We start 2025 with an unusual level of uncertainty that makes forecasting even more difficult. Nevertheless, we will formulate a framework to monitor the various risk factors in making investment decisions. First, there have been reported earnings from the dominant Magnificent 7 companies which account for approximately 30% of the S&P 500 index’s overall net income, as well as important GDP and interest rate announcements. Lastly, we will dive into the potential tariff impacts and outcomes using the previous 2018-2020 round of tariff negotiations as a reference point.

Fourth Quarter 2024 Earnings – Technology and AI in focus

It has been a good start to reporting season so far. Within the S&P 500, 82% of companies are beating consensus forecasts on earnings per share (EPS) and 63% are beating consensus on revenue. The stats are even better for the small cap index Russell 2000. The consensus EPS forecast for 2025 is now tracking $273 for 2025. This represents a 13% increase year-over-year and was revised down slightly from the December 2024 year end forecasts. It is worth noting, many investment professionals believe the consensus forecast is too bullish, our strategist – Lori Calvasina’s forecast is below consensus but still projects 10% earnings growth.

Consensus Earnings Forecast as of end of 2024 for S&P500

Source: Refinitiv I/B/E/S; data as of 11/22/24

In the context of Q4 earnings reporting, company executives expressed optimism over a more favorable regulatory environment and anticipate more mergers and acquisitions. Business confidence is ticking up. On the other hand, the same executive teams have expressed caution on the impact of tariffs, lower immigration, and the strong U.S. dollar’s impact on their corporation profit margins.

U.S. GDP grew 2.3% in Q4 2024, and 2025 consensus GDP forecasts have moved up to 2.2%. 2 of the Mag7 companies – Microsoft and Meta have reported their Q4 earnings. Their earnings results were in line with expectations. What is notable is their commitment to continued investments into AI with a focus on chips and data centers. Microsoft has cited significant productivity improvement from incorporating AI and believes lower AI prices will stimulate higher demand. Meta believes the higher investment in AI today will create an enduring competitive edge for itself in the future.

There has been much skepticism on the strength of the Canadian economy especially considering potential U.S. tariffs and slower population growth. Fortunately, in the latest Canada’s Business Outlook Survey, it shows inflation pressures are easing. Labour shortages have also abated. The Survey shows lower pessimism among Canadian businesses and rising sales expectations. In the latest Bank of Canada delivery, it also confirms that the Canadian economy is on firmer footing.

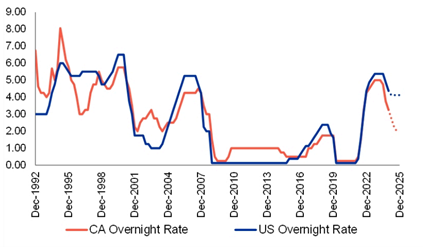

The Bank of Canada on January 29th cut its police rate by 0.25% as expected which then takes the current benchmark interest rate to 3%. It has expressed a wait and see approach to future interest rate cuts as it sees improving trends in the Canadian economy. Capital Markets still anticipate at least two more interest rate cuts; however, the anticipated interest rate trajectory is now mired in tariff uncertainty. The U.S. Federal Reserve most recently kept its policy rates unchanged at 4.5% as expected given the strength of the U.S. economy and the potential inflationary impact of tariffs. It is not entirely unlikely for the Federal Reserve to raise interest rates again if the U.S. economy runs too hot and inflation ticks up again in the future.

Current and projected Bank of Canada and U.S. Federal Reserve overnight rates

Source: Bloomberg, RBC Capital Markets

U.S. Tariffs and potential impact on the Canadian Economy

The Canadian dollar has weakened substantially since the announcement of potential U.S. tariffs. Within the companies in the S&P/TSX Composite index, 30% of the revenues are derived from the U.S. while approximately half are derived domestically. A 25% could be detrimental to our economy, however, stripping out Energy exports, the U.S. actually runs a trade surplus against Canada.

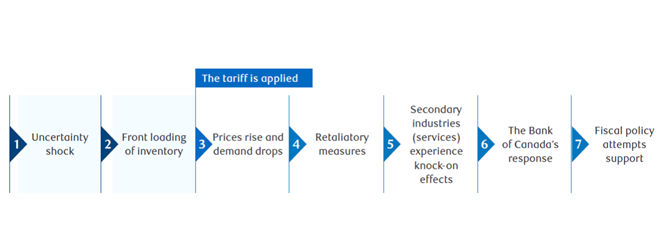

We can look to the 2018 – 2020 tariff experience for some guidance. President Trump proposed 25% tariffs on the Canadian and Mexican auto sectors and suggested that the U.S. may leave NAFTA. Trump also threatened a 5% blanket tariff on Mexico with a timeline for escalation to 25%. In the end, the U.S. implemented tariffs were smaller and temporary. The auto sector was spared given the integrated nature of the North American supply chain. Wolfe Research figures that the average North American car would become US$3,000 more expensive with a 25% tariff. Instead, the U.S. imposed a 25% tariff on foreign steel and a 10% tariff on foreign aluminum. In response, Canada imposed tariffs on C$12.6 billion of targeted U.S. imports. All these tariffs were eliminated upon the signing of the U.S.-Mexico-Canada Agreement free trade deal in the spring of 2019.

How a U.S. tariff flows through the Canadian economy

Estimated maximum cumulative effect on the economic output after two years, assuming reciprocation

U.S. tariff economic implications

Estimated maximum cumulative effect on economic output after two years, assuming reciprocation

The key to investing in 2025 is to remain nimble as many of the existing economic and international trading norms are being challenged. I question the traditional adage on diversification benefits and emphasize the need to focus on companies and industries that operate in environments that are more predictable and stable. Lower inflation is not a given in an environment where established global supply chain and trading partnerships are becoming more regional. We can see higher inflation in certain pockets of the economy. The U.S. had been a stabilizing force in the global trade network, but it is now revisiting some of its long standing policies which can have long lasting implications for the world economy and the financial markets.

Rita Li works with professionals, business owners and high net worth families to provide tailored investment advice, risk management and financial planning. Her team comprises of professionals with in-depth taxation, insurance, and legal expertise; together, they deliver a high standard of service to clients. Rita is a Chartered Financial Analyst CFA® and Certified Financial Planner CFP®. Rita holds her MBA from Richard Ivey School of Business.