Commentaire trimestriel - Printemps 2024

Dans notre commentaire du quatrième trimestre 2023, nous avons évoqué le début d’une divergence entre l’économie américaine et la plupart des autres économies mondiales. Appuyée par certaines données tels la progression du taux de chômage et le nombre de nouvelles faillites d’entreprises, cette disparité a continué à se manifester au niveau des politiques monétaires.

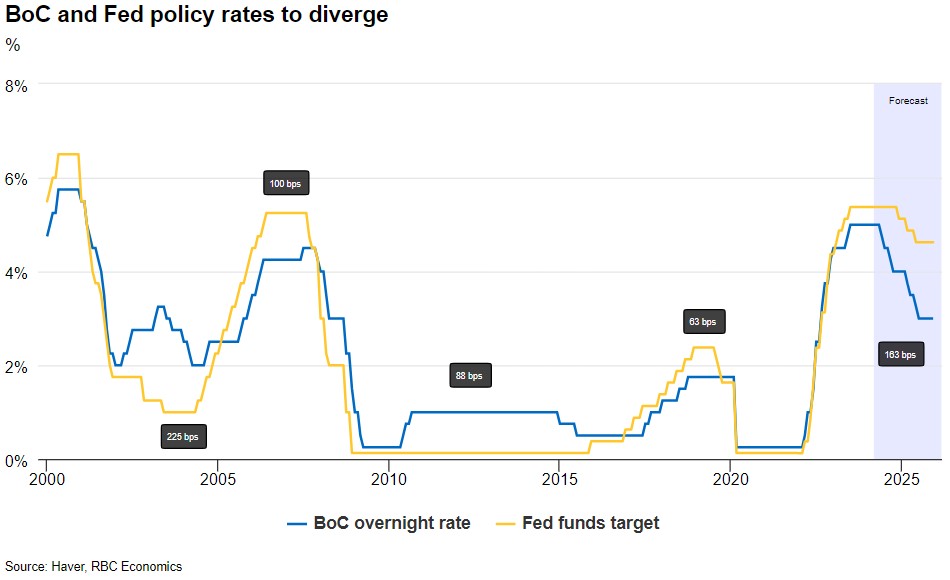

Selon RBC Economics, la Banque du Canada (BoC) devrait commencer à réduire son taux directeur dès juin, pour un total de 4 baisses en 2024, tandis que la Réserve fédérale américaine (Fed) retarderait sa première et unique baisse de taux en décembre 2024.

Un écart de plus en plus prononcé dans les performances économiques justifie une divergence dans les politiques monétaires attendues de la Banque du Canada et de la Réserve fédérale américaine

Cette différence s'explique en grande partie par le fait que l'économie américaine est moins sensible aux hausses de taux d'intérêt, et qu’elle affiche une meilleure productivité. Ceci a été confirmé par la récente publication sur l’inflation des données américaines, qui était plus élevée que prévu.

Conséquemment sur le marché des taux obligataires, nous pouvons constater que les taux américains restent les plus élevés des pays développés. À titre de référence, le taux d’une obligation du gouvernement américain, pour une période de 10 ans, tourne autour de 4.5%. En comparaison, pour la même période, une obligation canadienne offre un rendement de 3.7%, le Royaume-Uni 4.1% et pour le taux allemand, c’est 2.4%.

Lorsque le marché a éprouvé des difficultés en 2022 et pendant la majeure partie de 2023, il a souvent été aux prises avec des craintes liées à l’inflation et d’importantes hausses de taux d’intérêt de la Réserve fédérale américaine (Fed), ainsi qu’une hausse des taux des obligations du Trésor) et des risques de récession élevés. Fait important, la croissance des bénéfices a également diminué pendant une partie de cette période, mais au cours des six derniers mois, ces difficultés se sont en grande partie estompées. Nous pouvons résumer que la bonne tenue de l’économie américaine a entrainé les marchés boursiers mondiaux à bien débuter l’année.

La réalité est toutefois que les risques qui ont entravé le rendement en 2022 et 2023 n’ont jamais vraiment disparu.

Résultats du 1er trimestre 2024

Voici les résultats en $CAN des différents indices pour le trimestre se terminant le 31 mars 2024: +6,6% pour l’indice canadien S&P/TSX, +13.0% pour l’indice américain S&P 500 et +7,3% pour l’indice Europe-Asie-Extrême-Orient. Les taux d'intérêt ont de nouveau légèrement augmenté au cours des trois premiers mois de l'année, entrainant une performance légèrement négative des titres à revenu fixe. L’indice de référence FTSE TMX Canadian Bond a également affiché un rendement négatif de (-1,2%). Et il est à noter que la dépréciation du dollar canadien par rapport au dollar américain a eu un impact positif de +2,2 % sur les stratégies américaines au cours de la même période. Conséquemment, les résultats en dollars canadiens pour un portefeuille équilibré sont d’environ +5,0 % pour les trois derniers mois.

