Quarterly commentary as of December 31, 2023

In our September 30 2023 quarterly market comments, we mentioned the impact interest rates have on financial markets and that their evolution would depend on subsequent economic data coming out of the United States. Well, it turns out that October 20, 2023 was the first turning point for markets, because it was the first time that the American economy showed signs of weakness. This resulted in interest rates easing between the end of October and December 31. As a reference, the interest rate on the 10-year US government bond, which had briefly risen to 5.02% on October 20, began to gradually decline and end the year at 3.84%. This marked drop in interest rates led to a very good end to the year for the bond and equity markets in general.

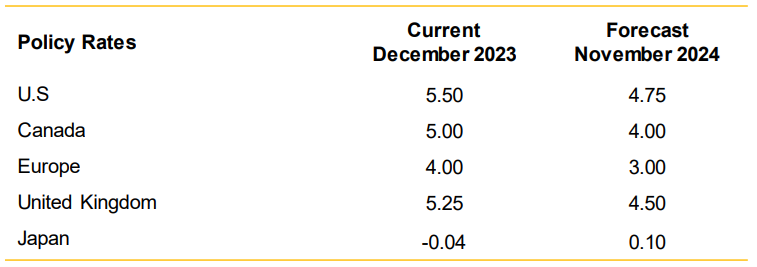

We can summarize the year 2023 by the following; despite the battle to counter inflation, the US economy has been more resilient than expected in the face of 10 interest rate increases from the central bank; the scenario of a soft landing for the economy is now favorably anticipated by the stock markets. This implies that the rate increases have been sufficient to slow inflation, and the hope is that the objective of bringing inflation back to the desired range of 2 to 2.5% is achievable by mid-2024, all while the American economy avoids a severe recession. Economists are already forecasting between 3 and 4 interest rate cuts in 2024.

Key rate forecasts already expected by the markets:

Source : RBC Global Asset Management

Performance at December 31st 2023

The last quarter of the year ended on a very positive note. The results in CAD of the various indices for the quarter ended December 31st 2023: +8.1% for the Canadian S&P/TSX index, +9.0% for the US S&P 500 index and +7.4% for the Europe-Asia-Far East index.

In fixed income, the marked drop in interest rates had a very positive impact on the bond markets. The benchmark FTSE TMX Canadian Bond Index posted a positive return of +8.3%. The depreciation of the US dollar against the Canadian dollar had a negative impact of (-2.4%) on US strategies over the same period. Canadian dollar results for a balanced portfolio are around +7.0% for the last three months.

Balanced portfolio returns for the year 2023 are generally between +9.0% and +11.0% in CAD.

Outlook 2024

Soft landing vs hard landing

As mentioned previously, the positive scenario for the American economy is now priced in by financial markets and in our opinion, this leaves little room for bad news in 2024. The coming months will confirm whether financial markets have been too optimistic in achieving a smooth economic slowdown (soft landing). It is the American economic data which will dictate the pace of interest rates and consequently, the performance of financial markets in the short-term.

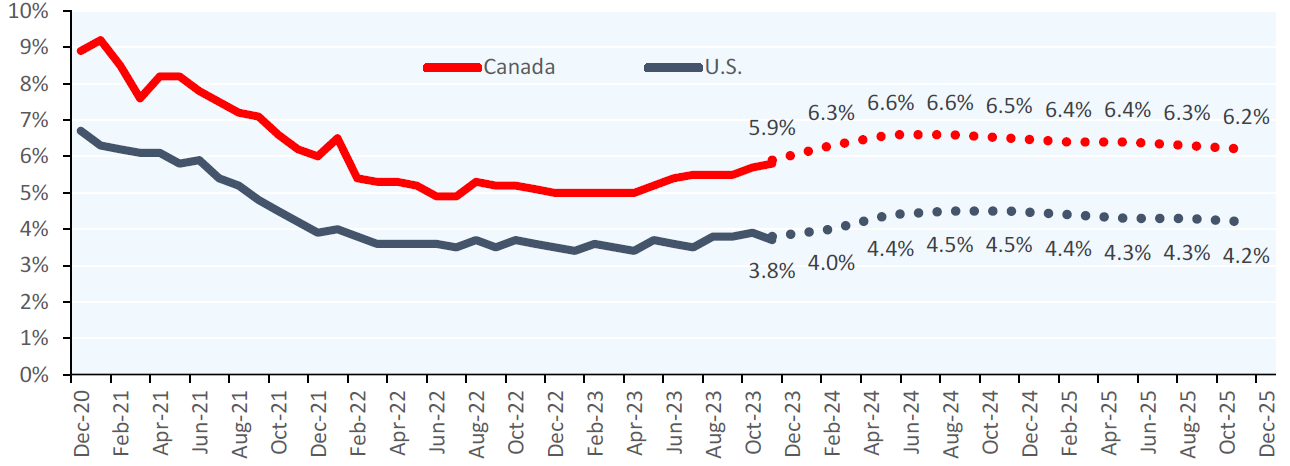

While we are less worried about the American economy for 2024, the rest of the global economy shows a poorer economic outlook.

