- We all have biases that work their way into our investing style and how we react to events, often highly correlated with our risk tolerance.

- We have also seen situations where the conditions in their industry influences investors’ decisions about their portfolios.

- This can be a positive if it relates to opportunities others are unlikely to see.

- Oftentimes, people correlate poor conditions or worrying signs in their industry with the outlook for the stock market.

- The world is a complex place, and there is nearly always an industry out of synch with the rest of the economy, but we can’t let these inputs override the myriad other factors that impact market performance.

The genesis of this article begins with a trip to Yorkdale mall in December, 2008. For those of you who don’t remember, this was near the deepest depths of the Great Financial Crisis. Lehman Brothers was no more, numerous bailouts had taken place and the S&P 500 was suffering its worst year since the Great Depression. The mood on Bay Street was less than festive, so imagine our surprise when we pulled into the parking lot and it was teeming with shoppers. The first thought that came to mind was “don’t they know that the world is ending?”. A couple of important lessons were learned that day. First, the world rarely actually ends, despite it feeling like it might rather often. Second, the vast majority of people don’t work in finance and didn’t have a front row seat to the carnage of the financial crisis. In fact many of them likely barely noticed if they still had their job (and 93% of Canadians did - the unemployment rate was 6.6%) or if they were living off their defined benefit pension.

We all have investing biases…

We bring this up as a reminder of the biases that we all have when it comes to investing. Many of the biases we see in our office are related to risk tolerance and what one’s historical experience has been. Those that invested for the first time and made near-immediate gains tend to give markets the benefit of the doubt, while those whose first experience was a major correction tend to keep their investments (and their advisors!) on a short leash. As discussed above, another source of bias exists, and that is related to the industry we work in. Sometimes specific industry insight is helpful as it can uncover opportunities those outside would be unaware of. When one’s industry is in disarray, however, it is very difficult to have a positive view of the economy at large, and that can impact investment decisions.

… and that includes those driven by what we see at work everyday

Imagine asking an autoworker how they felt in 2009, or anyone in hospitality their view of the economy during the spring of 2020. They would have told you it was the worst they had ever seen, and they were likely not in a mood to take risk in portfolios. Of course it turned out that in both those instances we were near major inflection points and the best course of action would have been to do the opposite of what every bone in your body was telling you. This is incredibly difficult to do, but resisting that urge is key to generating returns over time.

Being shaken out of our seat at the wrong time can be costly

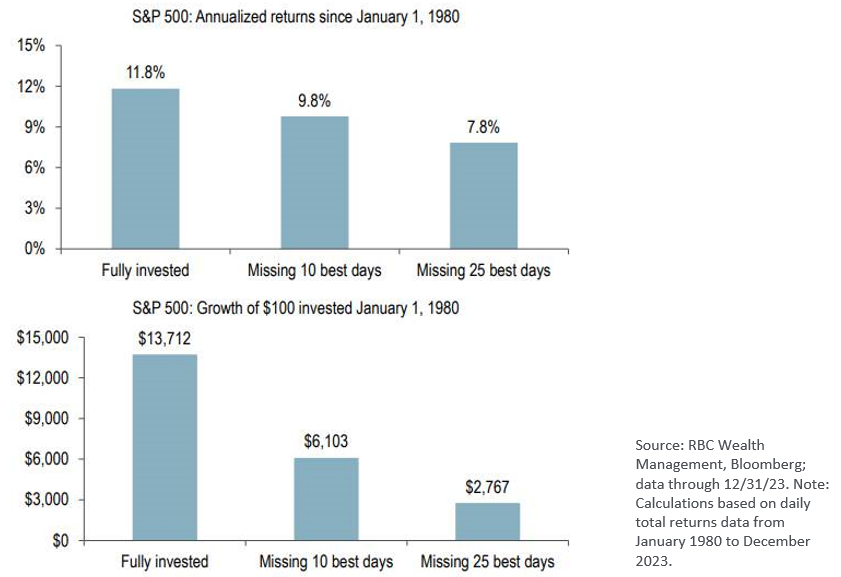

We have shown these charts before but they don’t get any less powerful. Typically the urge to go to safety in portfolios is after we have seen sharp losses, and once we are in the throes of a major correction it is anyone’s guess as to when or why it might turn. But when they do turn, it tends to be just as sharp. As seen above, missing only the 10 best days out of 10,000 trading days over 40 years makes a serious dent in returns.

One industry is not the stock market, and the odds are on the side of the long-term investor

In an economy as complex as ours, there is always going to be a sector that is out of synch with the rest, and it may or may not mean that trouble lies ahead. This is not an argument to never change asset allocation, but when we do we should do so on more evidence than “the restaurant business (real estate market, legal industry, etc.) is terrible right now”. Stock markets go up about 70% of the time, but there are going to be challenges in various parts of the economy 100% of the time. We don’t want the biases from what we see at work to detract from the benefit of compounding capital over a long period of time.

The Harbour Group

416-842-2300

Putting you first, every time, to help you navigate the complexities of managing your wealth. All of our team members, all of our resources, all of our collective insight: ALL FOR ONE: YOU™.

The information contained herein has been obtained from sources believed to be reliable at the time obtained but neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers can guarantee its accuracy or completeness. This report is not and under no circumstances is to be construed as an offer to sell or the solicitation of an offer to buy any securities. This report is furnished on the basis and understanding that neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers is to be under any responsibility or liability whatsoever in respect thereof. The inventories of RBC Dominion Securities Inc. may from time to time include securities mentioned herein. RBC Dominion Securities Inc. and its affiliates may have an investment banking or other relationship with some or all of the issuers mentioned herein and may trade in any of the securities mentioned herein either for their own account or the accounts of their customers. RBC Dominion Securities Inc. and its affiliates also may issue options on securities mentioned herein and may trade in options issued by others. Accordingly, RBC Dominion Securities Inc. or its affiliates may at any time have a long or short position in any such security or option thereon. Mutual funds are sold by RBC Dominion Securities Inc. There may be commissions, trailing commissions, management fees and expenses associated with mutual fund investments. Read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. RBC Dominion Securities Inc.* and Royal Bank of Canada are separate corporate entities which are affiliated. *Member CIPF. ®Registered Trademark of Royal Bank of Canada. Used under licence. RBC Dominion Securities is a registered trademark of Royal Bank of Canada. Used under licence. ©Copyright 2019. All rights reserved.