Business owners

The Nass Wealth Management team offers specialized services to help owners of small and medium-sized companies. As a business owner, you are responsible for wearing many hats. Finding time to pro-actively manage your personal wealth can be challenging. We can act as your personal CFO reporting to you, the CEO. As your Chief Financial Officer, it is our responsibility to work closely with your key advisors to develop a Master Financial Plan that will serve all of your personal, family and business needs. The time you save in researching solutions and managing multiple relationships with advisors can be spent where it matters most: enjoying time with your family and taking care of your business. Here are some of the often-asked questions to which we can assist you in finding the answers:

- How can i pay less tax on the income I am taking from my business?

- Am I taking full advantage of the benefits of incorporation?

- How can I transfer the business to my children and still get paid?

- How will my retirement be funded?

- Do I have sufficient protection in place to protect myself, my family and my business against risk?

- Do I have a driver in my key advisor group who will ensure my business advisors are all on the same page and collectively reviewing the big picture for my interests?

- Do I have enough diversification in my overall net worth or is it all in my business?

- Is my financial advisor providing transparent reporting and are they able to manage the important day-to-day investment decisions to allow me the time to put back into my family and business?

Along with our services, you also have the optional benefit of working with my partners in the various divisions of the Royal Bank, where they can provide added value to the success of your business.

My experience in working with my partners at the Royal Bank and RBC Insurance has assisted in the overall wealth management process by allowing the business owner to ensure there is:

- Effective and cost-efficient financial and banking structures in place to meet the needs of your business plan, as well as any other strategies developed through our wealth management process

- Possible cost reduction in employee benefit plans where that cost savings can then be redeployed in our overall strategy, while bearing in mind the need to retain good employees through offerings that are important to them in a benefit package

Working together with your overall team of professional advisors, we build a Master Financial Plan which is unique to your personal and business needs, and ensures that your entire team is united in helping you achieve success in your financial, family and business goals.

Family Office or Business

Managing the future of your business

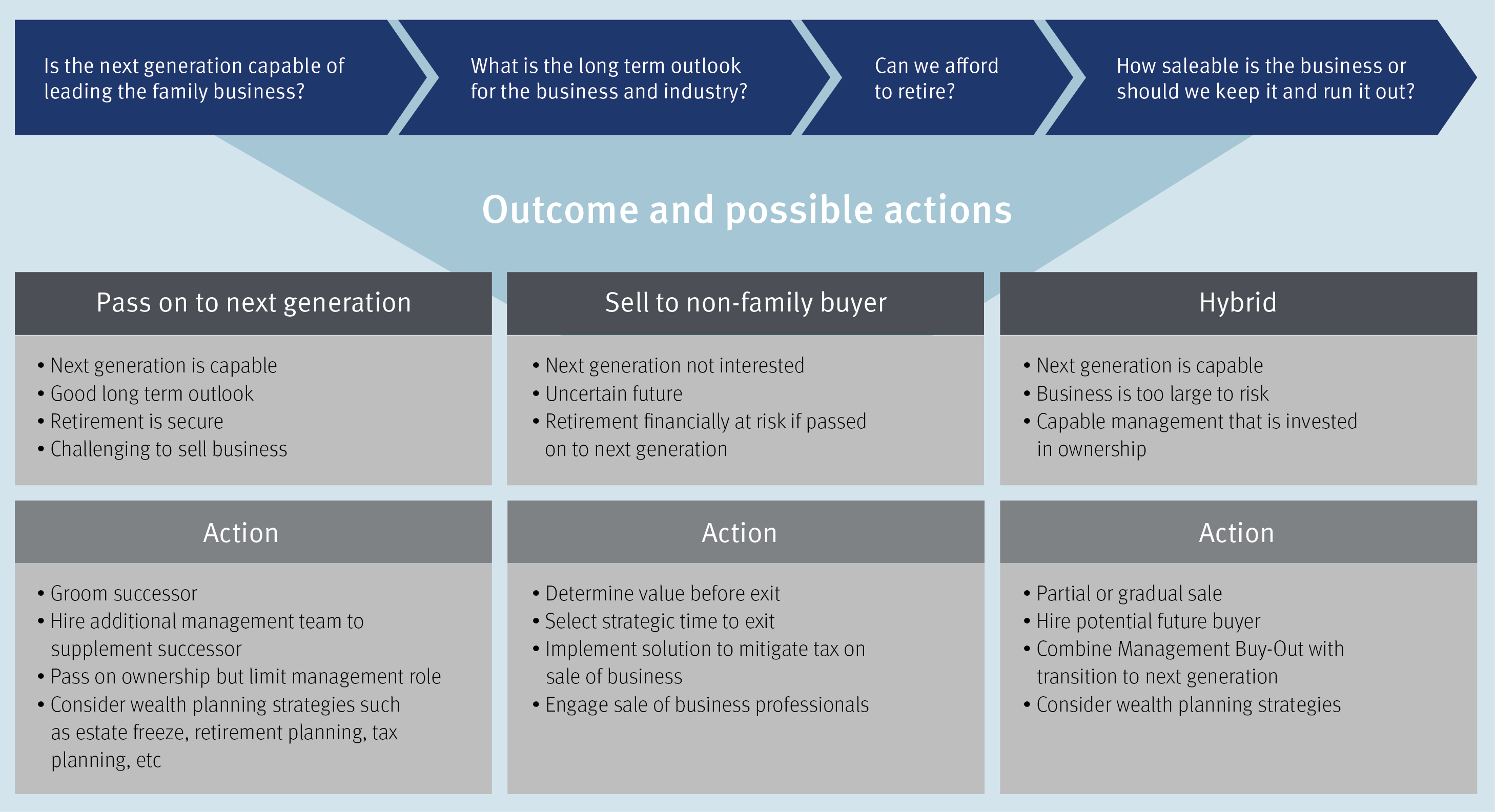

Like many things, when it comes to family education you’ll be most successful if you begin with the end in mind. You own a business. You’ve worked hard to get it to where it is today. One day — whether in one year, 10 years, when you pass away, or at some other time — someone else will run this business. If you’d like to decide in advance who that “someone else” will be, you need a succession plan. If you don’t have such a plan, you’re not alone. Many business owners don’t adequately plan their succession, if at all. There are many reasons for this complacency — from their reluctance to “let go,” to fear of creating family disharmony.