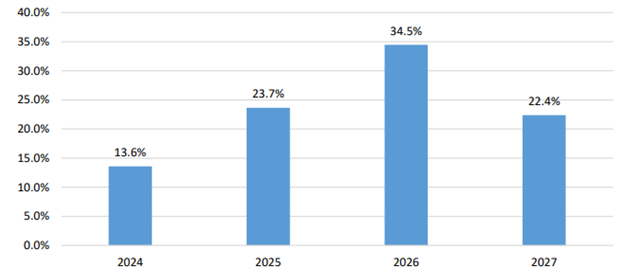

In Canada for example, in addition to a higher unemployment rate, the structure of our mortgage debts does not allow us to fix mortgage loans for a period of more than 5 years (versus 25–30 years in the United States). In 2024, almost 14% of mortgages will be up for renewal, in 2025 it is 24% and in 2026 the percentage of mortgages up for renewal rises to 35%! If the trend in interest rates continues, RBC Capital Markets Canadian bank analyst Darko Mihelic estimates that it will cost the Canadian household at least $400 more per month in mortgage payments. This will drag on consumers’ discretionary spending (e.g. clothing, restaurants, travel, etc.).

Percentage of Canadian mortgages to be renewed

Source: RBC Capital Markets. Does not include NA and TD, as these banks did not disclose a renewal schedule for their respective Canadian residential mortgage books.

Unemployment rate forecasts Canada vs. United States

Source: Haver, RBC Economics

In addition, geopolitical risk will need to be closely monitored. In 2022 and 2023, the economic consequences of the various conflicts were almost without major repercussions. However, if conflicts continue to escalate, they could begin to take a toll on the economy.

Equities

In 2023, the US stock market was divided into 2 distinct groups; the 7 largest American companies commonly called Magnificent Seven (Alphabet/Google, Apple, Meta Platforms/Facebook, Microsoft, Tesla and Nvidia), and the rest. Although the market in general, supported by good corporate profits, ended the year on a good note, the relative dominance of club seven was sweet revenge after a difficult year in 2022.

Now for 2024, we believe that both ‘groups’ start the year on generally equal footing. The high expectations for increased profits will have to become reality for markets to progress from the level attained in the last quarter of 2023.

We will continue to focus on a strategy that emphasizes quality and sustainable dividends, all while managing company-specific risks through prudent portfolio construction.

Bonds - attractive interest rate to start the year

As discussed with most of you over the past year, the rise in rates over the past 18 months allows investors to lock-in average interest rates around 5% for fixed income securities for the short and medium term. We would have to go back more than 15 years to find rates this high. And for taxable accounts, discount bonds (with a capital gains yield component) remain attractive.

How long will high interest rates be available? This could change during 2024, as markets believe that central banks have finished raising their key rates and that they could fall especially in the second part of the year.

Suggested strategic asset allocation

At the portfolio level and according to your investment policy statement, we continue to recommend a neutral weighting to equities while prudently rebalancing positions. As for fixed income, we will look to take advantage of opportunities to keep extending duration, effectively locking in higher rates for longer terms.

Please contact us with any questions or comments you may have.

We thank you for your trust and we wish you a happy new year 2024!

Mathieu & Anthony

This information is not investment advice and should be used only in conjunction with a discussion with your RBC Dominion Securities Inc. Investment Advisor. This will ensure that your own circumstances have been considered properly and that action is taken on the latest available information. The information contained herein has been obtained from sources believed to be reliable at the time obtained but neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers can guarantee its accuracy or completeness. This report is not and under no circumstances is to be construed as an offer to sell or the solicitation of an offer to buy any securities. This report is furnished on the basis and understanding that neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers is to be under any responsibility or liability whatsoever in respect thereof. The inventories of RBC Dominion Securities Inc. may from time to time include securities mentioned herein. RBC Dominion Securities Inc.* and Royal Bank of Canada are separate corporate entities which are affiliated. *Member-Canadian Investor Protection Fund. RBC Dominion Securities Inc. is a member company of RBC Wealth Management, a business segment of Royal Bank of Canada. ® / TM Trademark(s) of Royal Bank of Canada. Used under licence. © 2023 RBC Dominion Securities Inc. All rights reserved.