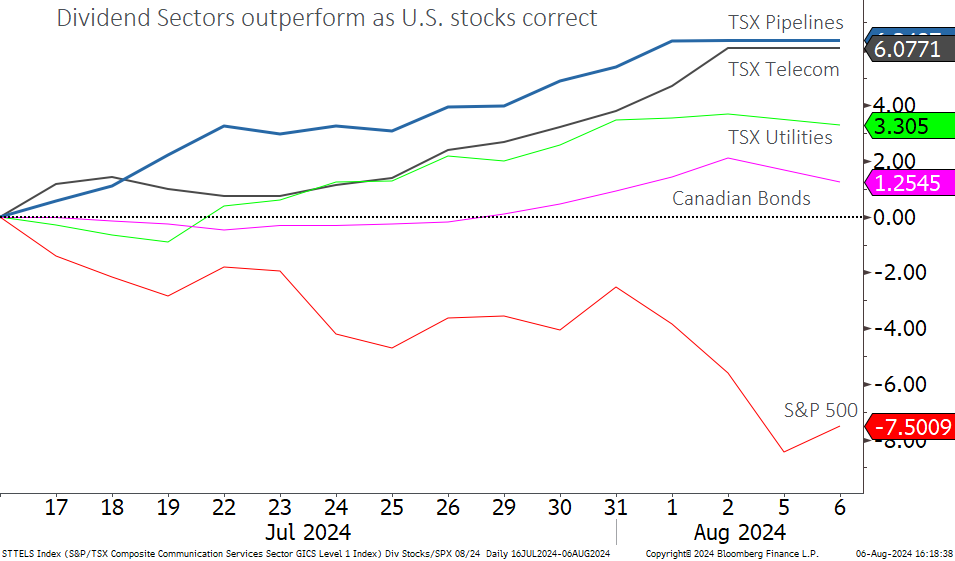

Balanced portfolios key to riding out volatility

When one narrow trend is dominating markets like artificial intelligence has for much of 2024, the point of engaging in portfolio diversification can seem moot. When markets turn, however, we quickly see the value of having a portfolio that can thrive in varied economic environments. A perfect example here is dividend stocks. These securities were left for dead as everyone spent the first half of 2024 clamouing for the next big thing in artificial intelligence. Since the S&P 500 peaked in mid-July, Canadian dividend stocks have traced out a nice rebound, showing that diversification does indeed have benefits, particularly when markets turn volatile.

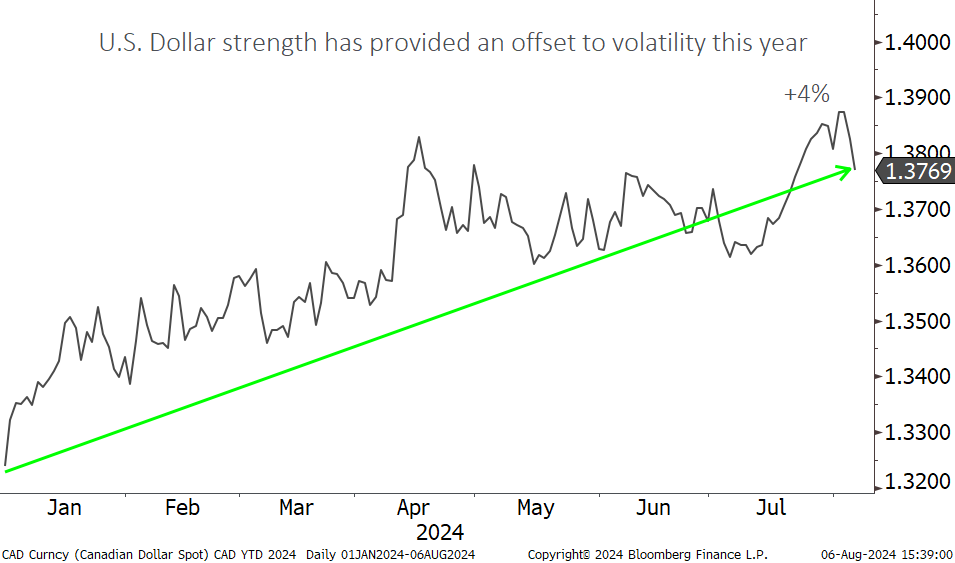

U.S. dollar remains the best “hedge” out there

We hold U.S. dollar investments in portfolios for two reasons. First, they give us exposure to the vast majority of securities that do not trade on Canadian markets, allowing us access to world-class companies in sectors that Canada is light on. Second and no less important, for Canadian investors the U.S. dollar tends to be one of the only things that goes up when everything else is going down. This year has been a particularly good one for the U.S. dollar, with the USD/CAD exchange rate up 4% as of this writing.

What can we expect after volatility spikes?

When market volatility erupts, the emotion we most commonly associate with it is fear. In fact, the most popular measure of stock market volatility, the VIX, is often referred to as Wall Street’s “fear gauge”. We saw a huge jump in the VIX on August 5, commensurate with the market volatility that was taking place. While jumps in the VIX are often associated with scary markets, the aftermath tends to be rewarding for those who have the patience to hold tight, or even add to their stock holdings. Over the next 3, 6, and 12 months, average returns after a big jump in the VIX have been well above long-term averages.

Financial plans can handle volatility; major shifts in strategy pose the real risk

While the projections laid out in financial plans look clean and tidy on the surface, behind the scenes the calculations involved account for bouts of market volatility. What they don’t account for is abrupt changes to asset allocation, particularly when markets are on the back foot. Sharply reducing equity weightings when markets are down introduces the challenge of getting back in. While it may sound counter-intuitive, this is often more difficult than the initial decision to sell, all the while introducing risk that long-term portfolio returns slip as markets recover and asset allocation is off-side. We don’t know what the future will bring but historically bursts of volatility such as we are seeing now don’t disappear overnight, and often take weeks or months to clear. After a smooth ride up for most of 2024 that may be disappointing to some, but in our experience a disjointed market creates opportunities for the prepared investor and is a blessing to those practicing dollar cost averaging.

The Harbour Group

416-842-2300

Putting you first, every time, to help you navigate the complexities of managing your wealth. All of our team members, all of our resources, all of our collective insight: ALL FOR ONE: YOU™.

The information contained herein has been obtained from sources believed to be reliable at the time obtained but neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers can guarantee its accuracy or completeness. This report is not and under no circumstances is to be construed as an offer to sell or the solicitation of an offer to buy any securities. This report is furnished on the basis and understanding that neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers is to be under any responsibility or liability whatsoever in respect thereof. The inventories of RBC Dominion Securities Inc. may from time to time include securities mentioned herein. RBC Dominion Securities Inc. and its affiliates may have an investment banking or other relationship with some or all of the issuers mentioned herein and may trade in any of the securities mentioned herein either for their own account or the accounts of their customers. RBC Dominion Securities Inc. and its affiliates also may issue options on securities mentioned herein and may trade in options issued by others. Accordingly, RBC Dominion Securities Inc. or its affiliates may at any time have a long or short position in any such security or option thereon. Mutual funds are sold by RBC Dominion Securities Inc. There may be commissions, trailing commissions, management fees and expenses associated with mutual fund investments. Read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. RBC Dominion Securities Inc.* and Royal Bank of Canada are separate corporate entities which are affiliated. *Member CIPF. ®Registered Trademark of Royal Bank of Canada. Used under licence. RBC Dominion Securities is a registered trademark of Royal Bank of Canada. Used under licence. ©Copyright 2019. All rights reserved.