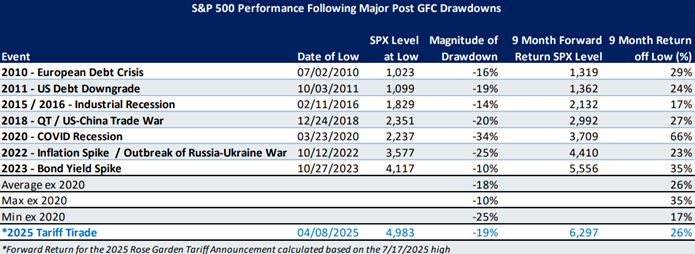

The second Trump term has lived up to the promise of delivering the unexpected. We have seen a 20% drawdown in April given the tariff scare and a subsequent V shaped recovery in under 20 days which make it the 5th fastest recovery in history. The speed of the recovery was unexpected as was the extent of the tariff threats at the initial announcement.

Markets have recovered the lost grounds mainly due to the subsequent concessions made by the Trump administration on the magnitude of the tariffs. This includes concessions made to China, due to U.S.’s reliance of certain key strategic minerals such as rare earth. Many of the tariffs are now settling in the 10-20% range which align with the initial market expectations. So far, economic release from the U.S. is strong, however, they are primarily on first quarter results which do not yet reflect the impact of tariffs due to inventory stocking ahead of tariff deadlines.

Rebounds off major, no-recession post – GFC pullbacks have been powerful

Source: RBC US Equity Strategy, Bloomberg

Earnings Check-up

Though it is early in the second quarter of 2025 reporting season, the percentage of companies beating consensus earnings and revenues forecasts are higher than the previous quarter. The rate of upward guidance is steady at just under 56% which is as good as this measure gets. The overall sentiment from management teams can be best described as cautiously optimistic with representative comments such as “global economy remains sluggish and moving laterally, not materially improving or worsening.”

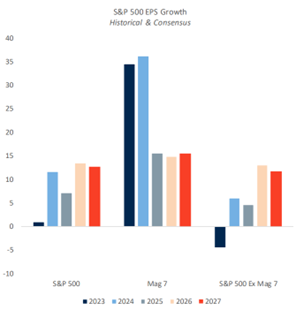

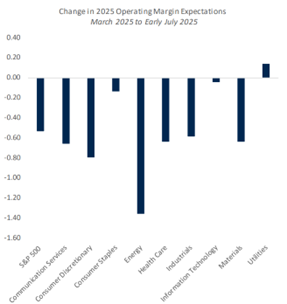

Earnings growth are forecasted to be modest in 2025 followed by stronger growth in 2026. The expectation is for the rest of the S&P500 companies to close the growth gap with the Magnificent 7 companies. There has been a significant shift in margin expectations in tariff sensitive sectors such as Energy and Consumer Discretionary.

Source: RBC US Equity Strategy, Bloomberg, as of 7/11/25

U.S. Dollar and the International Rotation Trade

One of the themes in the first quarter of 2025 is the depreciation of the U.S. dollar against other currencies. There is a divergence between interest rates in the U.S. which are still at an elevated levels and supportive of a stronger currency vs. a weaker U.S. dollar year to date. Against the Canadian dollar, U.S. dollar is down 5% and 11% against Euro. As a result, Canadian investors’ return year to date may not be as strong as the U.S. markets’ performance, partially due to the depreciation of USD against CAD.

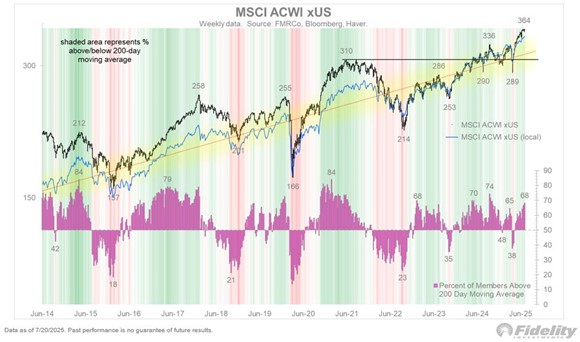

It is also notable that the international markets including the developed markets such as the OECD countries as well as emerging markets lead by China have outperformed so far this year. Germany’s DAX index is up 20% and so is China’s Hang Seng index. As the world moves from a U.S. led unipolar to a multipolar world, the argument for more international diversification is now stronger. Capital flows have largely been unobstructed in a post globalization world and it is possible to see some capital repatriation from other countries as U.S. becomes more restrictive.

MSCI ACWI ex-US index has made new highs in US dollar as well as local currency terms

Source: fidelity date as of 7/20/2025

The bulls’ and bears’ arguments for 2H2025

The tug of war between the market bulls and bears continues into 2025. The bulls argue the worst of the tariff scare is behind us and the new announcements are therefore incrementally positive. U.S. government has collected sizeable tariff revenues, and this new revenue source can be directed to address the U.S. deficit problem. Post trade negotiations, the Trump administration can focus on other pro business policies such as the extension of corporate tax cuts and industry de-regulations.

On the negative side, a delicate balance needs to be struck in renegotiating with trading partners without losing the influence and prestige that the U.S. has spent considerable political capital to achieve. There are questions if the Trump administration is up to the task. The U.S. government relies heavily on foreign buyers to refinance its debt, and it cannot afford risk losing the confidence of its creditors on the soundness of the U.S. capital markets system.

In conclusion, we have seen some major shifts in policies and heightened market volatilities as a result in the first half of 2025. International markets have been a bright spot while there is renewed worries about demand for U.S. denominated assets in light of tariff threats. Longer term the market performance hinges on the fundamentals in economic growth and asset valuations. We will continue to focus on the fundamentals as the changing landscape will create new opportunities for growth. The first year of the presidential cycles have seen strong performance in recent years. We are coming onto a more seasonally weak August and September period so we would want to be more cautious and more selective in making investment decisions.

Rita Li works with professionals, business owners and high net worth families to provide tailored investment advice, risk management and financial planning. Her team comprises of professionals with in-depth taxation, insurance, and legal expertise; together, they deliver a high standard of service to clients. Rita is a Chartered Financial Analyst CFA® and Certified Financial Planner CFP®. Rita holds her MBA from Richard Ivey School of Business.