We have now entered Q3 reporting season for 2025. Year to date, we have seen strong market performances in North America, in developed nations in Europe, Australasia and the Far East (EAFE) as well as emerging markets including the Brazil, Russia, India, China the “Bric” nations. This is an unexpected turn of events since the tariff announcement in April. The conventional economic wisdom is trade barriers will slow down global economic growth and bring on inflation, as a result, many market participants expect market performances to be more subdued. So far, that has not been the case. Here is a recap on some of the driving forces in 2025:

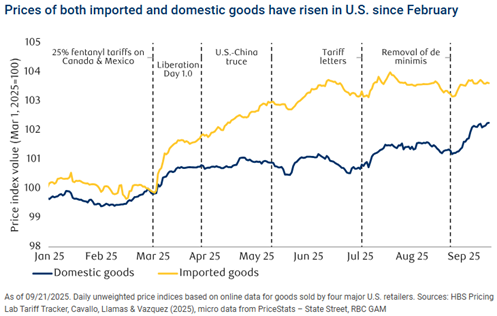

U.S. Tariffs: there have been some factors that have soften the tariff impacts so far. The average U.S. tariff rate as tracked by Evercore ISI Tariff Tracker is at 17.4%, which is lower than the headline announcements, however, more sector focused tariffs are arriving still. There are new estimates of the effect that tariffs have on U.S. consumer prices. The Harvard Business School Pricing Lab shows that the prices of imported goods have risen more quickly than the prices of domestic American goods:

Over in Canada, the central Bank of Canada expects headline inflation to remain close to the 2% target over the forecasted horizon and anticipates upside risks mainly from trade related factors such as larger than expected cost increases from tariffs or sudden reduction in sectoral tariffs.

U.S. Productivity pickup and AI spending

The Atlanta Fed’s GDPNow model is tracking an annualized real GDP growth in the United States of 3.8% for the third quarter of the year. This comes after an identically impressive 3.8% increase in the second quarter. Since the U.S. labour market has had anemic growth, this means productivity of the existing workforce has been fueling the GDP growth. U.S. Bureau of Labor Statistics estimate U.S. productivity has been rising at an 2.6% annualized pace.

AI technology spent has also provided a cushion to offset the tariff impacts. Magnificent 7 capital expenditures are on track to rise 58% in 2025 relative to 2024, totalling US$365Billion or 1.3% overall economic output. This is now a segment of the economy that is large enough to move the economic needle.

Looking to 2026 and beyond, AI investment is set to become even larger. Equity analysts project a further 21.5% increase in Magnificent 7 Capex. Continued AI related capital expenditures are expected to partially offset parts of the U.S. economy that are impacted by tariffs.

In the October update, RBC Economics expects Canadian real GDP to grow at 1.2% and U.S. real GDP to grow at 1.6%. Organisation for Economic Co-operation and Development (OECD) has a forecast of 1.1% for Canada and 1.5% for the U.S. in real GDP growth. These are not strong GDP growth forecasts, however, given the draconian tariff announcements earlier in the year, many economists have revised their GDP upwards to reflect milder tariff implementations.

With most of 2025 in the rear mirror, the main question that is top of mind is what happens next. There are many anxieties associated with tariff uncertainty and AI adoption in industries. We look for clues in the most recent company earning reporting and forward guidance.

Q3 reporting season is off to a strong start from the perspective of beat rates. 83% of S&P500 companies were beating consensus on EPS while 85% were beating on sales. For S&P 500 companies that have reported, Q3 revenue growth is 9.1% year over year and net income growth is 15.4%. The current estimate for earnings per share growth for 2026 is at 13.9%.

S&P 500 Consensus Annual EPS

Source: J.P. Morgan Equity Macro Research, Bloomberg Finance L.P. FactSet

Given the elevated level of S&P500 companies’ valuations, we will need to see the projected earnings growth materialize to continue to support strong market performances. From a macro standpoint, higher government spending and more accommodating monetary policies can be supportive for financial assets. The expectation on AI efficiency and boost to profitability will be high going into 2026 and that will be another determining factor to watch.

Rita Li works with professionals, business owners and high net worth families to provide tailored investment advice, risk management and financial planning. Her team comprises of professionals with in-depth taxation, insurance, and legal expertise; together, they deliver a high standard of service to clients. Rita is a Chartered Financial Analyst CFA® and Certified Financial Planner CFP®. Rita holds her MBA from Richard Ivey School of Business.