Navigating Crosscurrents – 2025 Outlook

In last month’s Capital Currents we looked back on what was a fairly remarkable year, where valuations, concentration, and surprisingly resilient economic data pushed equity indices to all-time highs in several respects. For this upcoming year, there are three important questions that we’re focused on:

-

Policy: How will trade, tax, and immigration policy unfold under Trump’s second term and a Canadian election?

-

Quick answer: Government policy is in a period of greater volatility than usual, and while tariffs are a risk, we believe patient investors will be rewarded for taking the long view through that volatility.

-

-

Earnings: Can corporations deliver on the sky-high expectations implied by stock valuations?

-

Quick answer: Although we expect the US economy and overall earnings growth to be very strong this year, we don’t think current index-level valuations are fully justified.

-

-

Fed & BoC: Will growing inflationary pressures allow the Fed/BoC to keep cutting?

- Quick answer: The BoC has more room to cut given sluggish Canadian data, but we aren’t expecting the Fed to be an ally in 2025 the way they were last year.

Policy: Just days into Trump’s 2nd term we’ve been given a reminder of how the president’s negotiating tactics and tendency for off-the-cuff remarks can create a great deal of uncertainty with respect to important policy objectives. Although we must always be vigilant to stay on top of changing realities, we also think it will be particularly important to look through volatility driven by political headlines, maintain a strong focus on underlying business fundamentals, and ensure that investment strategy is proactive rather than reactive.

The most immediate policy consideration is of course the potential for sweeping 25% tariffs on goods from Canada and Mexico. Canadian equities were thrilled to read a Wall Street Journal article suggesting the Trump administration would simply be conducting a sweeping “review” of trading partners, which suggested tariffs may not be an inevitability after all. The positive impact was short-lived, however, with Trump saying the 25% tariffs may be implemented on February 1st, which promptly unwound the positive price action seen after the WSJ article.

Those who closely followed markets during Trump’s first term will recall the almost constant undulation of China trade headlines, which would push markets higher just to be pulled back lower on another comment or development days later. This “headline volatility” is simply a reality of President Trump’s negotiating style, and investors must look through this volatility and avoid making constant reactionary shifts.

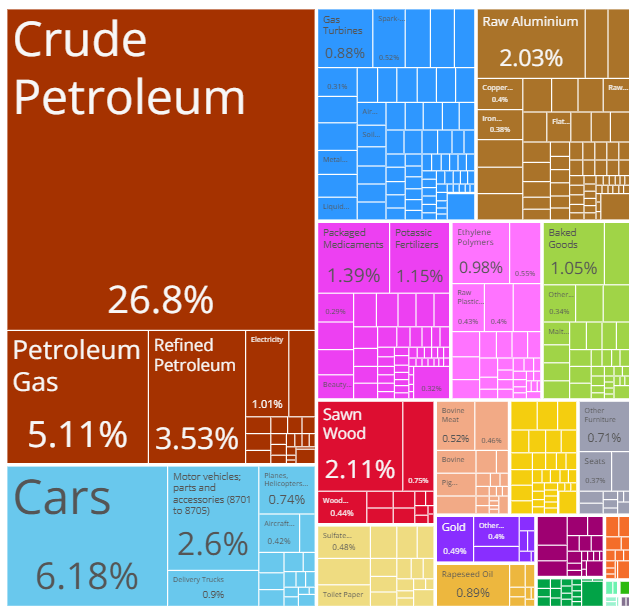

Our view on the tariffs is that they are a bargaining chip for the president and are unlikely to be a permanent fixture throughout his term (and there’s still a very real possibility they aren’t fully implemented in the first place). One major reason for this view is that taxing Canadian imports goes against several of the President’s stated priorities. Most notably, he has promised to lower gas prices for Americans, and a tariff on the over $100B in Canadian energy would undoubtedly raise the cost of energy for Americans meaningfully (see Canadian exports to the US above…the vast majority are raw materials). It would be a particularly acute cost in the Midwest, where refiners depend on a specific type of crude that is imported from Alberta (and there are precious few alternatives for them to replace that supply). The Midwest is perhaps the single most politically important region of the country for Trump, and the lack of alternative heavy crude import options means consumers would likely absorb most of the tariff cost via higher energy prices, with refineries and Canadian producers splitting the rest.