Et les rendements d’un portefeuille équilibré pour la période de 12 mois se terminant le 31 mars 2024, tout dépendant de votre répartition, se chiffrent généralement entre 9% et 11% en $ CAN.

Perspectives et observations sur les marchés boursiers : (extrait de perspectives Mondiales RBC gestion de patrimoine 11 avril) :

Comme l’indice S&P 500 se situe près de la barre de 5 000, nous croyons qu’il est prudent de surveiller trois risques persistants :

- L’inflation pourrait demeurer stable ou augmenter;

- La croissance du PIB pourrait ralentir;

- Les conflits géopolitiques et militaires en cours au Moyen-Orient et en Europe de l’Est pourraient s’élargir

Inflation : Le combat n’est pas terminé aux États-Unis

RBC Marchés des capitaux souligne que les données de l’indice global des prix à la consommation (IPC) et de base de mars, qui sont plus élevées que prévu par la majorité des analystes, ne sont pas le seul signal d’alarme sur l’inflation.

Les pressions inflationnistes en mars ont été généralisées. Plus de la moitié des éléments mesurés dans le panier des prix à la consommation ont enregistré une augmentation de l’inflation. De plus, les prix des biens ont grimpé après huit mois de baisse mensuelle.

Le rapport de mars sur l’IPC, combiné à d’autres tendances inflationnistes qui se sont détériorées plus tôt cette année, a incité RBC Marchés des Capitaux à revoir à la baisse ses prévisions à l’égard des réductions de taux d’intérêt de la Fed, qui sont passées de trois réductions de 25 points de base (pb) à une seule cette année. De plus, le groupe estime que la réduction se produira en décembre, soit après l’élection présidentielle américaine le mois précédent.

RBC Marchés des capitaux ne prévoit toujours que deux réductions de taux l’an prochain (l’une en janvier et l’autre en mars). Dans ce scénario, la Fed cesserait de réduire son taux directeur à 4,75 %, soit un niveau beaucoup plus élevé que lors des quatre cycles précédents de réduction des taux depuis 1990.

Nous ne croyons pas que le marché boursier soit particulièrement sensible au nombre exact de réductions de taux que la Fed pourrait mettre en œuvre d’ici la fin de 2024. Cependant, si la Fed devait réduire les taux de seulement 75 pb pour l’ensemble de son cycle de réduction des taux, comme RBC Marchés des capitaux le prévoit maintenant, nous pensons que le marché aura besoin de s’ajuster, car il tient probablement compte actuellement de plus de trois réductions.

PIB : La croissance économique américaine pourra-t-elle maintenir le rythme ?

Les prévisions consensuelles de Bloomberg pour la croissance du PIB en 2024 ont considérablement augmenté, passant de 0,6 % au milieu de 2023 à 2,2 % à l’heure actuelle. Pour sa part, RBC Marchés des Capitaux prévoit que le PIB pourrait dépasser ce rythme. Le PIB nettement supérieur à la tendance depuis le deuxième semestre de l’année dernière, les solides mesures de l’emploi sous-jacentes ainsi que l’amélioration des données du secteur manufacturier depuis le début de l’année confirment que la croissance du PIB en 2024 pourrait dépasser 2,0 %, selon nous.

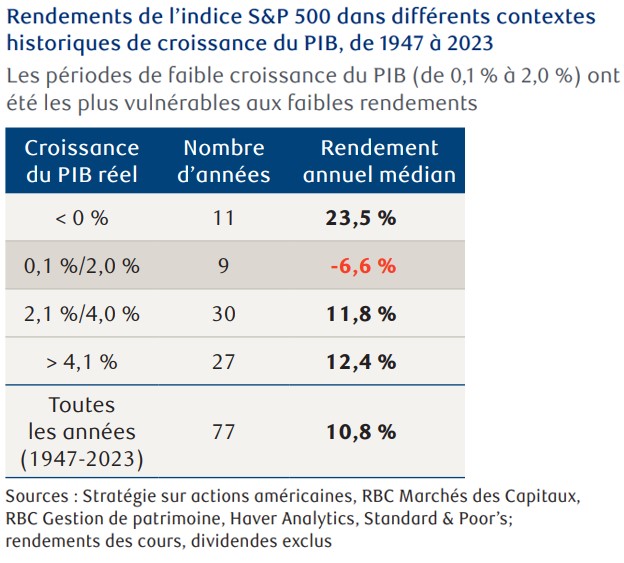

Une croissance annuelle du PIB au-dessus de 2,0 % correspond aux résultats historiques des périodes de bons gains pour l’indice S&P 500. L’indice a progressé de 11,8 % sur une base médiane annuelle, alors que la croissance annuelle du PIB se situait entre 2,1 % et 4,0 % selon une étude de Stratégie sur actions américaines, RBC Marchés des Capitaux.

