All spectacle and little substance

I was listening to a flurry of interviews on CNBC this morning for the drive in. One US government representative to the next, from each side of the aisle, fingers pointed mockingly in the other direction. The looming shut down of the US government at midnight tonight, a US president as blustery as ever…..but what does it really mean from the investors point of view.

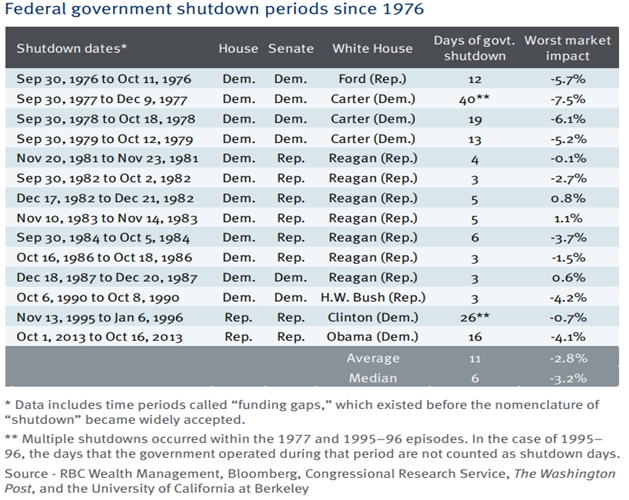

For all of the oxygen that this topic has been consuming, government shutdowns in the United States, are not all that uncommon. There are short term ripple effects on things such as services, employment (short term), and social security processing, however from the investor’s standpoint, they are metaphorically speaking…. a nothingburger.

The SP500 on average has shed ~2.8% across all shutdowns in recent memory (with the largest being 7.5%), with most losses recovered shortly after, or during the period itself. When considering how the event or news will impact your portfolios, you can see from the chart below that this has been a non-event in the past.

As always, we welcome your questions on this, and any other subject of interest. Please let me know if you would be interested in more information.