There is never a dull moment in the markets. A lot has happened in the first quarter of 2024. We have strong economic prints out of the U.S. while Canada has decidedly decelerated. Inflation in the U.S. especially has been stickier than anticipated. The markets are now pricing in approximately 2 rate cuts in benchmark rates down from the 7 rate cuts that were widely expected at the beginning of the year. Similarly, economists’ forecasts for the U.S. economy have gone from a recession to a soft-landing to no-landing. The broad indices are currently pricing in around 8% growth in earnings in the U.S. for 2024, which will most likely be the determinant factor for performance for the remainder of the year.

From recession to soft-landing to no-landing

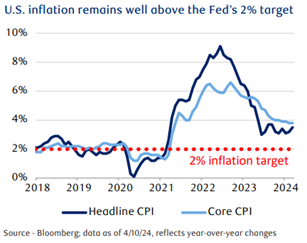

The real US GDP forecasts for 2024 have moved up to 2.5%, and 2025 real US GDP growth is now forecasted at 1.75%. The improvements are not large in magnitude, but are in the right direction, contributing to the no-landing scenario which means no significant slow down in the U.S. economy. It is a good time to provide an inflation check as well. As we’ve mentioned previously, the last mile of inflation will be sticky and more difficult to bring down to the 2% target. That has been the case so far:

There are many ways to gauge inflation; core inflation is the Fed’s preferred measure while headline inflation includes more volatile factors such as food and energy. Headline CPI in March was 3.5%, above the consensus expectation of 3.4% and up from 3.2% in February. The direction of inflation trends will be critical from here as markets are not currently prepared for a further rate hike scenario should inflation trends pick up again.

Earnings Update for the first quarter of 2024

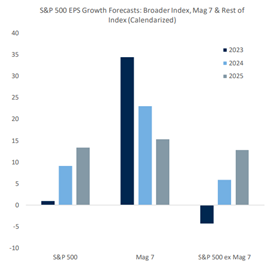

So far, 240 of the S&P500 companies have reported their Q1 earnings with 80% of them beating expectations and 20% missing expectations. The actual reported earnings growth was 2.3% vs. the remaining estimates of 6.1%. Overall, the blended earnings estimate is now around 3.9%. The bottom-up consensus EPS forecast for the S&P 500 for 2024 has moved up from $242 to $244 which implies an 8% growth in EPS.

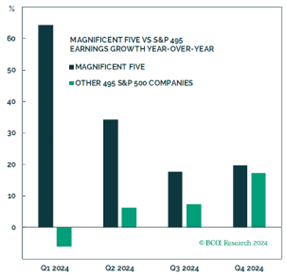

Many people are aware that the leadership has been concentrated in the top 5 to 7 names in S&P500, and that their performance is largely responsible for the gains in the index. The expectation from here on is for the leadership to broaden out the remaining 493 companies, which will further lend credit to a healthy recovering economy.

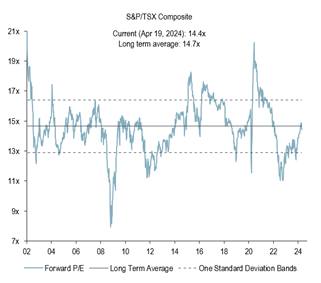

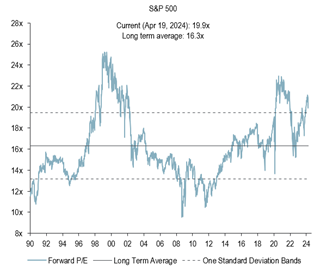

Yet to talk about earnings in isolation paints an incomplete picture. The valuation measured by forward P/E ratio provides some context in terms of how cheap or expensive the market is. P/E is one of the ways to gauge market valuations while some other models use GDP growth as well as more complex multi-factored models.

North American Equities: Forward P/E

At 20x Forward P/E, the U.S. markets are not terribly expensive as they had been previously in a bubble territory, but much of the growth and recovery has already been priced in the current level. That is why even though recessionary fears have eased with recent strong economic data, it is still best to exercise caution.

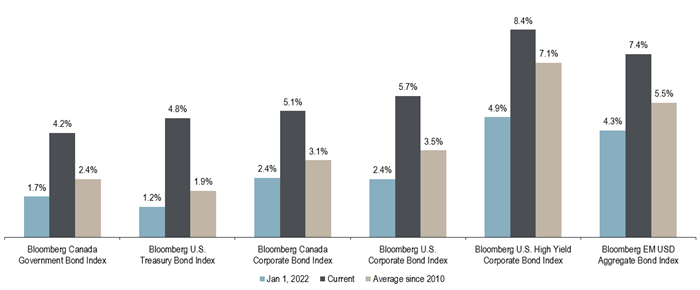

While we still need to be cautious with the stock markets, return profiles in fixed income markets are looking increasingly reasonable; it is worthwhile for people to look at what the bond markets can offer.

Index Yield to Maturity

Source: RBC Wealth Management, Bloomberg; data through 4/19/24

Ultimately, the right mix depends on an individual’s investment time horizon, overall net worth, liquidity needs and comfort level with degrees of volatility. There is a right combination for each person to achieve their investment objectives based on their lifestyles.

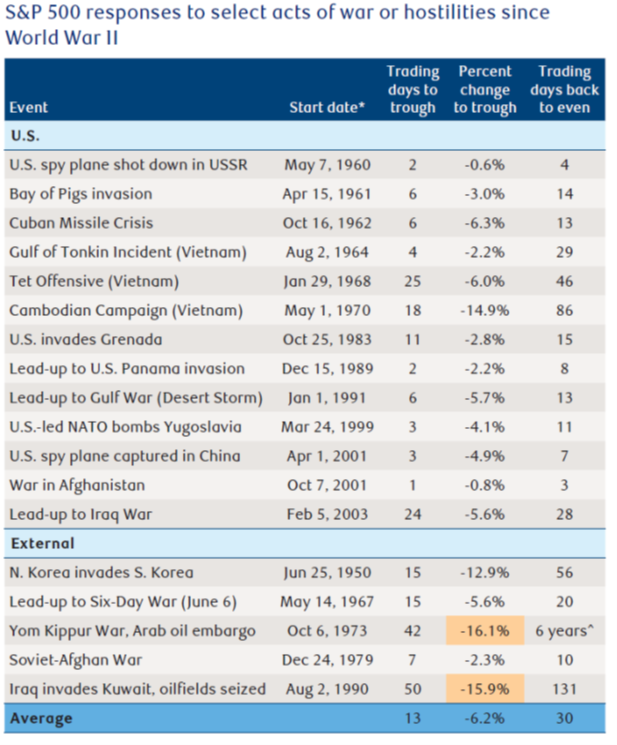

Lastly, it is worth touching on geopolitical risks as we are likely to move towards a multipolar world after a period of strong globalization of world economies. In 2024, we have seen the carry over of the Russian-Ukraine war as well as an escalation of the unrest in the Middle East. Markets can look past some geopolitical conflicts easily while others can have significant impacts. Ultimately, the level of their effect on the market depends on the impact on day-to-day business operations in the western hemisphere.

Rita Li works with professionals, business owners and high net worth families to provide tailored investment advice, risk management and financial planning. Her team comprises of professionals with in-depth taxation, insurance, and legal expertise; together, they deliver a high standard of service to clients. Rita is a Chartered Financial Analyst CFA® and Certified Financial Planner CFP®. Rita holds her MBA from Richard Ivey School of Business.