Soulignons toutefois que, lorsque le PIB se situait dans une zone plus faible de 0,1 % à 2,0 %, les marchés boursiers ont souvent enregistré de mauvais rendements, l’indice S&P 500 reculant de 6,6 % sur une base médiane annuelle.

Si la croissance du PIB venait à ralentir de manière importante plus tard cette année – une possibilité qui ne peut être écartée selon nos indicateurs économiques avancés – nous pensons que le marché boursier pourrait connaître des périodes difficiles

Géopolitique: Un constat brut

Un autre risque pour le marché est que les conflits militaires au Moyen-Orient et en Europe de l’Est, ainsi que les tensions géopolitiques qui y sont associées, pourraient s’accentuer.

Les marchés boursiers ont par le passé absorbé assez rapidement les conflits militaires et les escalades qui en découlent. Au cours des 19 événements clés qui se sont produits depuis la Seconde Guerre mondiale, l’indice S&P 500 a reculé en moyenne de 6,3 %, avant de se redresser complètement en 29 jours de bourse en moyenne. Toutefois, le marché et l’économie ont eu tendance à éprouver plus de difficultés et sur de plus longues périodes lorsque les prix du pétrole ont augmenté pendant une période prolongée.

Trouver le bon équilibre

En ce qui concerne le positionnement des actions dans les portefeuilles, nous recommandons d’équilibrer les risques associés à la persistance de l’inflation ou à sa réaccélération et le ralentissement éventuel de la croissance du PIB, avec la possibilité que l’économie américaine évite ces risques et reste résiliente.

Nous surveillerons de près l’évolution des taux d’intérêt, en particulier le taux des obligations gouvernementales 10 ans. Au moment d’écrire ces lignes, la persistance de l’inflation au-dessus de la cible de 2%, a ramené l’obligation de référence américaine au-dessus de 4.50%. Rappel, ce même taux avait débuté l’année 2024 à 3.90% (= taux accommodant pour les marchés boursiers) et il s’approche maintenant du 5% atteint au mois de novembre 2023 (= taux contraignant pour les marchés boursiers).

Au niveau de la gestion de vos portefeuilles, nous maintenons une pondération neutre selon la cible en actions de votre énoncé de politique de placement, et ce particulièrement à la suite des 5 derniers mois, qui ont été favorables (pour la période de novembre 2023 à mars 2024). Nous maintenons cette approche puisqu'il est probable que nous traversions une période de consolidation dans les prochains mois.

Lecture printanière

En terminant, nous vous invitons à lire deux articles de fond qui ont paru dans notre publication mensuelle Perspectives Mondiales du mois de mars dernier. Ces articles traitent plus particulièrement des élections américaines à venir, et soulignent que 2024 est également une année électorale très chargée à l’échelle mondiale.

Nous vous invitons à communiquer avec nous si vous avez des questions sur votre situation.

Bon début de printemps et au plaisir!

Mathieu & Anthony

Ces renseignements ne constituent pas des conseils de placement et doivent être utilisés uniquement dans le cadre d’une discussion avec votre conseiller en placement de RBC Dominion valeurs mobilières Inc. Ainsi, votre propre situation sera prise en considération comme il se doit et les décisions prises seront fondées sur l’information la plus récente qui soit. Les renseignements contenus dans les présentes ont été puisés à des sources jugées fiables au moment où ils ont été obtenus, mais ni RBC Dominion valeurs mobilières Inc., ni ses employés, ses mandataires ou ses fournisseurs de contenu ne peuvent en garantir l’exactitude ni l’intégralité. Le présent rapport ne constitue pas une offre de vente ni une sollicitation d’une offre d’achat de titres et ne doit, en aucune circonstance, être interprété comme telle. Il est fourni sur la base d’une entente selon laquelle ni RBC Dominion valeurs mobilières Inc., ni ses employés, ses mandataires ou ses fournisseurs d’information n’acceptent de responsabilité ou d’obligation de quelque nature que ce soit à son égard. Les portefeuilles de RBC Dominion valeurs mobilières Inc. peuvent parfois inclure des titres mentionnés dans les présentes. RBC Dominion valeurs mobilières Inc.* et Banque Royale du Canada sont des entités juridiques distinctes et affiliées. * Membre-Fonds canadien de protection des investisseurs. RBC Dominion valeurs mobilières Inc. est une société membre de RBC Gestion de patrimoine, division opérationnelle de Banque Royale du Canada. ® / MC Marque(s) de commerce de Banque Royale du Canada, utilisée(s) sous licence. © RBC Dominion valeurs mobilières Inc., 2024. Tous droits réservés.