This week, both major central banks in North America, loosened up the monetary policy reigns again. By yesterday afternoon, both the Bank of Canada, and the US Federal Reserve Bank had cut their overnight lending rates by 25 basis points (or a quarter of a percentage point), continuing the downward trend on costs of borrowing. But what does this mean for you?

When central banks lower their overnight lending rates, the direct impact to the consumer is generally felt only by short term rate borrowers. The easiest example is this.

- prior to the rate cut, the RBC Prime rate was 4.70%

- as of this morning, the RBC Prime rate is now 4.45% moving in lock step with the cut

- if you were borrowing $1MM, your annual interest costs just came down by 2500 bucks. Not a bad outcome, all things remaining equal

Those who have lines of credit, or variable rate mortgages, will immediately feel some relief on borrowing costs by the factor mentioned above.

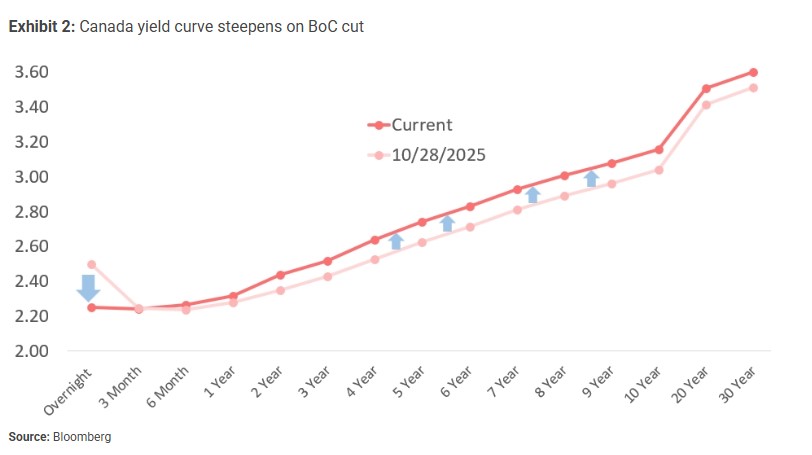

Those consumers looking at longer term fixed rates (like a 5 year mortgage on a new home or a renewal), likely won't see any impact or movement at all. The longer end of the curve, which is set by the market (and expectations around longer term borrowing costs) has not moved much of late, and will likely not budge much after this. In fact, after the cut yesterday, the long end of the curve moved UP 9-12 basis points.

Economy

The US tariff policy is taking a bite out of Canadian (and some global) economic activity. There will be an adjustment period required, which the recent series of cuts should help address. Realistically though, Canada is going to have to ramp up its productivity numbers to overcome the impacts of the tariff regime. At least for now

The markets

Markets like lower rates, and economies like lower rates. This bolsters economic activity, and thus is good for markets. With that being said, there is a careful balancing act for the longer term. Lower rates mean easier money, and easier money means inflation potential is ramped up. The US Fed and co did a masterful job bringing rates down without stoking inflation too much, but the work is never done. We shall see.