Ironically, the best time to create a succession plan is when you’re too busy managing your growing business. Planning a business exit can be emotional — there are often personal and family dynamics that may conflict with a business’s wellbeing. For this and other practical reasons, planning an exit requires an owner to think strategically, preferably with a professional’s help. The purpose of this type of planning is to create a clear exit path that is simple yet effective in meeting personal and business goals while preserving family harmony during what is often an emotional and conflict triggering process.

…a very rich person should leave his kids enough to do anything but not enough to do nothing… Warren Buffet

There are certain steps a family can implement to achieve open and trustful communication:

-

Always keep the door open to unpopular opinions.

-

Bring an outside facilitator to initiate and lead the process. This leads to more efficient and objective discussions.

-

Create a commonly agreed upon code of conduct for family meetings that will help keep discussions on lower emotional grounds.

-

Family meetings are more effective when properly planned with agendas tailored to the family’s circumstances. The three common agendas that concern family succession are summarized as follows:

Participation | Succession and Ownership | Governance |

- What is the prerequisite education and experience to joining the family business?

- When can family members join and is it a privilege or an entitlement?

- What are the roles and responsibilities of each family member in the business?

- How is compensation set for family members?

- How is performance evaluation performed?

- Can and how are family members terminated?

| - Who will take over the leadership of the business?

- At what point are family members eligible for ownership participation?

- How will ownership transition to the successive generation?

- Is ownership transferred or sold?

- Can the business be divided amongst the next generation?

- What are the exit rules and how is price set?

| - What are the family's guiding principles an dare they reflected in our family mission statement?

- Should we have a family participation agreement?

- How often are family meetings and who can call one?

- What should be included in a shareholders' agreement?

- How are conflicts and objections resolved?

- Should we have external members in the board of directors?

|

Executives

Understanding Your Alternatives

Whether you are retiring, starting a new job or taking time off, leaving an employer can often be an emotional time. Financial concerns and the need to make some important decisions, such as what to do with your pension, may add to your stress level, at least in the short term. If you have been a member of a pension plan for many years, the benefits that you have earned in the plan could likely be the largest source of income you will receive in retirement. Deciding what to do with this income involves many variables and can be quite confusing. And, once you make a decision, it is often irreversible.

When You Terminate Your Employment

Prior to or shortly after you have terminated employment, your employer should send you a written summary outlining your company pension plan options. You will be required to select one of the options by a specific deadline. Sometimes you may not have very much time to make your decision. And if you don’t act before the deadline, your employer may consider that you have chosen one of the options by default, which may or may not be the best one for you. This is why it’s so important to get the guidance you need to help you make the best decision quickly.

Reviewing Your Options

Speaking with your pension and benefits representative is the best way to find out about the specific options available to you when you terminate employment. The choices will vary significantly from plan to plan.

Retirees

You want to enjoy a comfortable retirement — who doesn’t? But between inflation, taxes, lower interest rates and the likelihood that you will live for many years after retirement, it can be difficult to earn sufficient income and still be confident that you have enough for the future.

But having enough retirement income to enjoy a meaningful lifestyle is still within your grasp. I write today because I believe that the retirement you’ve worked toward is still possible. As an Investment Advisor, I’d like to help make sure you’ve done everything you can to:

- Reduce market risk in your portfolio

- Generate income, even with today’s low interest rates

- Strategically reduce tax, and boost your after-tax income

- Draw on your investments in the right order — and reduce exposure to high tax rates

Women and Wealth Management

There are many financial challenges unique to women such as longer life expectancy, more likely to become widowed, more likely to leave the work force for periods of time, earn less and have lower pensions. Often women find themselves thrown into managing the family wealth where they may not previously have had an interest. We take the time to ensure that these women who now have taken over the management of the family financial wealth are provided with the understanding, guidance and time necessary to ensure they are comfortable with the plan developed for them and ensure any changes that need to be made are done with their complete involvement in the process. Our personalized wealth management solutions help with these unique challenges.

Our practice encourages couples to attend the annual review meetings together so that no matter who is the primary manager of the family financial wealth, both parties will have an understanding of the plan in place for their future and how it will be realized.

Institutional Clients

Our institutional investment solutions combine the needs of our institutional client with the expertise of our investment professionals and the innovation of our technology team. Our institutional clients are mostly organizations with large pools of capital that may be dedicated to long-term commitments such as pension plans, or may have short-term objectives like effective cash management. For institutional clients based in Canada, The Nass Wealth Management team provides tailored investment solutions that span a range of asset classes such as cash and fixed income instruments, as well as equities in developed economies and emerging markets around the world. Our clients include private organizations, foundations and other non-profit groups.

With our colleagues in RBC Global Asset Management and Capital Markets, we are able to deliver a broad array of institutional investment solutions. Our investment offerings are designed specifically for treasury managers and others responsible for managing corporate and institutional cash resources. We believe that taking a portfolio of funds approach to managing short-term cash resources can increase an organization’s effectiveness in meeting its short-term investment objectives, without compromising capital preservation and liquidity objectives.

We invite organizations to contact us to discuss their investment dilemma, scenario or aspirations.

Clients Include:

- Corporations

- Foundations & Other Non-Profits