We also believe increasing USD exposure will act as a diversifier against the threat of tariffs. Although USD looks expensive relative to the historical USDCAD rate, that dollar strength is very much justified relative to interest rates and economic data, and sweeping 25% tariffs would very likely lead to even further strengthening of the dollar relative to the loonie.

In any case, the early days of this administration are a reminder to investors that the best strategy is to stay focused on business fundamentals and the long-term investment thesis of each individual company, rather than attempting to speculate and time investments based on the vagaries of shifting political priorities.

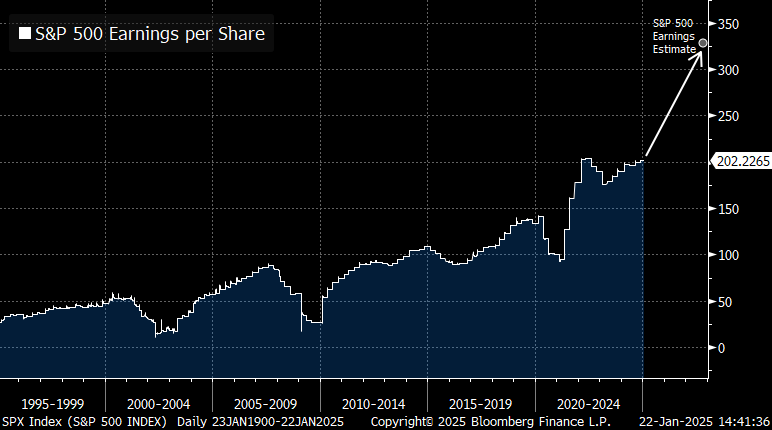

Earnings: A major driver for 2024’s excellent stock market performance was stronger than expected earnings growth. Markets have driven stock valuations to a point where the expectation is that this pace of earnings growth will continue for at least the next few years. Current valuations imply earnings growth of over 11% per year until the end of 2027 – significantly faster growth than the long-term 6-7% rate enjoyed by the S&P 500 over the last 30 years. In fact this level of earnings growth is faster than any point in the last 30 years other than the post-GFC and post-COVID recoveries, and that pace has never been maintained for a period of more than a year or two (see below).

That certainly isn’t to say that this level of earnings growth isn’t possible, but it does mean it’s one of the highest bars ever for stocks to continue this level of performance. When the baseline expectation from markets is for the fastest level of sustained earnings growth ever, we think it’s wise to take caution that expectations may be overly optimistic. This is another reason that we prefer more profitable, cash generating businesses over more speculative growth names.

