Invested but Watchful

Recent client discussions reveal considerable apprehension about 2026's investment outlook. Most people are worried about the direction of the economy, geopolitics, and industry disruptions via AI. Undoubtedly, the world is changing fast. In the investment industry, we call it regime change—a shift where historical correlations between economic variables may no longer hold, requiring fresh strategies. As our capital markets team analyzes industry data, AI and disruption are focal points for discussion in boardrooms across the U.S. and Canada. Coming into 2026, sentiment is upbeat, and the economic growth outlook is positive.

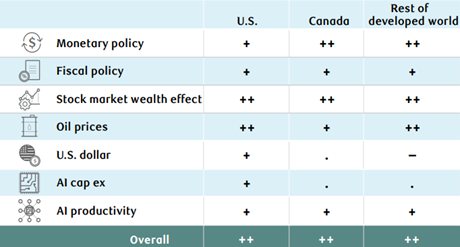

The recent monetary easing cycle that began in 2025 is still working its way through the economy. Monetary policies operate with a lag, so we should see more stimulative effects in 2026. On the fiscal front, many tax-cutting initiatives from the Big Beautiful Bill Act will take effect in 2026. Strong stock market performance combined with weak oil prices provide a cushion for consumer sentiment. Finally, AI capital expenditures and productivity gains will remain a dominant theme for years to come.

Growth Tailwinds for 2026

Note: As of 12/02/2025. Source: RBC GAM

However, not all is rosy. Economic crosscurrents exist, and we need to brace for both tailwinds and headwinds.

The Trump administration is unpredictable, and U.S. government shutdowns have become more frequent. This policy instability makes it difficult for companies to commit to long-term investments. That said, certain themes have strong bipartisan support—bringing manufacturing capabilities back to the U.S. and securing resource independence in rare earth minerals. Higher defense spending is another area of agreement between political parties. As the U.S. government intervenes more actively in market forces, political and policy decisions will play an increasingly central role in economic trajectory and industry sector performance.

A notable investment trend is the outperformance of international markets in 2025, a shift that has continued into 2026 year to date. This movement reflects a desire to diversify away from U.S. technology giants and the broader U.S. economy as the country pursues a more unpredictable path in international diplomacy. Our Economics team recently completed a deep analysis of fiscal health across major economies in North America, Europe, and Asia.

Global Fiscal-Health Scorecard

Source: IMF, Macrobond, RBC GAM

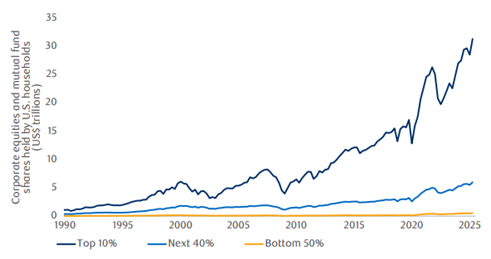

For investors who have participated in stock market growth, the rewards have been substantial. However, the path has not been smooth. Over the past decade, volatility spikes have been driven by tariff disputes, the pandemic, inflation concerns, and growth scares in 2018 and 2022, among other catalysts.

The Richest Americans Have Disproportionately Benefited from Stock-Market Gains

Source: Federal Reserve, Macrobond, RBC GAM as of Q2 2025

In U.S. markets, AI-centered growth, manufacturing reshoring, supply chain diversification, and labor supply are important thematic trends to monitor. We are watching the recent relative strength in international markets closely, as there is a growing need for diversification beyond large U.S. tech companies.

In times of uncertainty and rapid change, we remain vigilant in balancing capital protection from disruptive forces with identifying emerging opportunities in the economy to achieve stability and compound growth.

Rita Li works with professionals, business owners and high net worth families to provide tailored investment advice, risk management and financial planning. Her team comprises of professionals with in-depth taxation, insurance, and legal expertise; together, they deliver a high standard of service to clients. Rita is a Chartered Financial Analyst CFA® and Certified Financial Planner CFP®. Rita holds her MBA from Richard Ivey School of Business.