While the equity markets experienced a volatile start to September, the credit market has seen a massive surge in corporate bond issuances with a record 29 issuances on the first business day of the month. Bloomberg's bank survey suggests investment-grade companies to issue around $125 billion in bonds by the end of the month.

High-yield or lower-rated issuers have also been active, with $357 billion in bond sales through August 31, nearly doubling the pace from 2022 and exceeding last year's figures. In addition to bond sales, high-yield borrowers have been heavily involved in the loan markets, refinancing nearly $170 billion of upcoming debt— the largest reduction on record.

The market has managed to handle the large volume of new issues with ease. Credit spreads, which measure the additional compensation investors earn for assuming higher default risk, ended August near their lowest levels in almost two years. Since credit spreads and bond prices move inversely, corporate bond indexes have outperformed Treasuries this year.

It might seem surprising that such a high volume of bond issuance hasn't caused pricing pressure, but there are several explanations for this.

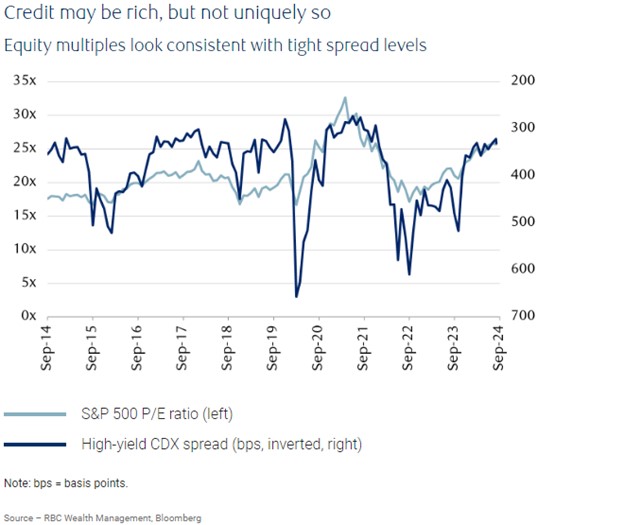

Firstly, while credit spreads are at historical lows (i.e. low compensation for credit risk), bond valuations still appear attractive relative to other asset classes. For instance, relative to S&P 500 valuations, corporate bonds don’t seem particularly overpriced. Current spreads are comparable to those in previous periods when stocks were trading at similar price-to-earnings ratios. For investors seeking income but are wary of current stock prices, corporate bonds offer an attractive alternative.

Furthermore, investors may have a higher degree of comfort around potential default risks given a reduced amount of loans coming due in the near-term. The fact that lower-rated, high-yielding borrowers have significantly paid down or extended their debt reduces the possibility of large-scale defaults.

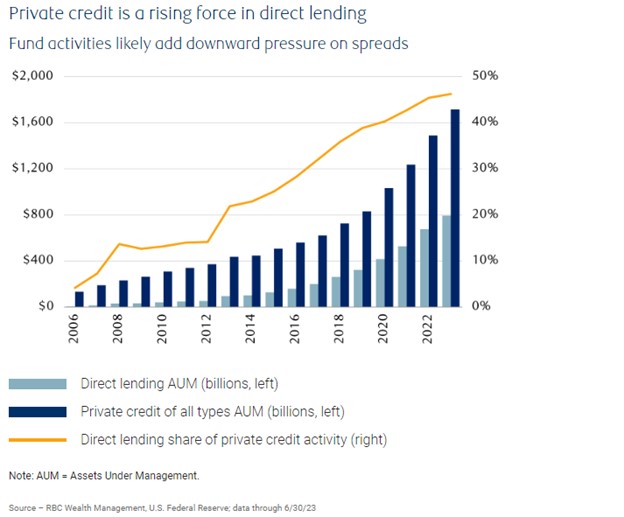

Another factor contributing to current demand is the growth of private credit funds. Although private credit typically involves direct loans rather than bond purchases, their activity impacts pricing across the capital structure. Direct lending has become a significant portion of the credit sector, growing from 4% to 46% of assets under management from 2006 to mid-2023. This influx of private credit might be exerting downward pressure on spreads.

Companies issuing bonds now are likely aiming to manage economic uncertainties and policy variability. With recession risks and potential outcomes from upcoming elections, locking in favorable funding rates makes sense. Case in point - high-credit borrowers can now issue 10-year bonds with yields below money market rates, creating positive cash flows just by depositing the bond sale proceeds.

For investors, corporate bonds offer a way to mitigate risk, especially as the Federal Reserve signals the start of a rate-cutting cycle. With cash returns expected to decrease, corporate bonds may become a valuable source of income.

The appeal of corporate bonds largely depends on the investor’s time horizon. For those with a long-term perspective, investment-grade bonds may offer attractive yields compared to U.S. Treasuries. However, over a shorter horizon, corporate bonds might struggle to outperform government securities, especially given the potential for a slowing economy and increased policy uncertainty. Please reach out to us to discuss how corporate bonds can potentially increase risk-adjusted returns in your portfolios.