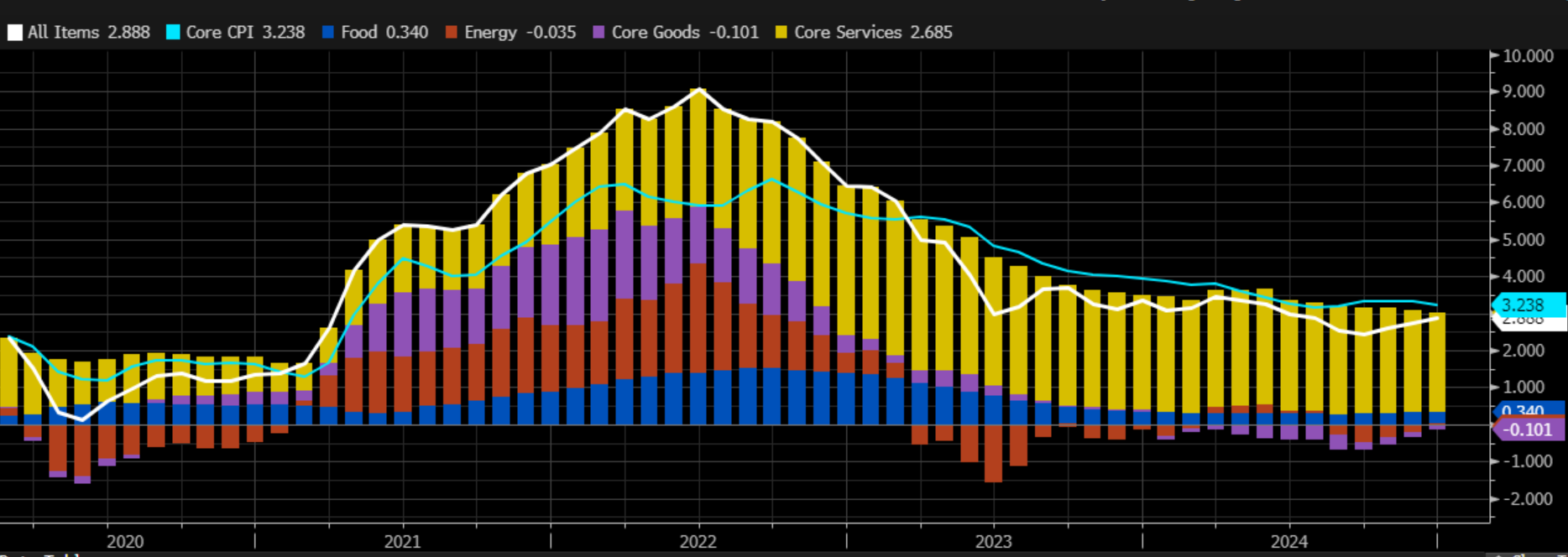

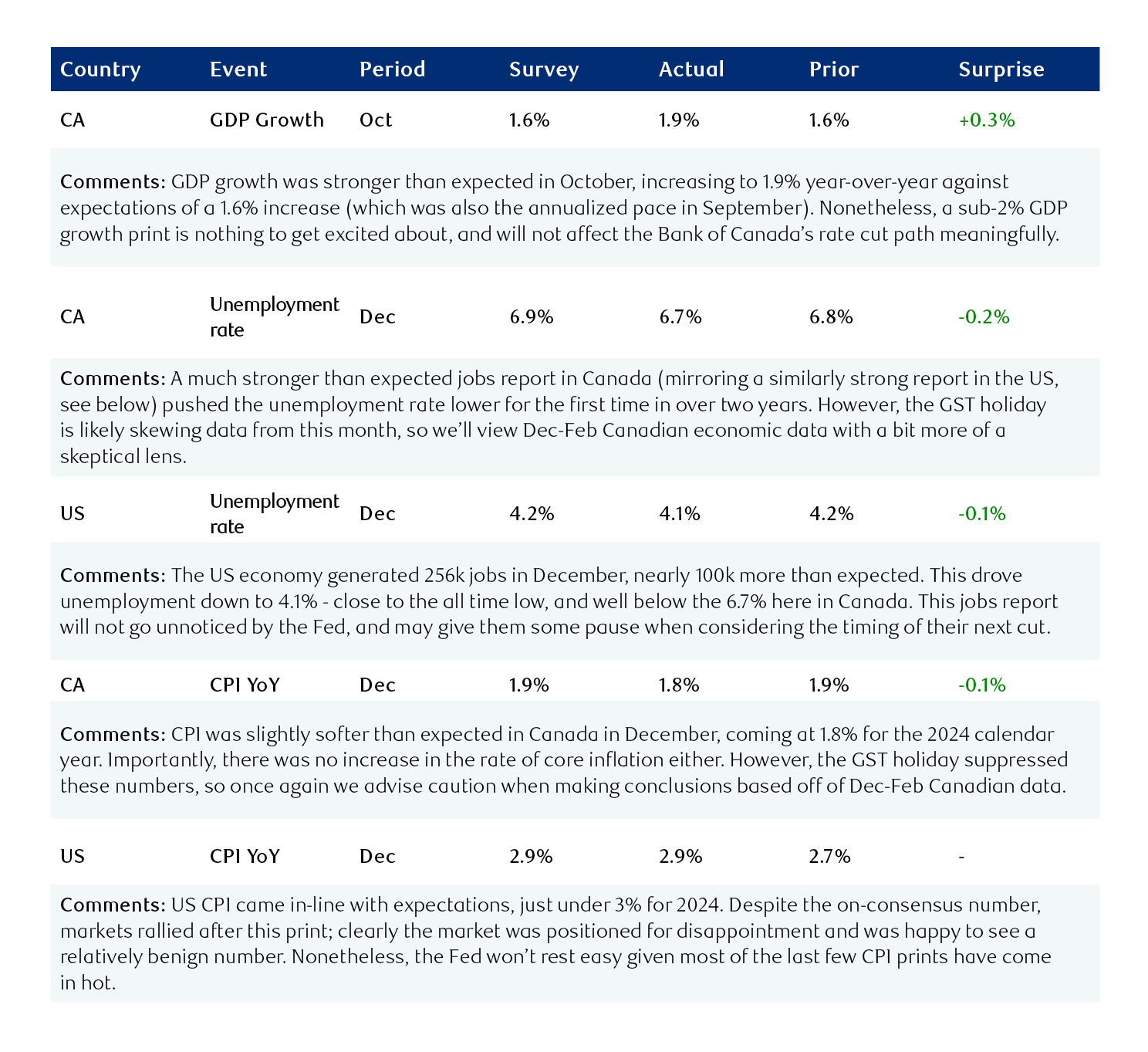

Fed & BoC: While it seems like the Federal Reserve’s rate cutting cycle is just getting started (first cut was in September), there are suddenly questions about whether we’ll see any further rate cuts at all. Likely yes, there are a couple more to come, but that is no longer a foregone conclusion. A swath of stronger than expected employment and inflation data has inserted some caution into the Fed’s thinking, particularly when combined with the backdrop of larger fiscal deficits and inflationary tariffs. The chart below shows that while energy (red), goods (purple) and food (blue) prices have stopped increasing, core services (yellow) has barely slowed down at all. Given that services are the segment of the economy most directly tied to monetary policy, the Fed may not have much room to cut further.

Here in Canada the picture is a bit different, simply because our economic data (including inflation) has been so much softer. A near record gap currently exists between Canadian and US interest rates, which is a major reason for the weak loonie, but that gap could open up even further this year. Ultimately we don’t think investors should count on accommodative central banks to boost returns again this year, and is another reason we’re entering the year with caution.

Bottom line: The past few years have been particularly eventful for investors, and we expect 2025 to be a very interesting year. The crosscurrents of shifting government policy, slowing rate cuts, and sky-high valuations & earnings expectations means something will have to give. Our view is that the big winners of 2023 and 2024 will have a much more difficult path to outperformance in 2025, and we aim to take advantage of that shift while maintaining a slightly more conservative tilt when allocating to stocks.

Compass Calls ~ A New Addition!

Compass Calls will offer regular updates with quick, informal insights on everyday topics that matter to our clients. Often featuring experts from within RBC and beyond, we break down key developments and provide objective advice on a variety of subjects to help our clients and their families stay informed and make better decisions.

They will take place the last Thursday of every month at 12pm EST. The virtual presentation will run no more than 15 – 20 minutes in duration. Please join us and register by clicking on the link below!

January 30, 2025 12pm EST ~ 2025 Start of Year Reminders

Join us for a quick, insightful webinar covering key reminders for 2025. We'll discuss TFSA and RRSP contribution limits, tax planning, and tips to align your portfolio for the year ahead. Perfect for staying on top of your financial goals and preparing for tax season.

Register

Profile

Many congratulations to our team member, Song Li, for completing his Canadian Securities, Derivatives Fundamentals and Options Licensing Course this month! Just like completing a challenging exam like this, your dedication, preparation, and perseverance have paid off. This accomplishment is a testament to your hard work and commitment to excellence. We’re proud to recognize and celebrate this success with Song. This also enhances our ability to better serve our clients, which is a bonus!