The bond market had a very difficult year in 2022, unable to provide investors with the expected ‘protection’ that is frequently associated with holding bonds. Ultimately, the bond market faced its worst year in over 97 years as investors even witnessed investment grade corporate bonds indexes (like LQD) fall by more than -20%.

Whereas some investors may question the value of continuing to hold bonds, we feel the setup for fixed income looks attractive. With unemployment at a record low of 3.5%, resilient corporate earnings results, and a GDP that continues to surprise on the upside, any potential recession in 2023 is expected to be mild and short-lived. Hence, we feel that credit risk, as reflected by corporate defaults, is relatively low. Investors should recognize that bonds that do not default will eventually reach par value at maturity, and therefore poor trailing performance has led to improved return expectations ahead.

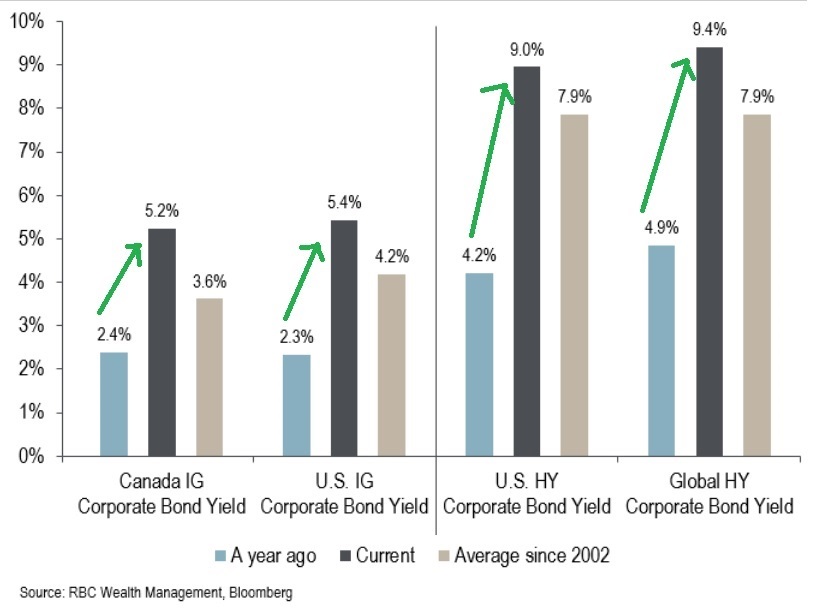

The sharp repricing of Canadian bonds is apparent when looking at corporate bond yields. As one can see in the chart below, the average yields on both investment grade and high-yield bonds doubled in 2022. These bonds now pay investors more than at any point since the global financial crisis. At current levels, another advantage for bonds is that the average issue trades at a significant discount to par. As these bonds approach par value at maturity, taxable investors can benefit from these discounts since they will receive more of their yield in the tax-efficient form of a capital gain.

We also feel that investors can begin to think about extending the duration of their bonds. Last year, as the central banks hastened to raise interest rates, prices for longer-duration bonds plummeted. The longer the duration, the more negative impact rising yields and rates would have on price. Hence, many investors recognized that the safest space in 2022 was at the shorter term of the yield curve. With the recent signaling from both Canadian and US central banks of a slowdown in rate increases, many investors are also expecting an eventual pause. If this occurs, bond yields should peak, which would mark an opportune time to purchase bonds that would inherently have higher yields and lower price risk. According to research from the Portfolio Advisory Group of RBC Wealth Management, rising bond yields tend to peak around 2 months before the last rate hike. Markets are currently pricing this to occur in the coming months. Assuming these expectations are on the mark, we may be entering the window where it is timely to start thinking about modestly extending duration in bond portfolios.

Managing fixed income continues to be difficult as so much hinges on the monetary policy direction of the central banks. These policies are uncertain as the direction is dependent on inflation and labour data, which can be very choppy. Speak to your advisor to review the fixed income portion of your portfolio. As we head towards a potential recession and recovery cycle, managing both interest rate and credit risk may require a more active approach than one is accustomed to.