We came into the year anticipating a more volatile market environment but the tariff announcement on April 2nd was more than what had been priced in by the investment community. Since then, much of the initial tough stance has softened and the markets have recovered some of the losses from the initial tariff shock. The question on everyone’s mind is if this correction is different and foretells a fundamental shift in the established norms of geopolitics. The answer is a resounding yes. However, as we revisit each of the previous market corrections from the Great Financial Crisis to the more recent Covid pandemic shock, they have all been different and unique from a historical perspective. Our message is that we can navigate our way through this crisis as well.

While we are not international policy experts, we can offer some food for thoughts from a market perspective. The U.S. has a ballooning budget deficit that it needs to address before it is too late. This is one of the key drivers behind the tariff and Department of Government Efficiency (DOGE) policies. Warren Buffet warned 20 years ago of the U.S. growing trade deficit and offered an illustrative 10% tariff system as a resolution mechanism[1]. The tariff underlines an economic reality that the U.S. can no longer borrow and consume at the rate that it has been as it reaches a debt limit that is unsustainable. This means companies will need to adjust with a greater focus on domestic industries, in the U.S. as well as internationally.

From recent earnings reporting, companies varied in terms of whether and to what extent they are baking tariffs into guidance. Several alluded to the idea that they hope to gain more clarity and certainty over the next 90 days. Several referenced the idea of a better currency backdrop given recent USD weakness. Digging in deeper on tariffs, companies believed they have the tools to manage through in the near term, but impacts will start to be felt in second half of 2025 and in 2026.

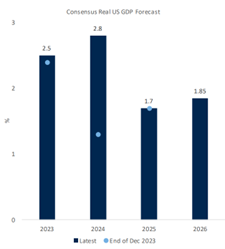

Below is a snapshot of the current consensus GDP and earnings forecast. The current consensus is a slow down of growth, not an outright contraction of growth in GDP and earnings growth.

[1] America’s growing trade deficit is selling the nation out from under us. Here’s a way to fix the problem – and we need to do it now. By Warren E. Buffet. Fortune, Nov 10, 2003

Source: RBC US Equity Strategy, Bloomberg; as of 4/25/2025

Putting the current market correction into historical context

A bear market, by definition, is a 20% decline from record highs on a closing basis. The S&P 500 came close to it in April because of the tariff scare. In times of uncertainty, managing downside becomes more important than capturing market upside.

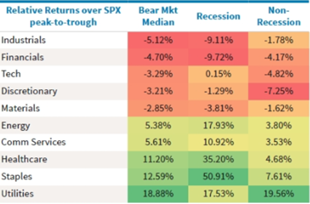

Here, we investigate the potential upside and downside scenarios at the sector level by examining relative returns from past S&P 500 bear market returns since 1980. As one might expect, defensive sectors, such as Utilities, Staples, and Healthcare tended to hold up better during the peak-to-trough drawdown of past bear markets. By contrast, cyclical sectors which are more sensitive to the business cycle, tend to lag the S&P 500.

Defensives held up better than cyclicals and Tech during the peak to trough phase of past bear markets.

Median relative returns shown over the peak to trough phase of S&P500 bear markets since 1980. Data as of 4/17/2025. Source: LSEG Data & Analytics, Bloomberg, Barclays Research

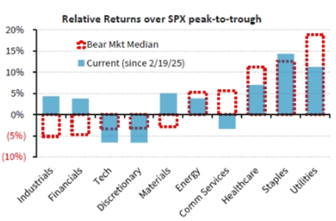

In the recent correction, Utilities, Communication Services and Healthcare sectors have outperformed previous market corrections. Industrials, Financials, and the Materials sectors may have more downside should a bear market scenario materialize.

Sector relative returns since the Feb 19 peak vs. historical bear market medians:

Median relative returns shown over the peak to trough phase of S&P500 bear markets since 1980. Data as of 4/17/2025. Source: LSEG Data & Analytics, Bloomberg, Barclays Research

In the backdrop of an uncertain environment both economically and geopolitically, it makes sense for portfolios to be more balanced and more defensive. In this context, we examine how a portfolio weighted 60% to equities and 40% to fixed income would have done historically, using the U.S. markets for our illustration:

Source: Bloomberg, RBC Dominion Securities.

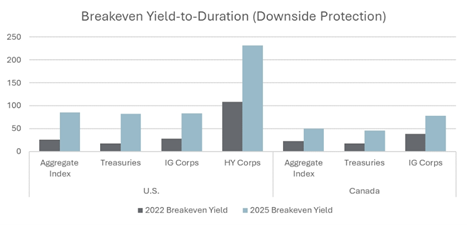

2022 was a rare occasion where both U.S. stocks (represented in beige) and U.S. bonds (represented in blue) have sold off at the same time. In this rare occurrence, the fixed income portion of a balanced portfolio did not provide protection to clients’ portfolio and the memory of the drawdown is still very fresh. The reason fixed income did not provide the protection it usually would is because interest rates had a rapid ascent from record lows as central banks looked to stave off inflation. Today, fixed income offers a much great cushion and protection. A balance portfolio, with fixed income more defensively positioned at the short end of the interest rate curve, should serve its purpose in principal protection well.

Today’s fixed income offer much more downside protection. A greater increase in yields is needed to result in negative returns:

Source: Bloomberg, RBC Dominion Securities.

Equity market downturns are always tough to endure, but they are a normal part of investing in stocks. Historically, markets finish positively about 70% of the time while negatively the remaining 30% of the time. Approximately half of the time, we see an intra-year drawdown of over 10%. The takeaway here is that macro or fundamental catalysts can sometimes upend stability and market drawdowns may occur from time to time to varying degrees. Successful long-term investing, in our view, means sticking to a plan to ensure we remain disciplined in our approach, which is particularly important during periods of market stress where emotions can often get in the way. We highlight the best and worst 20 days in the S&P 500 since 1945 in the exhibit below.

What’s noticeable is that historically, the market’s best days have often followed the sharpest drops. This time is no exception. Mistiming the market, even by just 20 days, can have significant consequences on long term returns.

I remind my clients during times of high stress that we have seen many crises from wars to recessions in the past. The markets and the economy have always overcome these obstacles and marched on higher. It is important to focus on what we can control, which is finding the right balance to help us stay invested and to reach our goals over our investment time horizon.

Rita Li works with professionals, business owners and high net worth families to provide tailored investment advice, risk management and financial planning. Her team comprises of professionals with in-depth taxation, insurance, and legal expertise; together, they deliver a high standard of service to clients. Rita is a Chartered Financial Analyst CFA® and Certified Financial Planner CFP®. Rita holds her MBA from Richard Ivey School of Business.